News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Silver strengthens amid global tensions and a declining US Dollar

101 finance·2026/01/12 13:57

What Can Investors Anticipate in Lam Research’s Q2 2025 Earnings Announcement

101 finance·2026/01/12 13:57

Gold and silver surge as US launches investigation into Federal Reserve involving Powell

101 finance·2026/01/12 13:57

JPMorgan Chase no longer anticipates a Fed rate cut, expects to hike in 2027

BlockBeats·2026/01/12 13:56

Why Remittix’s approach to crypto’s structural problem is starting to draw serious attention

Crypto.News·2026/01/12 13:54

BNY Opens Access to Tokenized Deposits for Institutional Clients

Coinspaidmedia·2026/01/12 13:54

Crypto Market News Today: DeepSnitch AI Surges 120% Amid Pre-Launch Excitement, Spot Bitcoin and Ethereum ETFs Experience $1B in Outflows

BlockchainReporter·2026/01/12 13:51

Earnings Outlook: Anticipating Philip Morris’ Upcoming Report

101 finance·2026/01/12 13:48

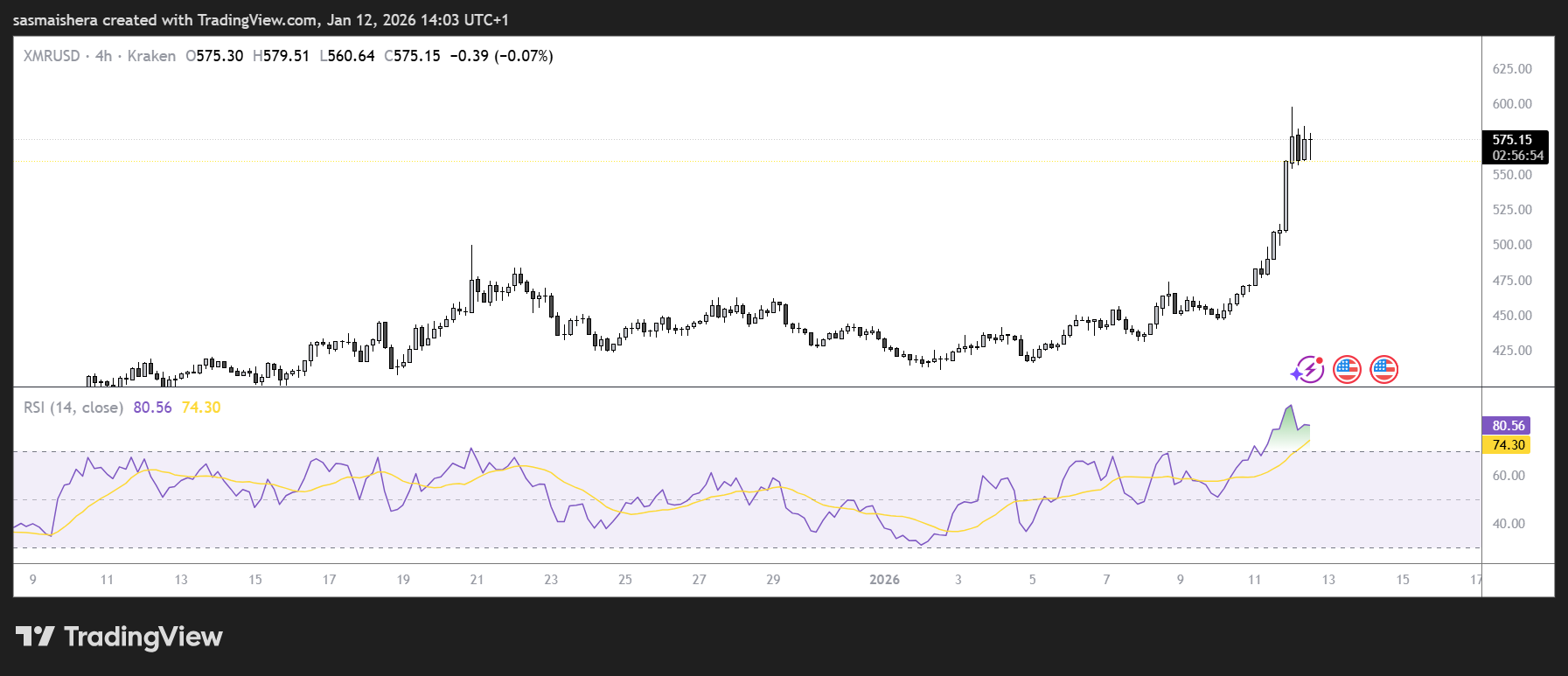

Monero price forecast: Is XMR heading towards $700?

Coinjournal·2026/01/12 13:48

Flash

12:00

A whale has once again increased its holdings by acquiring 1299.6 ETH at an average price of $3129.64, bringing its total holdings to 51,451.6 ETH.BlockBeats News, January 13th, according to AI Whale Monitoring, the whale who is bullish on ETH increased their holdings by another 1299.6 ETH after a week:Just 5 minutes ago, they withdrew ETH from an exchange at an average price of $3129.64. The total amount of ETH accumulated since December 5, 2025, has increased to 51,451.6 ETH, with a total value of $161 million and an average cost of approximately $3117.3. They are currently at a floating loss of $940,000. Compared to last week's short-term high point for ETH, the floating profit has retreated by over $9 million.

11:40

Polymarket: Probability of "Space public sale subscription exceeding $14 million" rises to 96%BlockBeats news, on January 13, the probability of "Space public sale subscription amount exceeding $14 million" on the prediction market Polymarket has risen to 96%, while the probability of "Space public sale subscription amount exceeding $16 million" is currently reported at 88%; the probability of "Space public sale subscription amount exceeding $18 million" is currently reported at 74%. As of now, the Space public sale has raised $12.5 million in funds.

11:36

Bitdeer mined 636 BTC in December, a year-on-year increase of 339%ChainCatcher news, Nasdaq-listed bitcoin mining and AI cloud service company Bitdeer Technologies Group has officially released its December operational data. Last month, the company mined 636 BTC, representing a year-on-year increase of 339% and a month-on-month increase of 21%. Its self-mining hashrate reached 55.2 EH/s. By the end of last year, the company's total bitcoin holdings amounted to 2,017 BTC.