News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Non-Farm Data Eases Employment Concerns; Iran Geopolitical Risks Fuel Commodities; Trump's Interest Rate Cap Policy Sparks Controversy (January 12, 2026)2Bitget Daily Digest (Jan.12)|Spot Gold Breaks Above $4,600; $271M TRUMP Unlock Scheduled This Week; Strategy May Disclose Additional BTC Purchases3Bitcoin Price Prediction: Expert Reveals December 2025 Bottom Signals Powerful Short-Term Rebound

Venezuela Used USDT to Pay for Oil Sales Post Sanctions: Report

CoinEdition·2026/01/12 13:24

XRP Price Prediction: XRP Consolidates as DeFi Narratives Expand Across Blockchains

CoinEdition·2026/01/12 13:24

Bitcoin Shrugs Off Powell Probe as DOJ Targets Fed Chair

Decrypt·2026/01/12 13:23

Venezuela Turns to USDT as Stablecoins Bypass Sanctions

Cryptotale·2026/01/12 13:21

'Sell America' trade returns as Trump's DOJ probes Powell

101 finance·2026/01/12 13:21

Sileon Expands Crypto Lending Offerings with ArtGis Finance Partnership

BlockchainReporter·2026/01/12 13:12

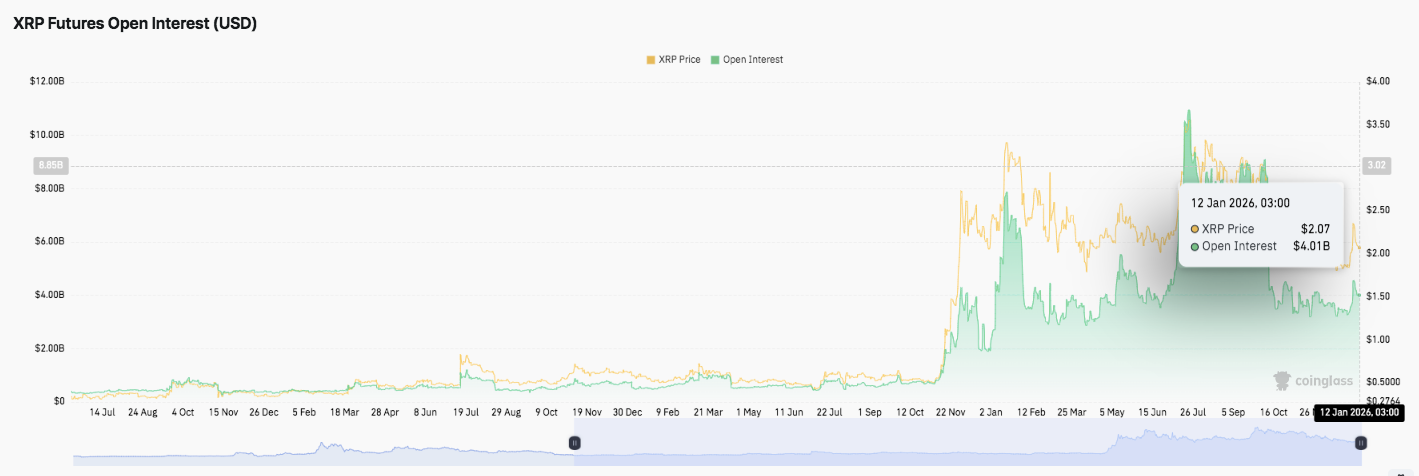

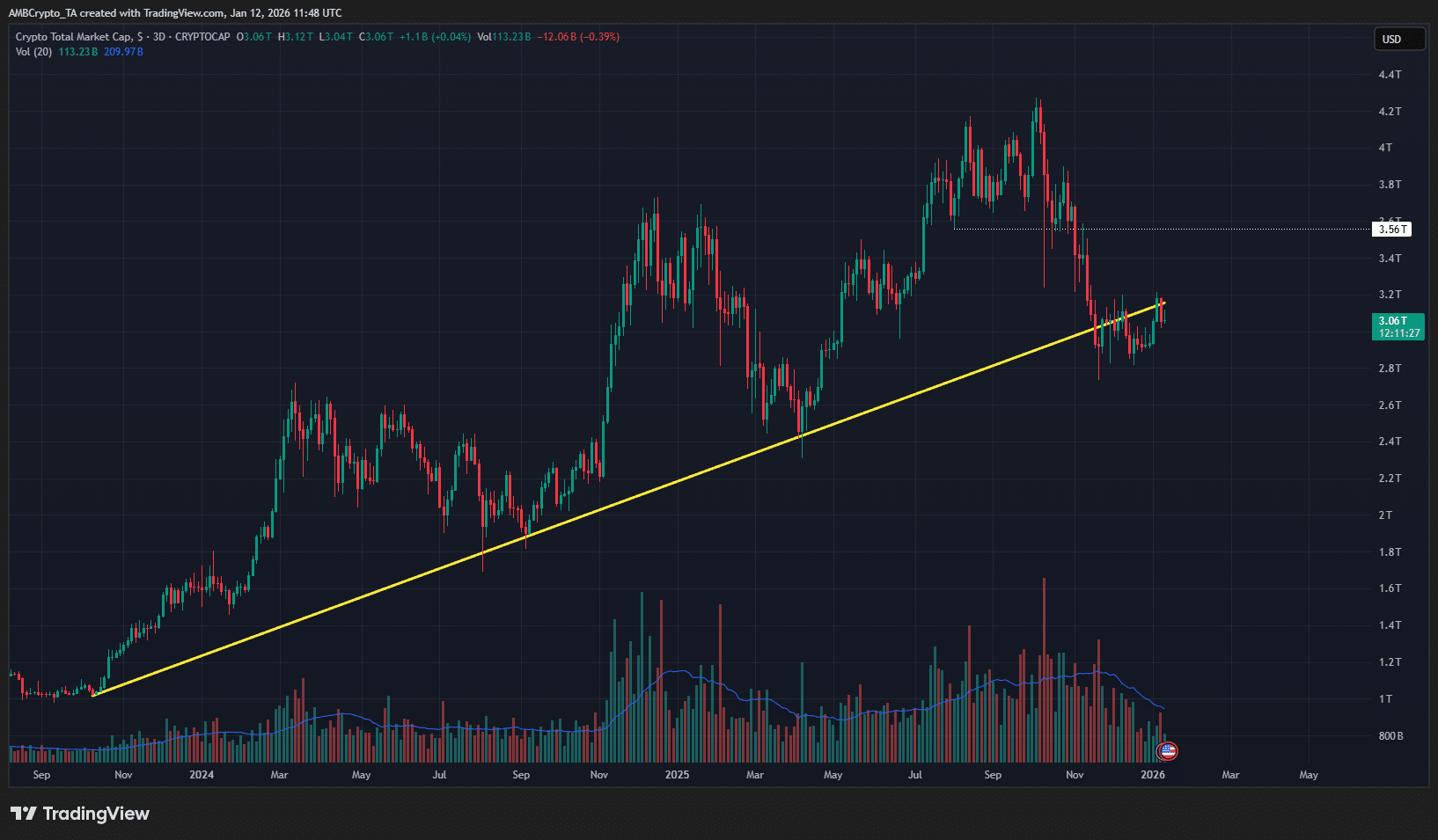

Here’s what needs to happen for XRP to reach $3 by the end of January

AMBCrypto·2026/01/12 13:03

Here's what you can anticipate in Veralto’s upcoming earnings release

101 finance·2026/01/12 13:03

XRP Shines as Crypto Funds Bag $454 Million Outflow

Coinspeaker·2026/01/12 13:00

Flash

15:50

Tom Lee: If Shareholders Do Not Approve BitMine's New Share Issuance Authorization, ETH Accumulation Pace Will Be Forced to SlowBlockBeats News, January 12th — In a statement released on Monday, BitMine Chairman Thomas "Tom" Lee said that whether BitMine can continue to accumulate Ethereum (ETH) depends on whether shareholders approve a new share issuance authorization for the company. If not approved, the company may be forced to slow down its purchasing pace in the coming weeks.

