News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Here are four key points to keep an eye on as major US banks release their earnings reports

101 finance·2026/01/12 18:18

Hyperliquid (HYPE) Sees Major Whale Unloading — Can Key Support Hold?

Coinsprobe·2026/01/12 18:15

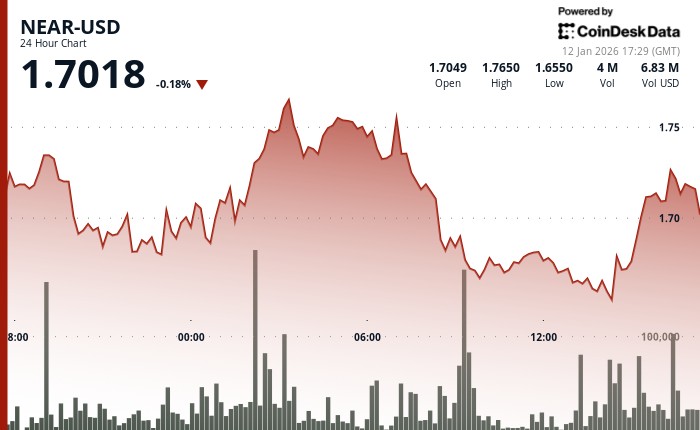

NEAR rises 5.7% to $1.73 before giving back gains

CryptoNewsNet·2026/01/12 18:12

BlockDAG’s Presale Nears Its Jan 26 End With Only 3.29B Coins Left as ZCash & XRP Seek Recovery

Coinomedia·2026/01/12 18:12

2 prominent Republican senators challenge Fed nominations after DOJ issues warnings to Powell

101 finance·2026/01/12 18:06

US Treasury Auction Results

101 finance·2026/01/12 18:06

BitGo targets nearly $2b valuation in IPO bid as crypto listings stir back to life

Crypto.News·2026/01/12 18:00

Developers have earned $550 billion through Apple’s App Store since 2008

101 finance·2026/01/12 17:57

EURC Borrowing on Aave Climbs to €42.4 Million New ATH, Indicating Growing Usage in DeFi

BlockchainReporter·2026/01/12 17:51

Crypto Market Structure Bill Vote Creates Pivotal Watershed Moment for Digital Asset Regulation

Bitcoinworld·2026/01/12 17:51

Flash

16:47

WLFI officially transferred 500 million WLFI tokens to Jump Trading, worth approximately $83.12 million. according to Onchain lens monitoring, World Liberty Finance has just transferred 500 million WLFI to Jump Trading, worth approximately 83.12 million USD.

16:24

Spot Gold and Silver Continue to Rise, Hitting New HighsBlockBeats News, January 13th, according to Bitget market data, spot gold reached up to $4630 per ounce, hitting a new all-time high, with a 2.67% increase during the day.

Spot silver surged $6.00 intraday, breaking through $86 per ounce, hitting a new all-time high, with a 7.59% increase during the day.

16:23

Jump Trading, the official WLFI Foundation transferred 500 million WLFI, worth approximately $83.12 millionBlockBeats News, January 13th, according to Onchain lens monitoring, World Liberty Finance transferred 5 billion WLFI to Jump Trading 5 minutes ago, worth approximately $83.12 million.