News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Imposes 25% Tariffs on Iran's Trade Partners; Google Market Cap Breaks $4 Trillion for the First Time; Gold Surpasses $4600 Threshold (Jan,13, 2026)2Bitget Daily Digest (Jan.13)|Market Risk-Off Triggered by Fed Independence Dispute; Meta Plans to Cut Metaverse Investment; Strategy Added 13,627 BTC Last Week

Trump's Iran tariff threat risks reopening China rift

101 finance·2026/01/13 10:57

EUR/JPY extends rally as Yen falters on political uncertainty, BoJ caution

101 finance·2026/01/13 10:54

Chiefs of global central banks: Express backing for Fed’s Powell

101 finance·2026/01/13 10:54

Pimco Expects Mortgage Rates to Decline as Fannie and Freddie Increase Purchases

101 finance·2026/01/13 10:45

SEC Chair Flags $60B Venezuelan Bitcoin Rumor as Unclear While Pushing U.S. Crypto Law Overhaul

Crypto Ninjas·2026/01/13 10:33

Banks Secure Major Victory as Crypto Legislation Prohibits Interest on Stablecoins

101 finance·2026/01/13 10:27

Whale Wallets Trigger Turmoil in the Bitcoin Market

Cointurk·2026/01/13 10:21

Lummis and Wyden Introduce Bill Exempting Blockchain Developers From Money Transmitter Rules

CoinEdition·2026/01/13 10:21

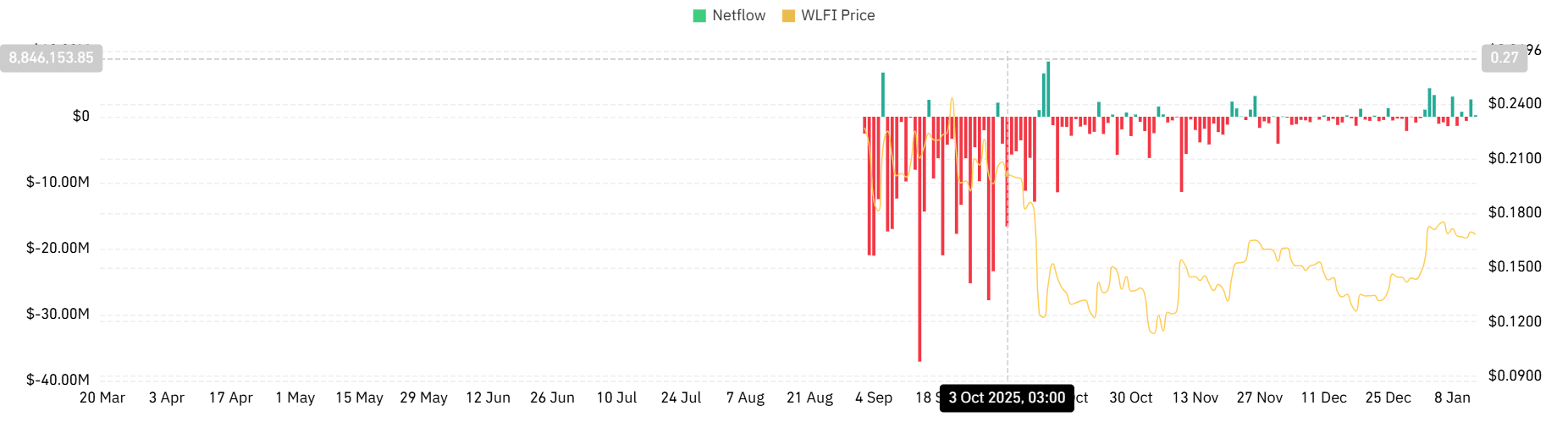

World Liberty expands into lending as WLFI faces selling pressure – Details

AMBCrypto·2026/01/13 10:03

World Liberty Markets Goes Live as USD1 Enters DeFi Lending With $3B Supply and Dolomite Liquidity

Crypto Ninjas·2026/01/13 09:57

Flash

12:59

Trump's Pre-Midterm Economic Policy Expectations Favor Cyclical StocksOn January 13, Wall Street interpreted Trump's recent economic statements as a signal for growth, betting that he will make every effort to stimulate the economy and consumption before the November midterm elections, which is favorable for the performance of cyclical sectors such as industrials, raw materials, and consumer discretionary. UBS believes that the relevant policies are more election-oriented, focusing on prices, housing, gasoline, and interest rate levels. Although the idea of a cap on credit card interest rates may temporarily weigh on bank stocks, both UBS and JPMorgan are optimistic about the performance of cyclical stocks, expecting that easing inflation will further drive economically sensitive sectors to outperform the broader market. BTIG pointed out that the S&P 500 index is approaching the 7,000-point mark, which may lead to a period of volatility and adjustment. Most institutions believe that cyclical stocks are likely to become the main theme of this round of the market.

