AAVE aims for breakout to $235 as bullish signals strengthen

The cryptocurrency market has begun the new week bearish, but some coins are going against the trend and trading in the green.

While Bitcoin is trading below $90k, some cryptocurrencies, including AAVE, have added gains in the last 24 hours.

At press time, AAVE is trading at $194 per coin, up by less than 1% but could rally higher over the next few hours or days.

The native coin of the Aave ecosystem is approaching the upper boundary of its descending parallel channel, with a breakout expected in the near term.

Furthermore, on-chain and derivatives data also support bullish sentiment, with technical indicators suggesting a breakout towards $235 over the next few hours or days.

Aave’s on-chain and derivatives data show a strong bullish sentiment

Copy link to section

According to CryptoQuant, Aave’s spot and futures markets are showing large whale orders, cooling bearish conditions, and buy dominance.

These data support the bullish outlook for the cryptocurrency and could signal a potential rally in the coming days.

Looking at the derivatives data, CoinGlass shows that Aave’s funding rate data also support signs of a rally.

The Aave OI-Weighted Funding Rate data, the number of traders betting that the price of Aave will slide further is lower than those anticipating a price increase.

THE OI-Weighted Funding Rate flipped to a positive rate last week and currently stands at 0.0088%, suggesting that longs are currently paying shorts. Usually, when the rates flip from negative to positive, Aave’s price has rallied.

Furthermore, the AAVE long-to-short ratio stands at 1.01, close to a new monthly high.

If the ratio is above one, it suggests that the bullish sentiment in the market outweighs the bearish sentiment.

Thus, more traders are betting on the asset price to rally.

