News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Satoshi-Era Miner Moves Millions in Bitcoin After 15 Years of Silence

BeInCrypto·2026/01/11 19:48

Key Figure in X Shared an Image Showing the Price of a Highly Anticipated But Not Yet Released Altcoin

BitcoinSistemi·2026/01/11 19:45

Are Crude Oil Markets Currently Showing Bullish Trends?

101 finance·2026/01/11 19:36

Two brothers and sisters who have influenced Goldman Sachs discuss their journey to leadership

101 finance·2026/01/11 19:24

Israeli cyber startup Torq raises $140 million at $1.2 billion valuation

101 finance·2026/01/11 19:21

Coming Fed Rate Cut Predicts Bullish Momentum for Crypto in 2026

BlockchainReporter·2026/01/11 19:15

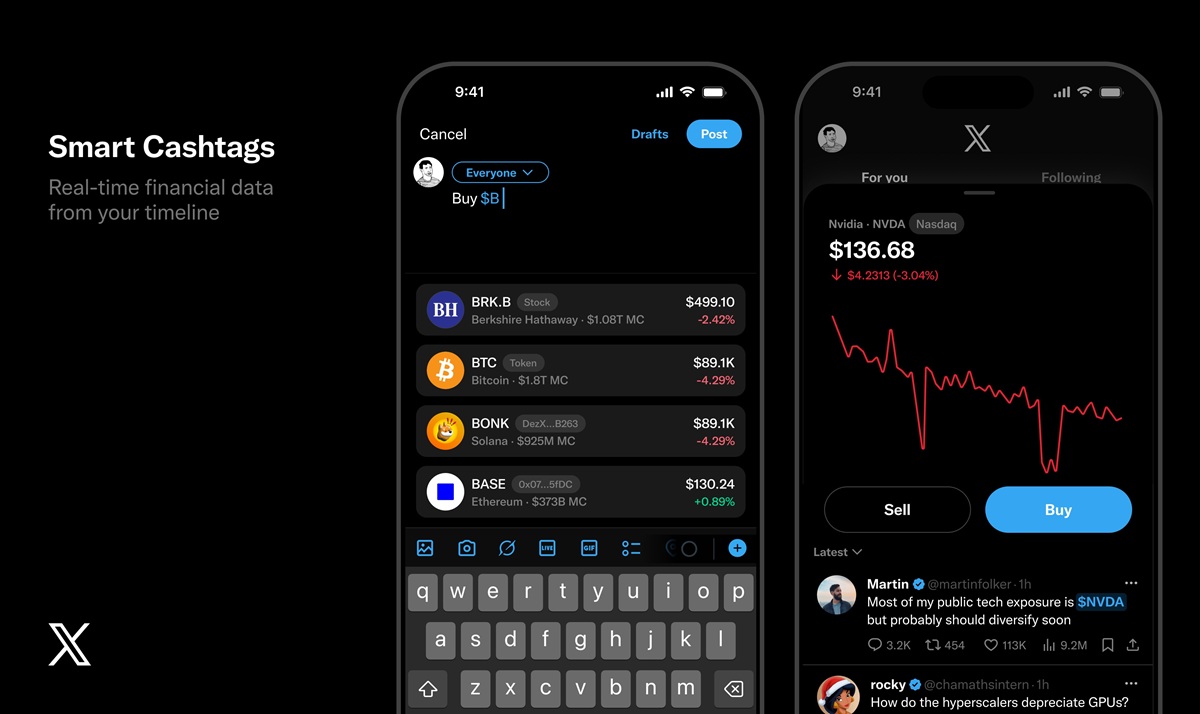

X Smart Cashtags: Elon Musk’s Platform Eyes Crypto and Stock Trading Integration

BeInCrypto·2026/01/11 18:54

Top Crypto Gainers in the Last 24 Hours: Monero and Chiliz Lead with Big Numbers

BlockchainReporter·2026/01/11 18:15

Flash

21:50

Comedian Russell Brand accepts bitcoin paymentsComedy star Russell Brand announced that he will accept payments in bitcoin from his 2.1 million fans. (The Bitcoin Historian)

20:36

BSC 24-hour transaction fees surpass SOLIn the past 24 hours, the total transaction fees on BSC have surpassed those of SOL, with the specific amount undisclosed. (Cointelegraph)

19:03

JPMorgan sees limited threat from stablecoins, ABA warns of $6.6 trillion riskThe American Bankers Association (ABA) sent a letter to the U.S. Senate, stating that yield-bearing stablecoins would impact its member banks' lending capabilities, but JPMorgan holds a different view on this matter.