ZEC surges 6 times in a month, what is driving this frenzy?

The halving event, privacy narrative, and endorsements from well-known institutions and investors have jointly driven ZEC to surpass its 2021 peak.

Original Title: Zcash Surpasses 2021 Peak as Traders Bet on Privacy Revival

Original Author: Akash Girimath, Decrypt

Translated by: Chopper, Foresight News

Summary

With the halving in November approaching and renewed market attention on privacy assets, Zcash (ZEC) has once again become a focal point, as traders actively position themselves around the privacy coin narrative. Sources told Decrypt that despite limited on-chain growth, endorsements from well-known investors and heated discussions on privacy topics have continued to drive market activity. Experts say the sustainability of this rally depends on market sentiment after the ZEC halving and whether user adoption can break through short-term speculation to achieve substantial growth.

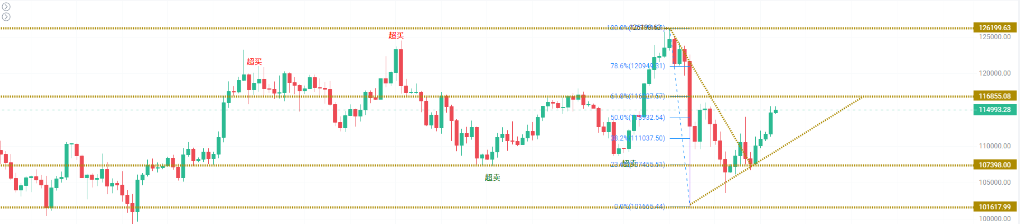

Driven by both speculative fervor and the return of the privacy theme, Zcash achieved triple-digit gains within 30 days, successfully surpassing its 2021 high. This privacy coin soared from a low of $54 to around $372 within a month, ranking among the best-performing assets in the market.

ZEC historical price trend, source: CoinMarketCap

This price is 11.5% higher than the closing price of $319 on May 8, 2021, but according to CoinGecko data, it is still down 88% from the all-time high of $3,191.93 set nearly nine years ago.

Multiple Catalysts Create the Perfect Storm

BuyUCoin CEO Shivam Thakral stated that Zcash's surge is the result of a perfect combination of multiple catalysts:

1. The upcoming November halving. On November 18, Zcash block rewards are expected to be halved from 3.125 ZEC to 1.5625 ZEC;

2. Rising privacy concerns have brought renewed attention to privacy coins;

3. Arthur Hayes' proposed "$10,000 price target" has sparked heated market discussion.

In the first week of October, Zcash experienced a significant upward breakout for the first time, triggered by endorsements from well-known investors such as Naval Ravikanth, as well as support from former Coinbase engineer and Helius CEO Mert Mumtaz.

As previously reported by Decrypt, Grayscale's decision to allow qualified investors to invest in ZEC tokens further fueled Zcash's upward trend in the second half of this month.

The renewed attention on privacy coins has also strengthened the entire sector. Over the past week, Monero and Dash have risen by 9.1% and 12.5% respectively, as traders begin to turn to these veteran anonymous assets.

"With global regulations tightening and digital surveillance controversies intensifying, privacy topics have once again become a focal point," Thakral added. "Although Zcash is a veteran coin, its privacy narrative is clear and concise; coupled with the upcoming halving, traders have found an easy and liquid way to position themselves for this theme."

Sustainability of the Rally in Doubt: Speculation Dominates, Fundamentals Await Validation

However, Thakral also cautioned that this rally is driven more by speculation than fundamental growth. The core evidence is the limited growth in the number of Zcash shielded transactions.

He stated that Zcash's subsequent trend depends on two key factors: first, the reaction of miners and investors after the halving; second, whether the privacy narrative can break through pure speculation to achieve real user growth, avoiding a reversal where good news is fully priced in and then sold off.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Fed is about to cut interest rates, marking a key turning point for the crypto market!

China-US Trade Truce Brings Risk Appetite Back to Crypto Market

Cardano Support Wobbles, Ethereum Slides to $3.8K; BlockDAG’s Tech Could Turn It Into Bitcoin 2.0