News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Non-Farm Data Eases Employment Concerns; Iran Geopolitical Risks Fuel Commodities; Trump's Interest Rate Cap Policy Sparks Controversy (January 12, 2026)2Bitget Daily Digest (Jan.12)|Spot Gold Breaks Above $4,600; $271M TRUMP Unlock Scheduled This Week; Strategy May Disclose Additional BTC Purchases3Bitcoin Price Prediction: Expert Reveals December 2025 Bottom Signals Powerful Short-Term Rebound

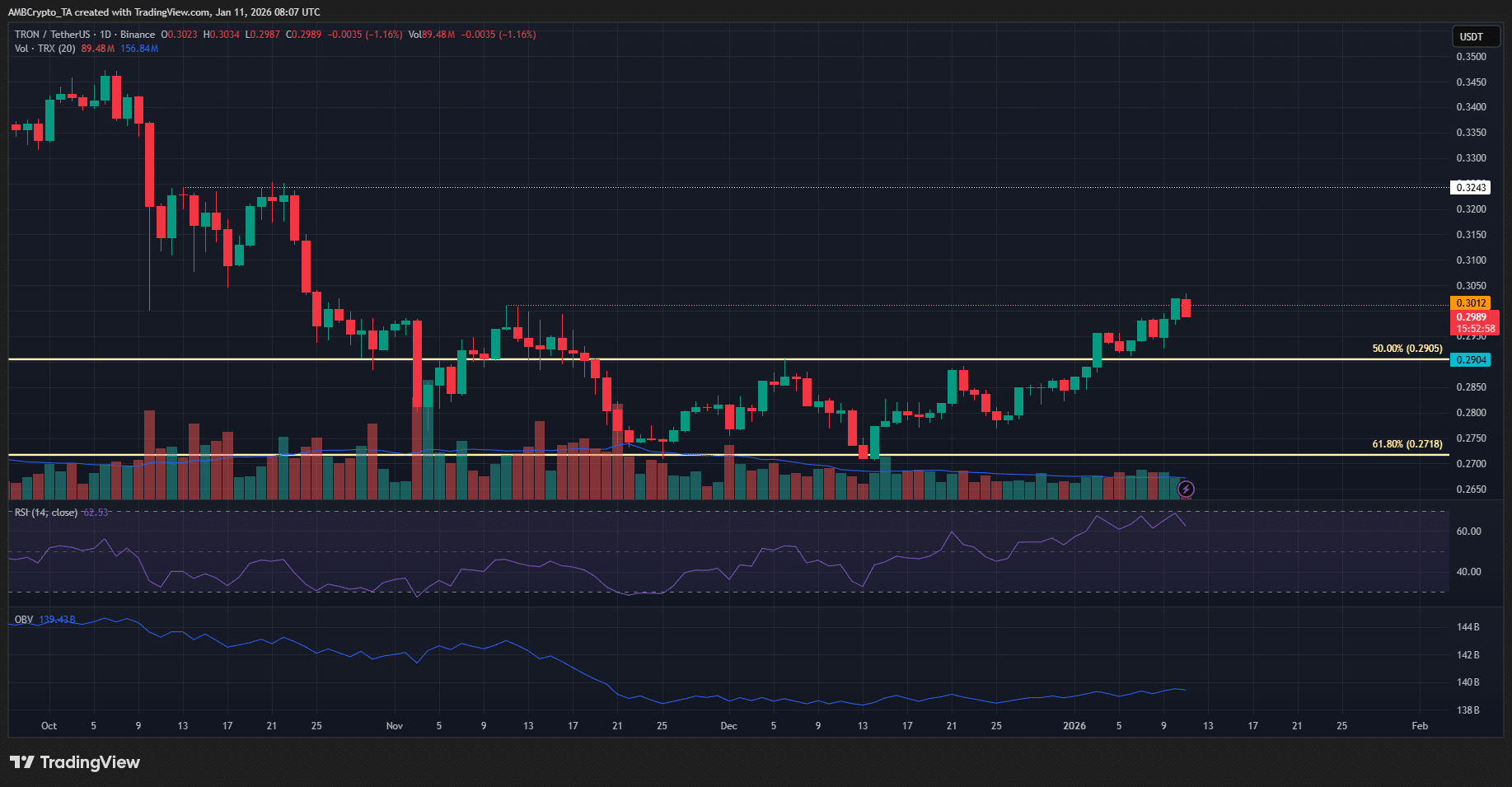

TRON holds bullish structure – But $0.30 remains a key level

AMBCrypto·2026/01/11 21:03

Bond traders’ major wager on 2026 is validated as US job growth slows

101 finance·2026/01/11 20:39

DOGE Price Alert – Technical Analysis Indicates Dogecoin may Go Down to $0.06

BlockchainReporter·2026/01/11 20:30

This Week, a Meeting Will Determine the Fate of Cryptocurrencies – Here’s the Date and Time

