Trader Times Ethereum Bottom Perfectly, Earns $29 Million Profit

Quick Take Summary is AI generated, newsroom reviewed. Trader bought Ethereum twice at exact market bottoms. Wallet 0x7422F5F528Cc36eA48F6cD8cdA5a9816E4573ede shows two dip buys. Profit reached about $29 million with 150% total gain. The trades reflect skillful market timing, not random luck.References X Post Reference

One trader made two purchases of Ethereum at accurately determined market bottoms and gained approximately 29 million in his profit. These trades are found in the wallet address of the trader, 0x7422F5F528Cc36eA48F6cD8cdA5a9816E4573ede, on Kraken. The bottom of the dips were the same as each purchase. The trader benefited almost 150 percent of two large accumulation phases. The trades present a unqipped accuracy and timing in a volatile market.

Never seen anyone time the $ETH bottom this perfectly.

— Lookonchain (@lookonchain) October 29, 2025

He bought the dip twice, both at the exact lows — making ~$29M(+150%) profit in total. https://t.co/coI5n0Zmkp pic.twitter.com/DRlIxi2t2r

Etherum Trades Post big profits

According to the blockchain information the trader purchased 7,240 ETH with a value of approximately $21.4 million at approximately 2,961 ETH. The other buy of 4,999 ETH valued almost 19.9 million was followed by another buy of approximately 3,982. The trader also sold some parts that were priced over 4,000, which turned out to be a huge profit since by the end of October 2025, Ethereum was selling at 4,021.11. These actions yielded a net total of 150% and good discipline of dip buying.

Ether bitcoin is trading at 4,021.11 which is negative by 2.4 per cent in the last 24 hours but has a robust upward trend. It has a market cap of 485.2 billion and its daily trade is approximately 33.7 billion. The coin is still the second-largest crypto by market value. The trading statistics indicate that traders still purchase dips, which strengthens the trust within the Ethereum ecosystem.

Historical Trends favour Dip-Buying Success

The last bottoms of Ethereum of 1,500 in 2023 and 900 in 2022 created massive rallies. Investors who had purchased at the time had grown by 100 to 300 percent. This is exactly the case with the activities of the trader. Both buys were done at low sentiment times when markets appeared to be weak. These records are a reflection of the previous recoveries where the patient buyers did better than short-term traders.

The data provided by Coin Gecko confirms that Ethereum was priced at $4,021.11 on October 29, 2025. The trading volume of 33.7 billion was enough to guarantee big purchases. Both transactions were as a result of short-lived corrections that ensued quick surges. The trader sold at the time when prices were almost at the highest point, this maximized exit and maximized gains. The accuracy is comparable to previous reports on similar Ethereum trades by Lookonchain.

Market Effect and More General Implications

The precision implies intensive technical analysis or good market understanding. The trader could have monitored the RSI rates or whale accumulation. Decisions were also likely to be informed by funding rates and on-chain metrics. Although there is speculation over insider knowledge, it has no evidence. The performance will continue to be one of the best performances in disciplined crypto trading in 2025.

This case gave the Ethereum investors confidence in the market. It is seen as an authenticating factor by many traders that even in this cycle, strategies of dip-buying can be effective. The narrative emphasizes the liquidity and strength of Ethereum even in the context of temporary pullbacks. Big money traders are now following comparable wallet patterns in order to determine the accumulation areas.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

