News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bitcoin Long-Term Holder Selling Pressure Eases: Glassnode Reveals Crucial Market Shift

Bitcoinworld·2026/01/12 14:06

BitGo IPO: Ambitious $201 Million Public Offering Signals Crypto Custody Breakthrough

Bitcoinworld·2026/01/12 14:06

XRP’s Whale Accumulation Increases as Investors Explore Alternative Income Strategies

Crypto Ninjas·2026/01/12 14:06

How you might gain from Trump’s proposal to purchase mortgage-backed securities

101 finance·2026/01/12 14:03

Dina Powell McCormick joins Meta as president and vice chairman

101 finance·2026/01/12 14:03

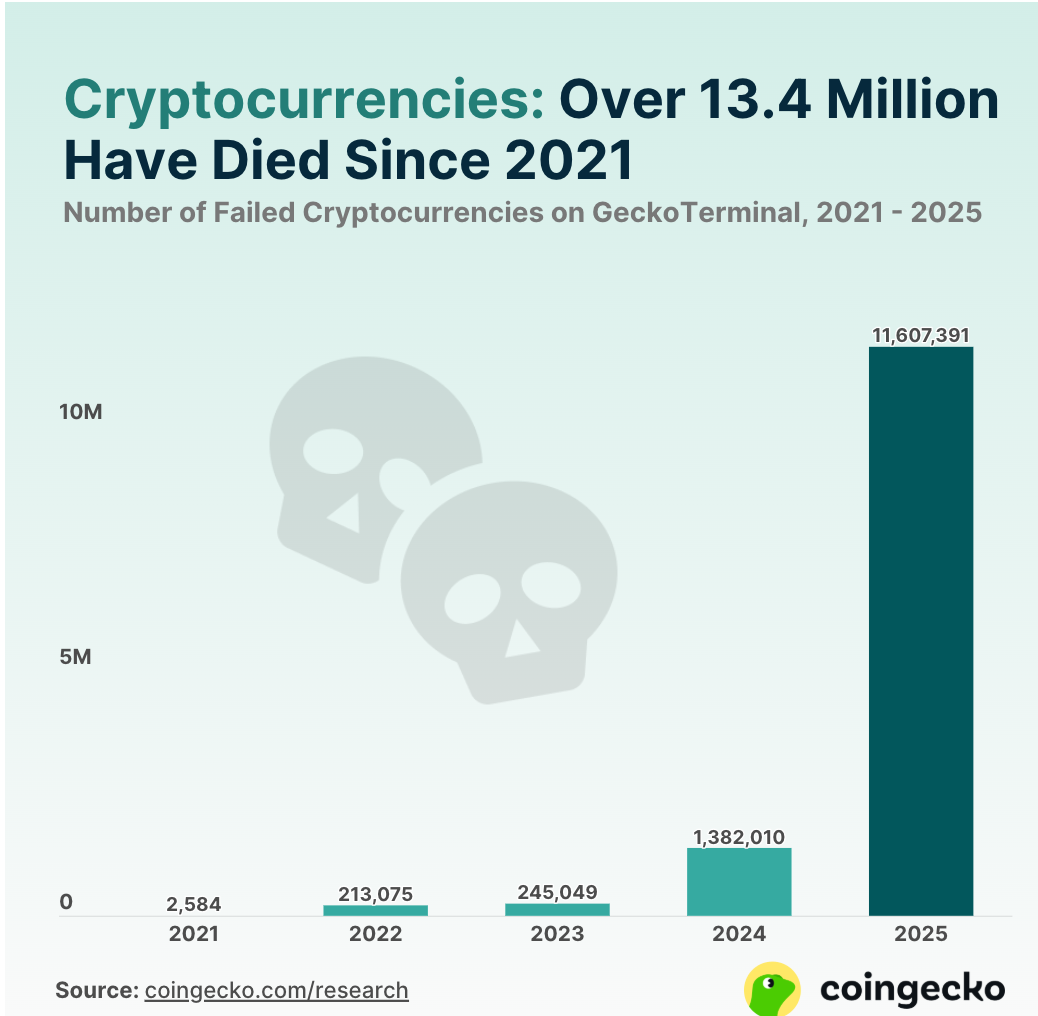

CoinGecko Research Says More Than 53% of Cryptocurrencies Have Failed

CoinEdition·2026/01/12 14:03

Spot gold rose more than $300 in January.

Cointime·2026/01/12 14:02

Solana Dominates 7-Day Onchain Activity as User Growth and DEX Volume Surge

BlockchainReporter·2026/01/12 14:00

World's most critical oil passage draws attention again as potential U.S. measures against Iran loom

101 finance·2026/01/12 13:57

Flash

02:20

Wintermute's main wallet is market-selling VVV.BlockBeats News, January 13th, according to onchainschool.pro monitoring, a major wallet of Wintermute is currently market-selling its VVV holdings.

Currently, the wallet still holds VVV worth about $100,000, and there are also transfers from other Wintermute-related wallets flowing in.

01:54

NYC Token Deployer Profits Around $1 Million by Adding One-Sided LiquidityBlockBeats News, January 13th, according to Bubblemaps analysis, former New York City Mayor Eric Adams launched the NYC token. Wallet 9Ty4M, associated with the token deployer, created a one-sided liquidity pool on the Meteora platform, withdrew approximately $2.5 million USDC at the price peak, and reinvested only about $1.5 million after a 60% token value drop, netting about $1 million in profit.

01:53

The Mt. Gox hacker's associated address deposited another 926 BTC into an unknown trading platform. according to Emmett Gallic's monitoring, the Mt.Gox hacker Aleksey Bilyuchenko's associated address has deposited 926 BTC to an unknown trading platform. The aforementioned address still holds 3,000 BTC (valued at $275 million).

It is currently unclear whether Bilyuchenko owns these assets. Bilyuchenko was last seen serving a 3.5-year sentence in Moscow.