12:56

Trump Expected to Increase Stimulus Ahead of Midterm Elections, Wall Street Bets on Cyclical Stocks StrengtheningBlockBeats News, January 13 – As the US midterm elections approach, Wall Street is interpreting Trump’s recent series of economic statements as “broad pro-growth signals,” betting that he will go all out to stimulate the economy and consumption before November, which would benefit cyclical assets. Market participants point out that from consistently calling for interest rate cuts to proposing ideas such as capping credit card interest rates, the core goal of the Trump administration is to maintain economic vitality and affordability for people's livelihoods. Investment banks generally believe that this policy orientation is more favorable to cyclical sectors such as industrials, raw materials, and consumer discretionary, rather than defensive stocks. Raymond James stated in its latest report that, given strong expectations for monetary and fiscal policy and Trump’s frequent pro-growth signals, it is difficult for the market to bet on a failure of cyclical economic recovery. UBS also pointed out that these policies are more election-oriented, with voters’ core concerns still focused on prices, housing, gasoline, and interest rates. Although Trump’s proposal to cap credit card interest rates once weighed on bank stocks, UBS believes that even if the policy is implemented, it may be temporary and have limited coverage, so the long-term impact on the financial sector is manageable, viewing the pullback in bank stocks as a buying opportunity. JPMorgan is also optimistic about cyclical stocks, expecting that slowing inflation will create room for further economic stimulus in 2026, driving economically sensitive sectors to outperform the broader market. However, from an index perspective, the S&P 500 index is approaching the key 7000-point mark. Historical experience shows that before breaking through important round numbers, the market often experiences volatility and corrections. BTIG pointed out that in the past five attempts to break through thousand-point milestones, there were four instances of interim pullbacks. Overall, in the short term, market sentiment may fluctuate due to policy uncertainty and earnings season, but most institutions still believe that, supported by pro-growth expectations and improved corporate earnings, cyclical stocks are likely to become the main theme of this market rally.

12:56

Trump Increases Stimulus Expectations Ahead of Midterm Elections, Wall Street Bets on Cyclical Stocks RallyBlockBeats News, January 13th: As the US midterm elections approach, Wall Street is interpreting President Trump's recent series of economic statements as a "broad growth stimulus signal," betting that he will spare no effort to stimulate the economy and consumption before November, thus benefiting the performance of cyclical assets.

Market participants point out that from continuously calling for interest rate cuts to proposing ideas such as capping credit card interest rates, the core goal of the Trump administration is to maintain economic activity and affordability for the people. Investment banks generally believe that this policy orientation is more favorable for cyclical sectors such as industry, raw materials, and non-essential consumer goods, rather than defensive stocks.

Raymond James stated in a recent report that given the strong expectations for monetary and fiscal policies, and the background of Trump frequently releasing pro-growth signals, the market finds it hard to bet on the failure of an economic cyclical recovery. UBS also pointed out that the related policies are more election-oriented, and the core concerns of voters are still prices, housing, gasoline, and interest rates.

Although Trump's proposal to cap credit card interest rates once suppressed bank stocks, UBS believes that even if this policy is implemented, it may be temporary and have a limited scope, the long-term impact on the financial sector is controllable, and the pullback in bank stocks is seen as a buying opportunity. JPMorgan Chase is also bullish on cyclical stocks, expecting that slowing inflation will further stimulate the economy by 2026, creating room for outperformance of economically sensitive sectors over the broader market.

However, from an index perspective, the S&P 500 index is approaching the 7000-point integer mark. Historical experience shows that before breaking through important integer levels, the market often experiences volatile adjustments. BTIG pointed out that in the past five attempts to breach a thousand-point integer mark, there have been four instances of phase retracements.

On the whole, in the short term, market sentiment may fluctuate due to policy uncertainties and earnings season, but most institutions still believe that with the support of growth expectations and corporate profit improvement, cyclical stocks are expected to become a key theme of this round of the market.

News