Aave eyes a breakout, with major resistance around $235

Copy link to section

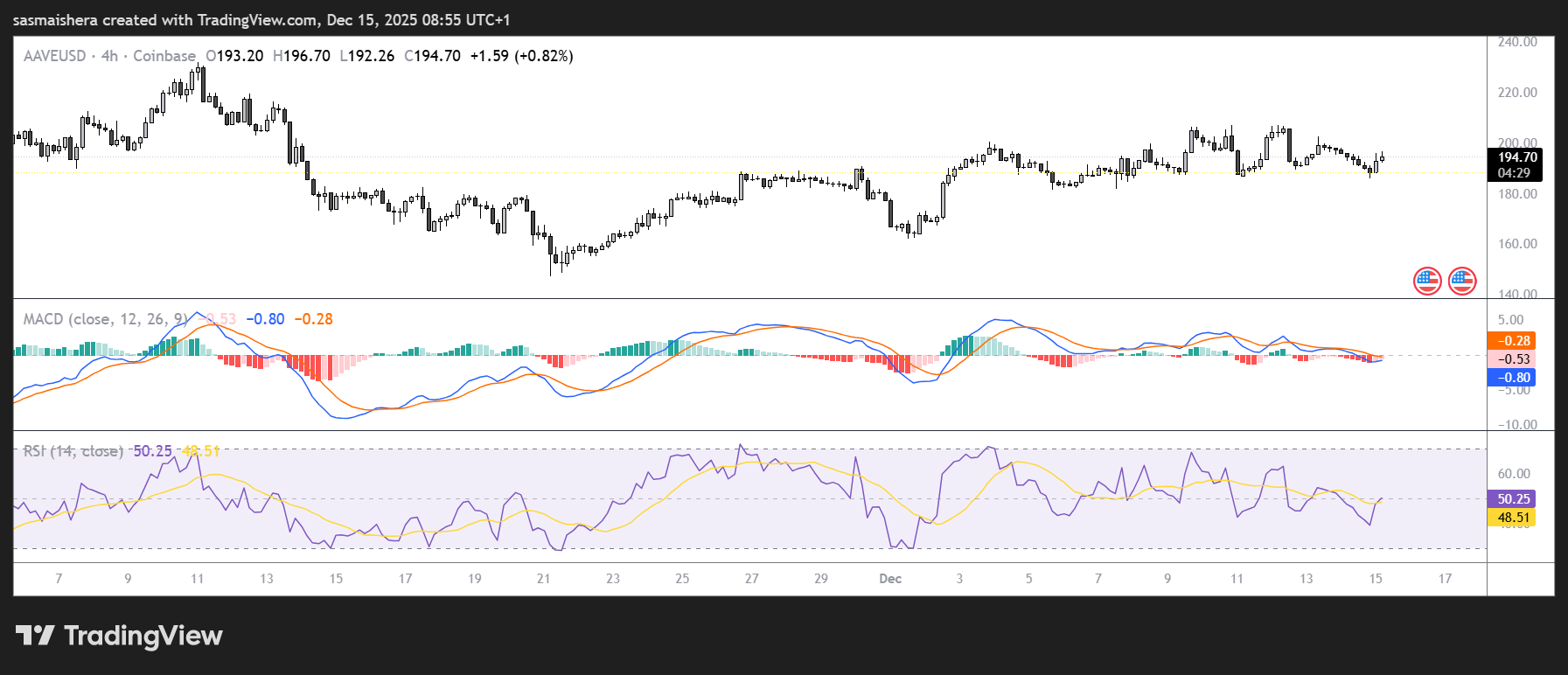

The AAVE/USD 4-hour chart is bearish and inefficient as AAVE has been unable to close the inefficiency gap left around $269.

The cryptocurrency is currently trading within a descending parallel channel pattern, as it is now approaching the upper boundary of this channel.

A breakout above this resistance channel could signal a potential bullish shift.

The momentum indicators suggest that buyers are in control of the market.

Relative Strength Index (RSI) on the 4-hour chart reads 50, indicating a growing bullish momentum.

The Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which remains intact, further supporting the bullish thesis.

If the bullish trend continues, AAVE could rally past the first major resistance level at $235 over the next few hours.

An extended rally would allow it to gain efficiency and hit the $296 resistance region in the medium term.

However, if AAVE faces rejection around the $235 resistance, it could extend the decline toward the daily support level at $186.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Emergence of Clean Energy Derivatives: How CleanTrade is Transforming Institutional Investment in Renewable Resources

- CleanTrade's CFTC-approved SEF designation in 2025 revolutionizes clean energy derivatives by introducing institutional-grade liquidity and standardized trading for VPPAs, PPAs, and RECs. - The platform's $16B notional trading volume within two months demonstrates rapid institutional adoption, with major players like Cargill leveraging its transparent infrastructure to manage energy risks. - Integrated ESG analytics and automated compliance tools enable investors to align portfolios with sustainability g

The Emergence of CFTC-Regulated Clean Energy Platforms and Their Influence on Institutional Investment Approaches

- CFTC-approved CleanTrade, the first SEF for VPPAs/RECs, transforms clean energy markets by addressing liquidity, transparency, and regulatory challenges. - Its $16B trading volume and Cargill-Mercuria's first transaction demonstrate institutional adoption of standardized, verifiable renewable energy assets. - CleanTrade enables ESG alignment through project-specific carbon tracking, reducing emissions by 15% for investors while complying with IRA-driven $2.2T global investments. - By bridging financial a

Clean Energy Market Fluidity and the Rise of CleanTrade: Strategic Considerations for Investors in a Regulatory Environment

- CleanTrade, a CFTC-approved SEF, addresses fragmented pricing and low liquidity in clean energy markets by standardizing VPPA, PPA, and REC trading. - The platform’s $16B in two-month transactions demonstrates institutional demand for transparent, ESG-aligned tools to hedge energy risks and track carbon impact. - By centralizing renewable derivatives and aligning with regulations like SFDR, CleanTrade lowers barriers for investors and developers, accelerating decarbonization while boosting market efficie

The Rise of a Dynamic Clean Energy Marketplace

- Global clean energy investment hit $2.1 trillion in 2024, driven by decarbonization trends and institutional demand. - REsurety's CFTC-approved CleanTrade platform addresses liquidity gaps by standardizing VPPA/REC trading with oil-like transparency. - The platform processed $16 billion in two months, enabling risk mitigation and rapid capital reallocation amid policy shifts. - Advanced analytics and structured workflows transform clean energy assets into tradable instruments, attracting diversified inst