BitcoinSistemi·2026/01/11 20:18

XRP and Ethereum Hold Ground, Apeing Tops as the Upcoming Crypto Presale With Whitelist Stage 1 at $0.0001

BlockchainReporter·2026/01/11 20:15

One US location just banned CBDCs, but its new state token is doing something even more surprising

CryptoSlate·2026/01/11 20:09

Cryptocurrency Market Signals a Promising Shift in 2023

Cointurk·2026/01/11 19:12

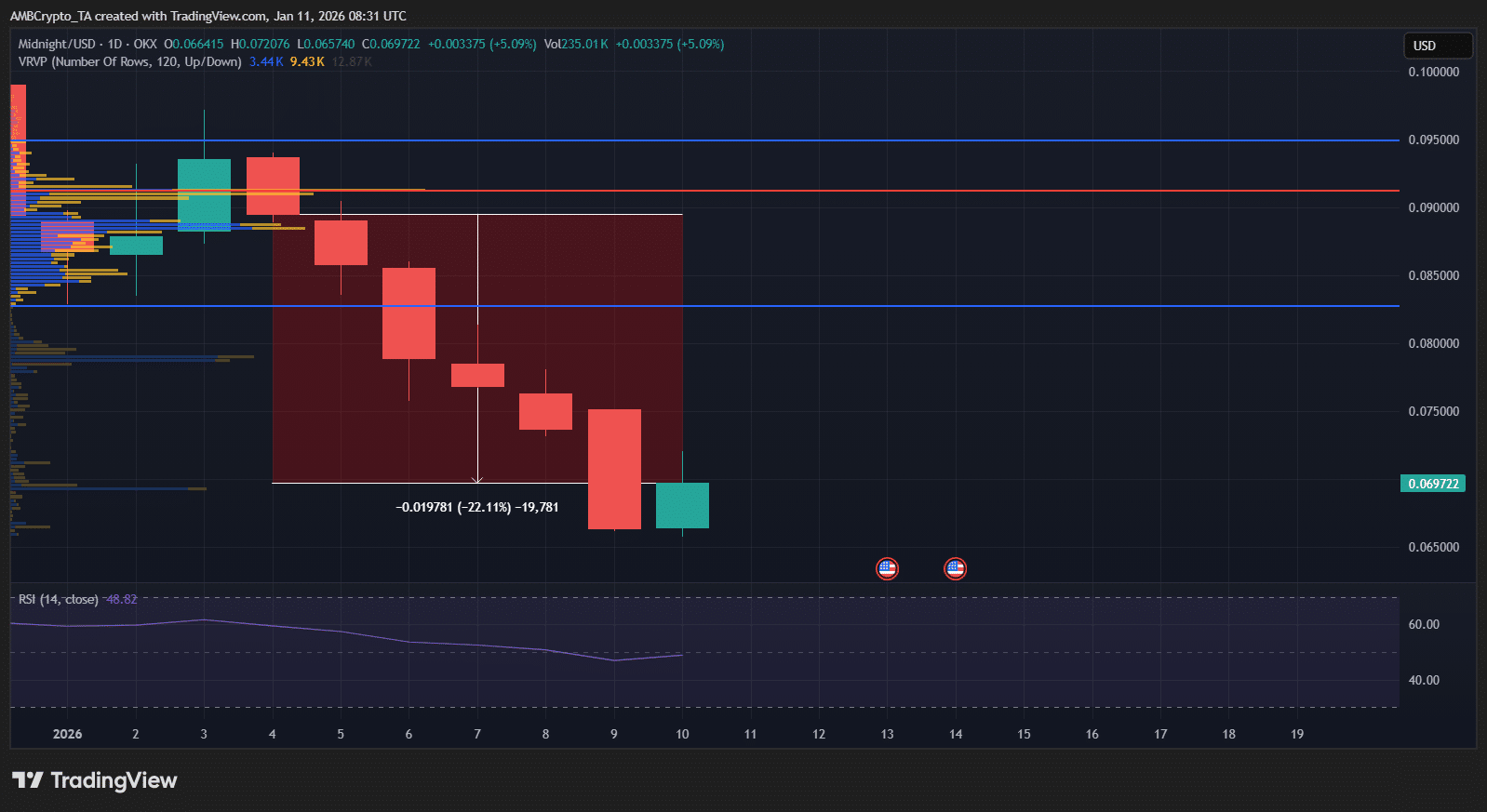

Crypto market’s weekly winners and losers – POL, JASMY, NIGHT, ZEC

AMBCrypto·2026/01/11 19:03

BlockDAG Holds $0.003 Entry Window Ahead of Jan 26 as Ethereum Stabilizes Near $3,130 and Tron Tests $0.30

BlockchainReporter·2026/01/11 19:00

Dogecoin Price Prediction: House Of Doge Japan Partnership Meets Bullish Divergence Signal At $0.139

CoinEdition·2026/01/11 18:21

Flash

06:39

H100 plans to acquire Swiss bitcoin treasury company Future Holdings AGForesight News reported that Nordic Bitcoin treasury company H100 Group AB has signed a letter of intent with the shareholders of Swiss Bitcoin treasury company Future Holdings AG, intending to acquire all of its shares. This proposed transaction marks H100's business expansion into Switzerland and aims to further strengthen the company's expertise in Bitcoin asset management and related capital market activities.

06:34

Strategy counterparty whale increases long positions, with total holdings reaching $315 millionOn January 12, Coinbob's popular address monitoring showed that the Strategy counterparty whale address (0x94d) has been continuously increasing its long positions in major cryptocurrencies such as ETH and BTC over the past few hours. The total position size has risen from about $250 million at 10:00 (UTC+8) today to $315 million, an increase of over $60 million. Around 4:00 (UTC+8) today, this address closed its short positions in ETH, BTC, and SOL, then switched to opening long positions, and subsequently increased its holdings in several major cryptocurrencies. As of press time, it holds long positions in seven major cryptocurrencies, with a total size of about $315 million, making it the largest BTC bull on the Hyperliquid platform. In the past four hours, the BTC long position has increased to $157 