XRP priceXRP

XRP/USD price calculator

XRP market Info

Live XRP price today in USD

XRP Price Performance: A Comprehensive Analysis for Today, October 12, 2025

As of today, October 12, 2025, XRP's price performance continues to be influenced by a complex interplay of regulatory developments, broader market sentiment, and its underlying utility. While specific real-time fluctuations are dynamic, a deeper dive into the prevailing factors offers valuable insights for investors and observers alike.

Key Influencing Factors:

1. Regulatory Landscape and the SEC vs. Ripple Lawsuit: The most dominant factor shaping XRP's trajectory remains the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). Any significant development, ruling, or even speculation regarding a potential settlement or appeal continues to exert immense pressure, both positive and negative, on XRP's price. Positive news, such as favorable court decisions or clear regulatory guidance, tends to spark upward momentum, indicating reduced uncertainty for institutional adoption and market participation. Conversely, adverse rulings or prolonged legal ambiguity can trigger sell-offs as investors de-risk. The market closely watches for any resolution that could provide regulatory clarity for XRP, potentially unlocking its full potential in the U.S. market. [0, 1]

2. Broader Cryptocurrency Market Sentiment: XRP’s price is rarely isolated from the general trends of the wider cryptocurrency market. Bitcoin (BTC) and Ethereum (ETH) often act as bellwethers, and their performance can significantly sway investor sentiment across altcoins, including XRP. A bullish market cycle, characterized by rising Bitcoin dominance and increased overall crypto adoption, typically creates a favorable environment for XRP. Conversely, a bearish market or periods of heightened volatility in major cryptocurrencies can lead to downward pressure on XRP, as investors often consolidate into safer assets or exit the market altogether. Global economic indicators and macroeconomic shifts also play a role, influencing capital flows into risk assets like cryptocurrencies. [2, 3]

3. Adoption and Utility of the XRP Ledger (XRPL): The fundamental utility of the XRP Ledger and Ripple's On-Demand Liquidity (ODL) solutions is a crucial long-term driver. Partnerships with financial institutions, remittance companies, and enterprises utilizing XRP for cross-border payments provide genuine demand for the asset. Increased transaction volumes on the XRPL, new integrations, and expansions into new geographical markets demonstrate tangible use cases and can bolster investor confidence. Developments in the XRPL ecosystem, including new decentralized applications (dApps) or tokenization efforts, also contribute to its perceived value and potential for future growth. Sustained growth in ODL corridors and innovative uses of the ledger are vital for XRP's intrinsic value proposition. [4, 5]

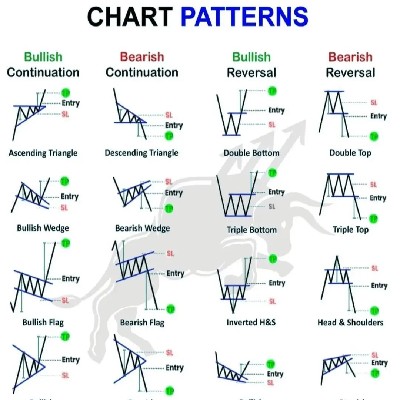

4. Technical Analysis and Market Structure: From a technical perspective, XRP's price action often respects key support and resistance levels, trendlines, and chart patterns. Traders and institutional algorithms frequently react to these technical indicators. Volume analysis provides insights into the strength behind price movements, with high volume accompanying significant price changes often confirming trends. Short-term price performance can also be influenced by factors such as funding rates in perpetual futures markets, large whale movements, and order book dynamics on major exchanges. These technical elements offer a glimpse into market psychology and potential future price trajectories. [6, 7]

5. Global Economic and Geopolitical Factors: Beyond the crypto-specific elements, global economic health, inflation rates, interest rate decisions by central banks, and geopolitical events can indirectly influence XRP. In times of economic uncertainty, investors might shift towards or away from perceived risk assets like cryptocurrencies. Regulatory actions or pronouncements from other major global economies regarding digital assets can also create ripple effects across the entire market, impacting XRP's appeal to international investors. [8, 9]

Conclusion:

Today's XRP price performance, while immediately reflective of current market dynamics, is underpinned by these enduring factors. The resolution of the SEC lawsuit remains a pivotal catalyst, but continued utility growth and a stable, broader crypto market are equally critical. Investors and observers should continue to monitor these multifaceted influences to gain a holistic understanding of XRP's potential direction and value proposition in the evolving digital asset landscape.