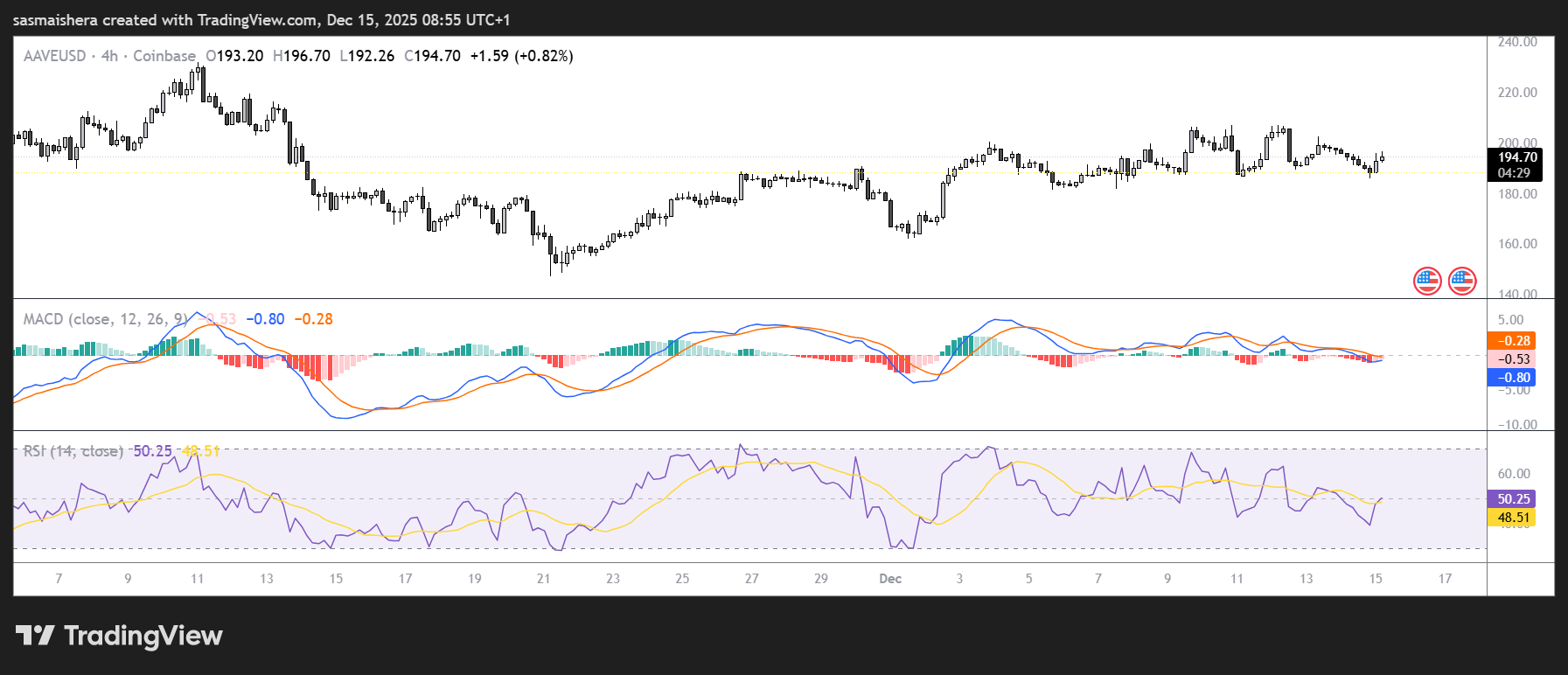

AAVE aims for breakout to $235 as bullish signals strengthen

Everyone Wants Your Bitcoin, Warns '$1 Million BTC' Advocate Samson Mow

Kevin Hassett, expected to become the new FED chairman, made remarks that will anger Donald Trump! "It has no effect!"

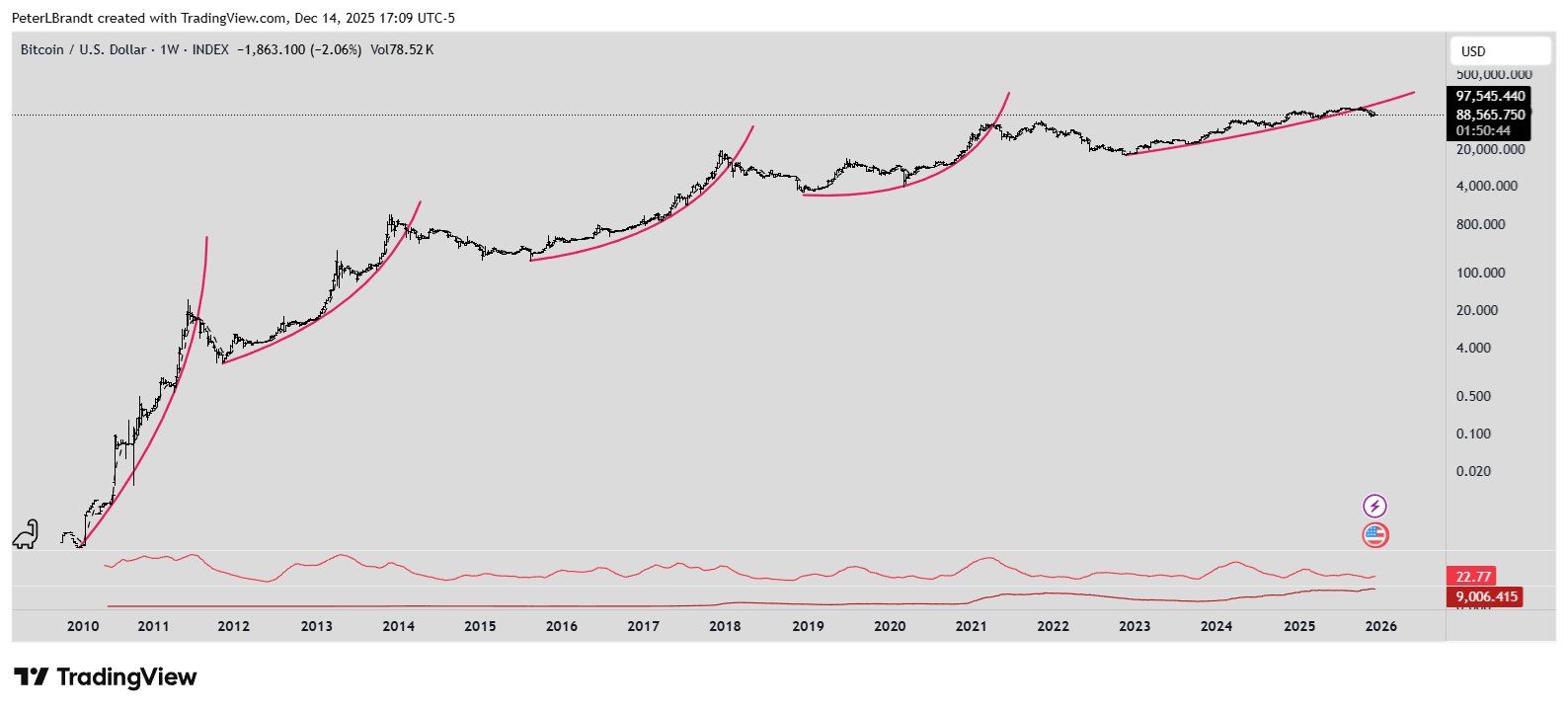

Bitcoin's Parabolic Arc Snaps: Trader Peter Brandt Eyes $25K Crash Floor