News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Tether Freezes $182M in TRON-Based USDT

Coinomedia·2026/01/12 13:45

Bears in Control: Can DOGE Turn the Tables and Go Bullish Soon?

post-154761

post-154761

post-154761

Newscrypto·2026/01/12 13:45

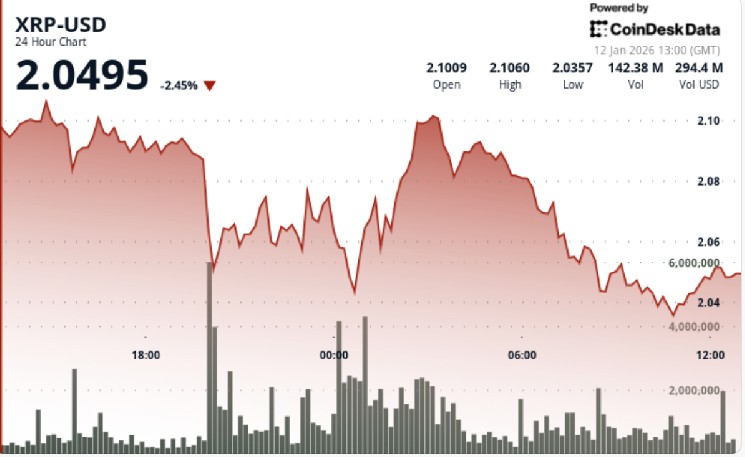

XRP stays pinned near $2.05 as the range tightens into a make-or-break zone

CryptoNewsNet·2026/01/12 13:42

What Can Investors Anticipate in Globe Life's Fourth Quarter 2025 Earnings Announcement

101 finance·2026/01/12 13:42

UK Labour MPs Urge Elections Bill Ban on Crypto Donations Amid Rising Political Funding Concerns

Cryptonewsland·2026/01/12 13:42

3 Token Unlocks to Watch in the Second Week of January 2026

BeInCrypto·2026/01/12 13:39

Dubai bans Monero, Zcash as DIFC slams door on privacy tokens and tightens stablecoins

Crypto.News·2026/01/12 13:30

Ether eyes breakout to $3,500: Check forecast

Coinjournal·2026/01/12 13:30

What's Driving the Markets This Monday Morning?

101 finance·2026/01/12 13:27

Flash

05:46

Preview: The U.S. will release the December CPI data tonight at 9:30 PM, and the market generally expects price pressure to remain stubbornBlockBeats News, January 13: Tonight at 21:30, the United States will release the December CPI data. The market generally expects that this inflation data will show persistent price pressures and remain below the Federal Reserve's 2% target.

According to a composite survey by Bloomberg and FactSet: the overall CPI is expected to rise by 0.3% month-on-month and 2.7% year-on-year. The core CPI, excluding the volatile food and energy categories, is expected to rise by 0.3% month-on-month and 2.7% year-on-year.

Despite the slightly lower forecast from the Cleveland Fed's Nowcast model (core CPI up 0.22% month-on-month), the mainstream Wall Street view is that inflation has not cooled significantly. CME Group data shows that the market is betting with a 95% probability that the Fed will keep interest rates unchanged in January.

05:37

A whale transferred 10 million USDC to Lighter to short 5x LIT, spending $2.2 million to buy 1,059,000 LIT.BlockBeats News, January 13th, according to Onchain Lens monitoring, despite the continued decline of LIT, a whale has transferred 10 million USDC to Lighter and is currently hedging it.

The whale has opened a 5x leveraged short position on LIT and spent $2.2 million to purchase 1,059,000 LIT at an average price of $2.08. Currently, it still holds 2,788,000 USDC and may continue to buy.

05:35

A bipartisan text of the US crypto bill has been released, potentially giving banks an advantage in the current battle over stablecoin yields. according to crypto journalist Eleanor Terrett, after months of intense negotiations among Senate Republicans, Democrats, and industry insiders, a bipartisan text of the 278-page crypto market structure bill has been released. Banks may gain the upper hand in this round of stablecoin yield disputes.

The latest draft (page 189) stipulates that companies shall not pay interest solely because users hold balances. Users can receive rewards, but only when the rewards are associated with account opening activities or engaging in transactions, staking, providing liquidity, collateralizing assets, or participating in network governance. Senators now have 48 hours to propose amendments to the bill text, so it is unclear whether these provisions will remain unchanged by Thursday.