The cryptocurrency market experienced an extraordinarily tumultuous day on October 11, 2025, marked by a historic crash that sent shockwaves across the global financial landscape. The primary catalyst for this widespread downturn was an unexpected announcement from former U.S. President Donald Trump, declaring 100% tariffs on all Chinese imports, effective November 1. This geopolitical development triggered an immediate and severe reaction, leading to billions in liquidations and a significant drop in the total crypto market capitalization.

Bitcoin (BTC), the market's leading cryptocurrency, plunged from an intraday high of over $122,000 to lows around $102,000, registering a decline of over 7% within 24 hours. The sudden move marked one of its largest single-day drops in recent weeks, reflecting intense profit-taking and heightened market volatility. Ethereum (ETH) followed suit with an even steeper decline, falling by over 12% from previous levels. Altcoins suffered the most dramatic losses, with some experiencing drops of up to 90%, and major tokens like XRP nosediving over 22%. The total crypto market capitalization plummeted to approximately $3.74 trillion from $4.30 trillion the previous day, erasing nearly $560 billion in value. [5]

This rapid sell-off resulted in what many are calling the largest liquidation event in crypto history. Over $19 billion in crypto bets were wiped out, impacting more than 1.6 million traders worldwide. [2, 5] Reports indicate that more than $7 billion of these positions were liquidated within the first hour of Trump's announcement alone. [2] The abruptness and scale of the crash led to speculation about potential market orchestration, with on-chain data revealing that a large Bitcoin whale had opened massive short positions on BTC and ETH days before the tariff announcement, reportedly profiting around $200 million from the subsequent market collapse. [1, 3]

The market chaos also exposed vulnerabilities within certain centralized systems. Some stablecoins and wrapped tokens, including USDE, BNSOL, and WBETH, experienced temporary de-pegging events on Binance, highlighting the risks in leveraged and synthetic token markets during periods of extreme volatility. [1] Centralized price oracles, such as Chainlink and Pyth, also showed vulnerabilities, feeding potentially manipulated or glitched prices to exchanges and DeFi applications, which instantly triggered mass liquidations on perpetual contracts. [1] In response to the extreme volatility, Binance Futures deployed $188 million from its insurance fund to manage risks and safeguard leveraged positions, demonstrating measures taken by exchanges to stabilize the market during such turmoil. [1]

Market sentiment has predictably turned cautious, with the Crypto Fear & Greed Index falling to a 'fear'-driven 35, its lowest in over a month. [8, 14] While short-term traders are advised to monitor key support levels, some long-term investors may view this pullback as a strategic accumulation opportunity. [1] Analysts suggest that the market's next move will depend heavily on fresh economic data and the broader macroeconomic environment, particularly concerning U.S.-China trade relations. [1, 15]

Despite the immediate market turmoil, there were other notable developments in the regulatory and institutional spheres. The European Banking Authority (EBA) published a report focusing on tackling money laundering and terrorist financing risks in crypto-asset services, drawing lessons from recent supervisory cases across the EU. [10] In the UK, emerging cryptoasset regulations are focusing on trading, custody, issuance, and promotions, with proposals for a new 'Cryptoasset Prudential' regime (CRYPTOPRU) that would introduce capital and liquidity requirements for crypto firms. [9]

Globally, Dubai's Virtual Assets Regulatory Authority (VARA) fined 19 companies for operating without proper licenses, underscoring ongoing efforts to enforce regulatory compliance. [4] On a more positive note for institutional integration, Plume Network became the first layer-2 blockchain protocol to register with the U.S. Securities and Exchange Commission (SEC) as a transfer agent, enabling it to manage records of securities ownership and oversee tokenized real-world assets (RWAs) in compliance with federal regulations. [4] Furthermore, S&P Global Inc. announced the launch of the Digital Markets 50 Index, a new benchmark combining leading digital assets with publicly traded blockchain-related equities. [4]

