With a single sentence from US Treasury Secretary Besant—"No longer considering a 100% tariff on China"—global market risk sentiment was instantly ignited, and cryptocurrency investors quickly turned their attention to this negotiation that could reshape the global economic and trade landscape.

On October 26, after two days of talks between the US and Chinese economic and trade teams in Kuala Lumpur, Malaysia, US Treasury Secretary Besant announced that the two sides had reached a "very substantive framework agreement" and decided to no longer consider imposing a 100% tariff on Chinese goods.

The easing of US-China trade relations comes at a critical juncture, six months after the implementation of Trump’s tariff policy. During this period, the counterproductive effects of the US-initiated global tariff war have become apparent: Germany is no longer the US’s largest trading partner, Japan’s trade surplus with the US has dropped sharply by 22.6%, US farmers are facing a sharp decline in agricultural exports, and domestic US inflation continues to climb due to tariff policies.

I. Breakthrough Progress in US-China Economic and Trade Consultations

During the fifth round of US-China economic and trade consultations held in Kuala Lumpur, Malaysia from October 25 to 26, both sides achieved what was described as "very substantive progress." After the talks, US Treasury Secretary Besant stated that the US and China had reached a "very successful framework" and specifically emphasized that the US would no longer consider imposing a 100% tariff on Chinese goods—a key concession.

In this round of consultations, both sides held "frank, in-depth, and constructive" discussions on several core issues. According to information released by the Chinese side, these topics included:

● US 301 investigation measures on China’s maritime logistics and shipbuilding industries

● Extension of the reciprocal tariff suspension period

● Fentanyl tariffs and law enforcement cooperation

● Agricultural trade

● Export controls

Li Chenggang, China’s Vice Minister of Commerce and International Trade Negotiator, stated that both sides had reached a "preliminary consensus on properly resolving several major economic and trade issues of mutual concern", and the next step would be to go through their respective domestic approval procedures.

This breakthrough is not an isolated event, but rather the result of the ongoing evolution of US-China economic and trade relations over the past six months. Below is a summary of the key milestones in the Trump administration’s tariff policy since 2025:

Table: Major Timeline of Trump Administration’s Tariff Policy on China since 2025

Date | Policy Action | Key Content |

April 2025 | Declared "National Emergency" | Imposed a 10% baseline tariff on the world citing national security |

May 12, 2025 | Signed executive order to lower tariffs on China | Temporarily reduced tariffs on China to 10% for 90 days |

August 11, 2025 | Continued suspension of additional tariffs | Extended the suspension period for additional tariffs on China to November 10 |

October 26, 2025 | Kuala Lumpur consultations reached a framework | No longer considering 100% tariffs on China, reached preliminary consensus |

II. Six-Month Effects of the Trade War Fully Emerge

It has been six months since the Trump administration launched the tariff war, and its counterproductive effects are now emerging on multiple fronts.

In terms of restructuring trade patterns, the US’s economic and trade relations with other countries have changed significantly.

● According to the latest data from the German Federal Statistical Office, in the first eight months of 2025, the US is no longer Germany’s largest trading partner, with China taking its place.

● This change is closely related to the US’s tariff increases and higher trade barriers. From January to August 2025, Germany’s exports to the US amounted to 101 billion euros, a year-on-year decrease of 6.5%. In August alone, exports were only 10.9 billion euros, a year-on-year drop of 20.1%, hitting a new low since November 2021.

US agricultural exports have been severely hit.

● In the just-concluded September, as the world’s largest soybean importer, China’s imports of soybeans from the US fell from 1.7 million tons in the same period last year to zero—the first time since November 2018.

In stark contrast, South American soybeans are selling briskly.

● Maryland farmer David Brier expressed concern: "This is going to be a very, very tough year." According to Iowa State University professor Chad Hart, the number of US farm bankruptcies this year will surge by about 50% compared to 2024.

Inflationary pressure is rising.

● Research by the Federal Reserve Bank of St. Louis found that during June to August, Trump’s tariffs raised the overall PCE increase by 0.5 percentage points. The average PCE increase during this period was 2.85%. The study pointed out that tariffs account for a considerable proportion of recent inflation.

III. Mounting Domestic and International Pressure

The Trump administration’s tariff policy is facing not only international backlash but also growing opposition at home.

Economists jointly oppose. Nearly 50 prominent economists, including former Federal Reserve Chairs Bernanke and Yellen, have jointly pressured the US Supreme Court, calling for most of Trump’s global tariffs to be overturned.

● These economists, with diverse political views, pointed out in their amicus brief to the court that the Trump administration’s tariff policy is based on a misunderstanding of the global economy. They criticized Trump for imposing tariffs on countries based on trade deficits that are nearly impossible to balance.

● They wrote in the document: "Reciprocal tariffs do not 'solve' trade deficits." They added: "This is very basic economics, but its impact is far-reaching."

Supreme Court challenge. The US Supreme Court has announced it will quickly review the legality of most of the Trump administration’s tariffs and will hear oral arguments on November 5.

