News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

For companies exposed to the dual risks of the crypto market and the stock market, has the worst already passed?

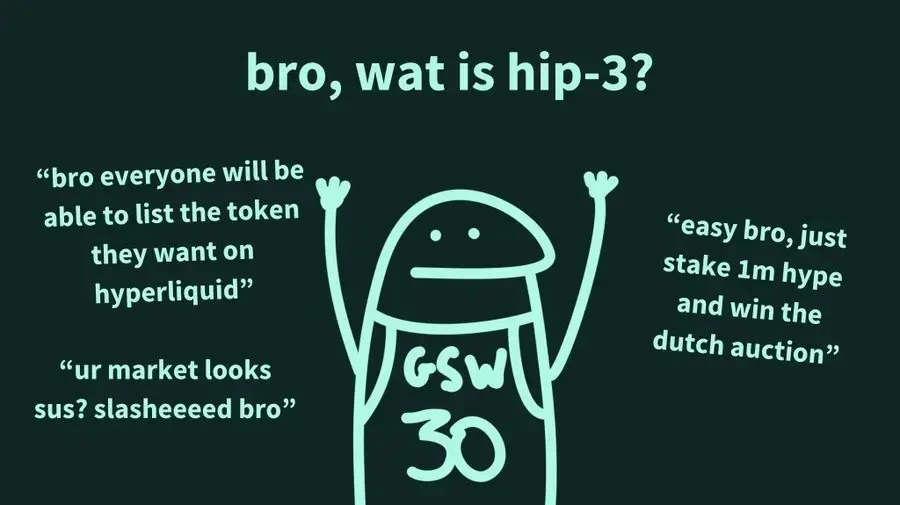

HIP-3 is a major improvement proposal for the Hyperliquid exchange, aimed at decentralizing the launch process of perpetual contract markets by allowing any developer to deploy new contract trading markets on HyperCore.

Bitcoin rebounds as trade tensions ease and Israeli hostages are released, with buyers returning to the market after last week's cryptocurrency crash.

Yieldbasis recently completed a $5 million funding round (accounting for 2.5% of total supply) through Kraken and Legion, with a fully diluted valuation (FDV) of $200 million.

Multiple institutions predict that the bull market climax will continue in Q4, led by projects such as Monad, Meteora, Limitless, Zama, and MegaETH.

- 04:12Data: The current Crypto Fear & Greed Index is 39, indicating a state of fear.ChainCatcher news, according to Coinglass data, the current Crypto Fear & Greed Index is 39, up 2 points from yesterday. The 7-day average is 46, and the 30-day average is 50.

- 04:12Scallop's total locked volume surpasses 50 million SCA, accounting for 40% of the token's circulating supply.On October 14, according to official data, the current Scallop total value locked (TVL) has exceeded 50 million SCA, accounting for 40% of the token's circulating supply, with an average lock-up period of 3.71 years. Notably, locking SCA can earn up to a 4x borrowing incentive multiplier, further promoting the circulation and utilization of assets within the ecosystem. Industry insiders point out that this data reflects the community's strong recognition and trust in Scallop's long-term development prospects.

- 04:02Data: Ethereum spot ETF saw a total net outflow of $429 million yesterday, marking three consecutive days of net outflows.ChainCatcher news, according to SoSoValue data, the total net outflow of Ethereum spot ETFs yesterday (October 13, Eastern Time) was $429 million. The Ethereum spot ETF with the largest single-day net outflow yesterday was Blackrock ETF ETHA, with a single-day net outflow of $310 million. Currently, the historical total net inflow of ETHA has reached $14.178 billion. The second was Grayscale Ethereum Mini Trust ETF ETH, with a single-day net outflow of $49.6729 million. Currently, the historical total net inflow of ETH has reached $1.481 billion. As of press time, the total net asset value of Ethereum spot ETFs is $28.748 billion, with the ETF net asset ratio (market value as a proportion of Ethereum's total market value) reaching 5.56%. The historical cumulative net inflow has reached $14.48 billion.