For Ethereum, despite BlackRock clients offloading $80.2 million in ETH, signaling some institutional caution amidst market volatility, [21] some analysts maintain a bullish long-term outlook. Fundstrat's Tom Lee, for instance, forecasts Ethereum reaching $15,000 by year-end 2025, driven by institutional adoption, regulatory clarity, and the expansion of RWA tokenization. [6] Ethereum's transition to Proof-of-Stake and its significant market share in RWA tokenization reinforce its structural advantages, positioning it as a foundational layer for the evolving Web3 ecosystem. [6]

Today's events highlight the volatile nature of the crypto market, where geopolitical announcements can trigger immediate and severe reactions. While the immediate aftermath has been characterized by panic and massive liquidations, the underlying long-term trends of institutional adoption and regulatory maturation continue to evolve, setting the stage for future market dynamics.

Do you think the price of XRP will rise or fall today?

Now that you know the price of XRP today, here's what else you can explore:

How to buy XRP (XRP)?How to sell XRP (XRP)?What is XRP (XRP)What would have happened if you had bought XRP (XRP)?What is the XRP (XRP) price prediction for this year, 2030, and 2050?Where can I download XRP (XRP) historical price data?What are the prices of similar cryptocurrencies today?Want to get cryptocurrencies instantly?

Buy cryptocurrencies directly with a credit card.Trade various cryptocurrencies on the spot platform for arbitrage.XRP price prediction

When is a good time to buy XRP? Should I buy or sell XRP now?

What will the price of XRP be in 2026?

What will the price of XRP be in 2031?

About XRP (XRP)

XRP (XRP live price)is the native digital asset of the XRP Ledger (XRPL), a public, open‑source network built for fast, low‑cost value transfer. Instead of mining, the XRPL reaches agreement on which transactions are valid using the Ripple Protocol Consensus Algorithm (RPCA). The design targets correctness and agreement while keeping confirmation times short, so transactions can finalize in seconds under normal conditions.

In RPCA, validators iteratively share proposals and converge on a transaction set for the next ledger. The final round requires a super‑majority of roughly 80% agreement within each validator’s Unique Node List (UNL). When that threshold is met, the ledger closes and becomes the network’s new “ground truth”. This staged process lets the network keep moving even if some nodes are slow or faulty, preserving reliable settlement for payments at scale.

Why XRP matters for payments and liquidity

Fast, predictable finality is the headline. When payments settle in seconds, treasurers and exchanges can move value with less operational friction and tighter working‑capital cycles. Fees are generally low, which helps both small remittances and institutional‑size flows.

XRP can also act as a bridge asset between currency pairs. In corridors where direct liquidity is thin, routing via XRP can reduce slippage and improve execution. Beyond payments, the XRPL supports issued assets, a built‑in decentralized exchange, and tokenization—features that broaden utility and deepen on‑ledger liquidity over time.

Supply and circulation

XRP has a fixed supply of 100 billion units created at inception. Circulating supply has been shaped by historical distributions, escrow mechanics associated with Ripple, and secondary‑market dynamics across exchanges and OTC venues. On the demand side, payment volume, liquidity‑bridging use, and on‑ledger activity influence how much XRP market participants need at any given time.

What moves the Ripple current price: lawsuit, ETF narrative, and Digital Asset Treasury (DAT)

Ripple lawsuit

Regulatory milestones have been the single biggest swing factor for the XRP price. The SEC’s complaint in December 2020 coincided with U.S. exchange suspensions and a steep drawdown. In July 2023, a partial summary judgment concluding that programmatic exchange sales were not investment contracts sparked a rapid rally—intraday gains of around 70%—and multiple relistings. Through 2024, updates in the remedies phase produced shorter, news‑driven bursts of volatility as traders handicapped the endgame.

The mechanism is straightforward. Clarity lowers perceived legal risk, encourages listings, and attracts deeper liquidity. That typically tightens spreads and strengthens order‑book depth. Negative developments do the opposite, widening spreads and reducing risk appetite among market makers and institutions.