● The tariffs involved in the lawsuit include the 10% "baseline tariff" imposed globally under the 1977 International Emergency Economic Powers Act (IEEPA), higher tariffs on trading partners without trade agreements with the US, and the so-called "fentanyl tariff."

Restructuring international relations. In response to US tariff policies, countries are actively seeking alternatives.

● Canadian Prime Minister Carney bluntly stated in a speech that the close ties between the US and Canada, once an advantage, have now become Canada’s Achilles’ heel. "Our relationship with the US will never return to what it was."

● Carney is now looking to markets outside the US: "In the next 10 years, we want to double Canada’s exports to non-US countries, creating over 300 billion Canadian dollars in new trade."

IV. Easing Trade Tensions Becomes a Boon for Crypto Assets

The easing of US-China trade tensions most directly reduces the global market risk premium and drives capital back into risk assets. As a representative of high-risk appetite, cryptocurrencies may see inflows from traditional market funds.

From multiple perspectives, the easing of trade tensions brings the following impacts to the crypto market:

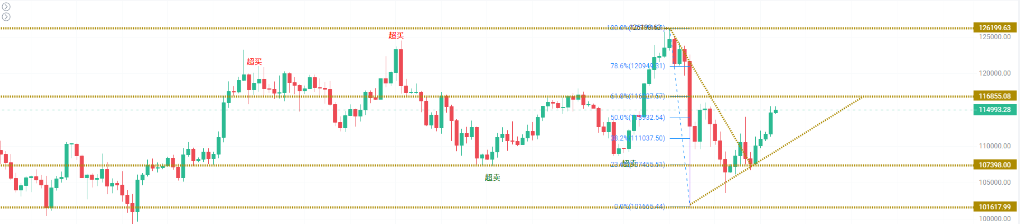

● Price and trading level: During the escalation of the trade war, bitcoin showed positive correlation with traditional risk assets. Once trade tensions ease, this correlation may weaken, and bitcoin will once again highlight its independent market characteristics.

As market sentiment warms, activity during Asian trading hours may increase significantly, especially as Chinese investors may increase allocations via USDT and other stablecoins, boosting the trading volume of the bitcoin/USDT pair.

On-chain fundamentals: After the news of the trade truce, the number of large on-chain bitcoin transactions (over $100,000) increased, indicating a rebound in institutional participation. The supply of stablecoins continues to grow steadily, providing ample liquidity for the market.

● Capital and liquidity: As trade tensions ease, the appeal of the safe-haven US dollar declines, and the dollar index has fallen below the 100 mark. A weaker dollar typically benefits dollar-denominated crypto assets, as it lowers the cost for international investors to hold such assets.

● Industry and sentiment: The crypto industry’s response to US-China trade progress has been generally positive. Trade barriers and tariff costs for mining machines, chips, and related equipment may decrease, which is conducive to optimizing the global bitcoin mining industry chain.

Table: Changes in Trade Surplus with the US in Major Countries/Regions (2025)

Country/Region | Period | Change in Trade Surplus with US | Main Reason |

Japan | April-September 2025 | Decreased by 22.6% | Automobile tariffs remain high at 15% |

China | First half of 2025 | Decreased by 29.8% | Mutual imposition of high tariffs |

Eurozone | April-August 2025 | Decreased by 20% | Exports to US down 5%, imports up 4% |

V. Tariff Uncertainty Not Fully Eliminated, Cautiously Track Follow-up Developments

Although US-China economic and trade consultations have made positive progress, crypto investors still need to pay attention to the following potential risks:

● Supreme Court tariff ruling: The US Supreme Court will hear oral arguments on the legality of Trump administration tariffs on November 5. Nearly 50 economists, including Bernanke and Yellen, have submitted written opinions calling for these tariffs to be overturned.

If the Supreme Court rules the tariffs illegal, it could trigger a new round of policy uncertainty affecting global markets.

● November 10 tariff decision: According to the executive order of August 11, the suspension period for additional tariffs on China will expire on November 10. Whether the Trump administration will further extend the suspension or propose new conditions will directly affect market trends.

● Confidence in dollar assets: Former Treasury Secretary Yellen has warned that Trump’s tariff policy has caused "foreign investors to worry about confidence in the US." If the dollar’s credibility continues to erode, it may benefit crypto assets in the short term, but could trigger a global liquidity crisis in the long run, affecting all risk assets.

Investors should closely monitor the following key developments to judge the market’s future direction:

● Expected meeting between Trump and Chinese leaders: US Treasury Secretary Besant revealed that the framework reached in the consultations will be discussed by "the two heads of state on Thursday (the 30th)."

If the leaders’ meeting takes place as scheduled and confirms the framework agreement, market risk appetite is expected to improve further.

● Key US economic data: US inflation, employment, and GDP data to be released in the coming weeks will affect the Federal Reserve’s policy stance, which in turn will impact the crypto market through liquidity channels. Special attention should be paid to the non-farm payroll report on November 1 and the CPI data on November 12.