Lee stated, "We must proceed with the issuance immediately because BitMine's current 500 million share authorization is about to be depleted, and once exhausted, our ETH accumulation rate will slow down." The shareholder vote is scheduled for Thursday. According to the regulations, the issuance proposal needs to receive support from 50.1% of all outstanding shares to pass. "This is a very high threshold, making it extremely difficult to obtain authorization for the issuance," Lee emphasized in the statement.

15:46

Today, US Bitcoin ETFs saw a net outflow of 3,734 BTC, and Ethereum ETFs saw a net outflow of 42,299 ETH. according to Lookonchain monitoring, today the US Bitcoin ETF had a net outflow of 3,734 BTC, with a 7-day net outflow of 7,706 BTC; the Ethereum ETF had a net outflow of 42,299 ETH, with a 7-day net inflow of 8,466 ETH; the Solana ETF had a net inflow of 36,370 SOL, with a 7-day net inflow of 328,049 SOL.

15:40

Web3AI Agent Platform Neuramint Completes $5 Million Seed Round FinancingBlockBeats News, January 12th, According to official sources, Web3 AI agent platform Neuramint has announced the completion of a $5 million seed round of financing. This round of financing was led by Maelstrom, Borderless Capital, Selini Capital, Symbolic Capital, Lattice Fund, and Node Capital.

It is reported that this financing will accelerate platform development, expand Web3-native SDK integrations, and support the upcoming Neuramint Beta public testing. The new funds will also drive further integration with major DeFi protocols and blockchain networks, supporting DeFi automation, NFT operations, cross-chain bridging, and large-scale DAO governance.

News