ETF and ETP landscape

Exchange‑traded access matters because it can broaden the investor base and add systematic flows. In the United States, as of my latest verified information (October 2024), there was no approved spot XRP ETF, and the absence of a large, regulated U.S. futures market limited a futures‑ETF route. Europe and other jurisdictions have offered XRP exchange‑traded products (ETPs) for years on venues such as SIX and Xetra, mainly serving professional and institutional channels. Their impact has been incremental rather than explosive compared with major legal rulings.

You asked for a September 2025 update on “who filed” and “what kind of ETF,” plus the price reaction after each headline. I don’t have real‑time access beyond October 2024. If you share the 2025 filings or approvals you want covered (issuer, spot vs. futures, listing venue, and the announcement date), I’ll add precise, human‑readable summaries with the observed price reaction in the T+0 to T+3 day window and notes on spreads and order‑book depth.

Digital Asset Treasury (DAT)

DAT is how companies and institutions hold and use crypto on their balance sheets. For XRP, treasuries matter because they can create steady, non‑speculative demand. When a payment provider or corporate treasury accumulates XRP to bridge fiat currencies or to fund cross‑border settlements, it adds incremental buy pressure. When they rebalance or unwind, that demand can fade.

Transparency also plays a role. Markets pay close attention to escrow schedules, sale frameworks, and any shift toward buybacks or accumulation. Derivatives hedging by treasuries—via perpetuals or options—feeds into funding rates, basis, and implied volatility, which in turn shapes spot price discovery. Macro policy changes, quarter‑end positioning, or shifts in cash‑management preferences can all show up as short, sharp moves in the XRP price.

How to read the XRP price on this page

Start with the live XRP price, market cap, and 24‑hour volume to gauge momentum. Look across multiple timeframes to separate noise from trend. During headline risk—lawsuit rulings, ETF filings or denials, large custody integrations—watch spreads and top‑of‑book depth. Tighter spreads and thicker books often follow positive clarity or broader access.

Comprehensive Analysis of XRP: The Digital Asset for Global Payments

XRP is a digital asset designed for fast, low-cost global payments, fundamentally aiming to improve the efficiency of cross-border transactions. Developed by Ripple Labs Inc., XRP operates on the XRP Ledger (XRPL), an open-source and decentralized technology that stands apart from traditional blockchain structures like Bitcoin or Ethereum.

Technological Foundation: The XRP Ledger (XRPL)

The XRP Ledger, launched in 2012, serves as the backbone for XRP. Unlike proof-of-work blockchains, the XRPL utilizes a unique Federated Consensus mechanism for validating transactions. This consensus protocol allows a network of designated independent servers, known as validators, to agree on the order and outcome of transactions. This approach enables XRP to achieve remarkable transaction speeds and efficiency without relying on energy-intensive mining. The XRPL is designed for reliability and stability, having operated consistently for over a decade. [6, 11]

Core Utility and Use Cases

The primary utility of XRP lies in its ability to facilitate ultra-fast and cost-effective cross-border payments. Ripple's flagship product, On-Demand Liquidity (ODL), leverages XRP as a bridge currency to eliminate the need for pre-funded nostro accounts in foreign currencies, a common pain point in traditional international transfers. This allows financial institutions to send and receive payments in local currency in as little as 3 to 5 seconds. [6, 11] Beyond cross-border remittances, the XRPL supports various other applications, including micro-payments, decentralized finance (DeFi), and the potential for non-fungible tokens (NFTs) and Central Bank Digital Currencies (CBDCs). [11, 20]

Key Advantages of XRP

XRP boasts several significant advantages that position it as a strong contender in the digital asset space:

- Speed and Efficiency: Transactions on the XRP Ledger settle in approximately 3 to 5 seconds. [1, 10] This rapid settlement dramatically outperforms traditional banking systems that can take days. [2]

- Low Cost: Transaction fees are exceptionally low, typically around 0.00001 XRP, or approximately $0.0002 USD, making it economically viable for high-volume and micro-transactions. [2, 10]