million, the ETH long position to $91 million, and the SOL long position to $33.14 million, all showing unrealized profits. This address began building positions in December last year, with an initial account size of about $20 million. Due to its trading direction being opposite to that of a certain exchange, it is regarded as the on-chain counterparty of that exchange.

06:31

「Strategy Long Opponent Position」 Further Increases Long Position by Over $60 Million, Total Position Size Rises to $315 MillionBlockBeats News, January 12th, according to Coinbob Popular Address Monitor, the "Strategy Whale" address (0x94d) has once again adjusted its position in the past few hours, continuously increasing its long position in mainstream coins such as ETH and BTC. Its total position has increased from approximately $250 million at 10 a.m. today to the current $315 million, adding over $60 million.

Around 4 a.m. today, the address closed its ETH, BTC, and SOL short positions at breakeven, then went long at around $90,600 for BTC, and successively increased its positions in several mainstream coins. At the time of writing, it holds long positions in 7 mainstream coins, with a total size of around $315 million, currently the largest long position on BTC on the Hyperliquid platform. The specific position changes in the past 4 hours are as follows:

20x BTC Long: Position size increased from $121 million to $157 million, average price $90,800, unrealized gains $1.86 million;

20x ETH Long: Position size increased from $70 million to $91 million, average price $3,123, unrealized gains $950,000;

20x SOL Long: Position size reached $33.14 million, average price $138, unrealized gains $1.03 million;

The address started accumulating positions in December last year, with an initial account size of about $20 million, and then gradually increased its short positions in mainstream coins such as BTC and ETH. As its trading direction is opposite to the public company MicroStrategy, which has been continuously buying BTC, the market views this address as its explicit "on-chain counterpart." Recently, it has repeatedly taken large long positions in its main holdings, with a position size reaching over a billion dollars.

News