In the early morning of October 30 (Thursday) in the East 8th time zone, the Federal Reserve will announce its October interest rate decision. At this meeting, the Federal Reserve is highly likely to cut interest rates by 25 basis points.

Meanwhile, the ADP report, known as the "mini non-farm payrolls," showed that the US private sector lost 32,000 jobs in September, the largest decline since March 2023. The US CPI in September rose by 3.0% year-on-year, lower than market expectations. These economic data provide a basis for the Fed's decision to cut rates.

I. Event Overview

The upcoming October FOMC meeting and subsequent policy statement and Chairman's speech are filled with uncertainty, making it a key event that could shake global financial markets. The market is holding its breath, trying to decipher a clear signal for the Fed's future monetary policy path. Probability and Basis for Rate Cut

● Market expectations for a Fed rate cut are highly aligned. According to AiCoin data, the market is betting on a 98.3% probability that the Fed will cut rates by 25 basis points in October, with only a 1.7% probability of keeping rates unchanged.

● A research report from Huatai Securities pointed out that since the US job market continues to slow down and tariffs have a mild impact on inflation, the Fed is expected to cut rates by 25 basis points.

● The US September CPI data has reassured the market. The data shows that the overall US CPI in September rose by 3.0% year-on-year and 0.3% month-on-month. The core CPI, excluding volatile food and energy prices, rose by 3.0% year-on-year and 0.2% month-on-month, both lower than market expectations.

Cooling Labor Market

● Due to the US government "shutdown," the September US non-farm payroll data was not released as scheduled, adding uncertainty to future expectations.

● The Fed's Beige Book released on October 15 showed that labor demand was generally sluggish across US regions and industries.

● Most Federal Reserve districts reported that due to weak demand, increased economic uncertainty, and increased investment in AI technology, more employers are reducing headcount through layoffs and natural attrition.

Possibility of Stopping Balance Sheet Reduction

Given that recent volume and price indicators both suggest the Fed has reached the threshold to stop balance sheet reduction, and the Fed has already communicated this with the market—it is not ruled out that Powell may announce the end of balance sheet reduction at the October FOMC.

II. Impact on the Crypto Market

The Fed's rate cut decision will have multi-layered effects on the cryptocurrency market, potentially reshaping everything from capital flows to underlying logic.

Price and Trading Aspects

● Expectations of a rate cut usually lead to a weaker US dollar index, which directly benefits crypto assets like bitcoin that are denominated in USD. A weaker dollar lowers the cost for global investors to buy these assets, thereby boosting demand.

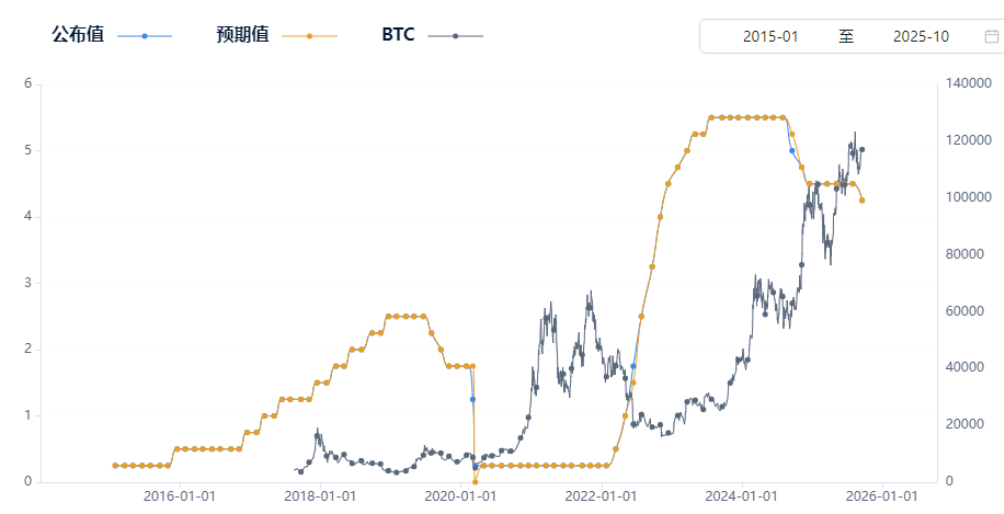

● Historical data shows that cryptocurrencies often perform well during Fed monetary easing cycles. Improved liquidity environments reduce the opportunity cost of holding non-yielding assets, making investors more willing to allocate funds to potentially high-return assets like bitcoin.