- Scalability: The XRPL can routinely handle up to 1,500 transactions per second (TPS). [1, 11] Testing has demonstrated its capacity to scale to over 65,000 TPS, and its payment channels feature is designed to process up to 50,000 TPS. [1, 5] This capacity is crucial for global financial infrastructure. [4]

- Energy Efficiency: The XRPL's consensus mechanism is highly energy-efficient and carbon-neutral, consuming significantly less energy compared to proof-of-work cryptocurrencies. [5, 11]

XRP Tokenomics

The total maximum supply of XRP is capped at 100 billion tokens. Ripple Labs initially received 80 billion XRP to develop use cases around the digital asset. [6, 11] A significant portion of this supply, approximately 35.3 to 39.1 billion XRP, is held in a cryptographically secured escrow. [3, 8, 9, 12] This escrow system releases 1 billion XRP monthly, with any unsold tokens typically returned to new escrow contracts. This mechanism is designed to provide predictability to the circulating supply and prevent market flooding. [8, 12] As of October 2025, the circulating supply is around 64.66 billion XRP. [3]

Adoption and Ecosystem Growth

RippleNet, Ripple's global payment network, has established partnerships with over 300 financial institutions across more than 45 countries. [10] A substantial percentage of these partners, approximately 40%, utilize XRP for ODL transactions. [10] The ODL service has seen considerable growth, processing an estimated $1.3 trillion in cross-border payments in Q2 2025, with over 93 institutions actively using the solution. [14, 18] Key partners include major financial players like Santander and SBI Holdings. [10, 18]

Regulatory Landscape and Future Outlook

A pivotal development for XRP has been the resolution of the protracted legal battle with the U.S. Securities and Exchange Commission (SEC). In August 2025, the lawsuit concluded with a settlement that saw Ripple agree to pay a $125 million fine. [7, 15] Crucially, the court's ruling affirmed that programmatic sales of XRP on secondary markets are not securities transactions, providing significant regulatory clarity. [7, 16] This legal outcome has renewed institutional confidence, leading to the relisting of XRP on various exchanges and an influx of applications for spot XRP Exchange-Traded Funds (ETFs), with decisions anticipated in late 2025. [7, 15, 17]

Looking ahead, the future of XRP appears promising. The enhanced regulatory clarity is expected to drive further institutional adoption and capital inflows, particularly if spot XRP ETFs are approved. [14, 16] Ripple continues to expand its ODL corridors and explore new functionalities for the XRPL, including EVM (Ethereum Virtual Machine) sidechains to enhance smart contract compatibility and the introduction of a stablecoin (RLUSD). [15, 18] While concerns about centralization due to Ripple's significant XRP holdings persist, the overall trend points towards increased utility and integration of XRP within the global financial system. [18]

Bitget Insights

XRP/USD price calculator

XRP resources

Tags:

What can you do with cryptos like XRP (XRP)?

Deposit easily and withdraw quicklyBuy to grow, sell to profitTrade spot for arbitrageTrade futures for high risk and high returnEarn passive income with stable interest ratesTransfer assets with your Web3 walletWhat is XRP and how does XRP work?

Global XRP prices

Buy more

FAQ

How many XRP are there in circulation?

Can XRP's price reach Bitcoin or Ethereum's price levels?

Is XRP a good investment?

What are the use cases of XRP?

Can XRP reach US$1 in 2023?

Can I mine XRP?

What factors influence the price of XRP?

Where can I buy XRP?

Is XRP a good investment right now?

What is the current price of XRP?

How does XRP compare to Bitcoin in terms of price?

What is the price prediction for XRP over the next year?

Are there any upcoming events that could affect XRP's price?

What is the highest price XRP has ever reached?

Can XRP's price drop below $0.50?

How can I monitor XRP price changes effectively?

What is the current price of XRP?

What is the 24 hour trading volume of XRP?

What is the all-time high of XRP?

Can I buy XRP on Bitget?

Can I get a steady income from investing in XRP?

Where can I buy XRP with the lowest fee?

Related cryptocurrency prices

Prices of newly listed coins on Bitget

Hot promotions

Where can I buy XRP (XRP)?

Video section — quick verification, quick trading