On-chain Fundamentals

● The Fed's rate cut may change the asset allocation strategies of large institutional investors. As yields in traditional financial markets decline, the potential returns of cryptocurrencies become more attractive, possibly leading to more institutional capital flowing into the crypto ecosystem.

● If the Fed continues to cut rates and corporate bond yields fall accordingly, some listed companies may add bitcoin to their balance sheets, continuing the trend seen in 2020-2021.

Capital and Liquidity

● Xu Changtai, Chief Market Strategist for Asia Pacific at JPMorgan Asset Management, pointed out that Fed rate cuts are generally favorable for risk asset performance. This environment may also benefit the crypto market.

● Rate cut cycles are usually accompanied by increased market risk appetite, and investors' willingness to allocate to high-risk assets such as cryptocurrencies will increase. Improved global liquidity conditions will also bring more incremental funds to the crypto market.

Industry and Sentiment

The Fed's rate cut will be interpreted by the crypto community as a signal of fragility in the traditional financial system, reinforcing the logic of bitcoin as an alternative store of value. The low correlation between cryptocurrencies and traditional assets may become more attractive in a rate-cutting environment, especially when the economic outlook is uncertain.

III. Market Views and Analysis

Market analysts have put forward different views on the impact of the Fed's rate cut on the crypto market.

● "Traditional Finance Connection" View - Zhang Hao, Chief Analyst at Coin Policy Consulting

"The Fed's rate cut will narrow the gap between traditional yields and crypto yields, prompting more capital to seek higher returns. Inflows into bitcoin ETFs have increased in the past two weeks, and a rate cut may accelerate this trend.

"Cryptocurrencies, especially bitcoin, are becoming a new destination for capital."

● "Macro Turning Point" View - Li Mengqi, Researcher at On-chain Capital

"The current crypto market has not fully priced in the impact of a rate cut. The key is whether the liquidity gate will open again, and the growth of stablecoin supply is the next key indicator.

"If the Fed not only cuts rates but also stops balance sheet reduction, the dual liquidity injection may recreate the crypto market boom seen at the end of 2020."

● "Crypto Native" View - Mason Thompson, Founder of Crypto Consensus

"The real game-changer is not the rate cut itself, but the confirmation of a policy shift. The Fed shifting from fighting inflation to supporting growth means more fiscal stimulus may follow.

"The debt monetization narrative will boost bitcoin's value storage proposition. Smart money is already positioning itself."

IV. Risk Warnings and Dynamic Tracking

Although the market is optimistic about the Fed's rate cut, investors should remain alert to potential risks and closely monitor key developments.

Potential Risks

● First, beware of the "buy the rumor, sell the fact" market reaction. Even if the Fed cuts rates as expected, the crypto market may experience a short-term pullback due to profit-taking. The market has already partially priced in the rate cut expectation.

● Second, the Fed's future policy path remains uncertain. Morgan Stanley Investment Management's global fixed income team believes that the Fed's guidance on the pace of subsequent rate cuts may be more important than this rate cut itself.

● Finally, structural risks within the crypto market should not be ignored. Excessive leverage and exchange reserve security issues may be exposed during periods of increased market volatility.

Key Dynamics to Track

In the coming days, investors should focus on the following two key developments:

● First, the Fed's policy statement after the FOMC meeting and Powell's press conference. The market will look for clues as to whether there will be another rate cut in December. It should be noted that there are still some internal disagreements within the Fed regarding the future path of rate cuts.

● Second, the US Treasury's bond issuance plan and the performance of long-term Treasury yields. If the 10-year US Treasury yield remains high after the rate cut, it may limit the upside of the crypto market.

The market generally expects the Fed to announce a 25 basis point rate cut early Thursday morning, but the real focus for the crypto market is what Powell will say about the future path of rate cuts. If a dovish signal is released, bitcoin is likely to break out of its recent consolidation range and start a new round of gains; if the statement is conservative, the market may fall into a "buy the rumor, sell the fact" profit-taking scenario.