News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Ethereum’s hidden ‘death spiral’ mechanic could freeze $800 billion in assets regardless of their safety rating

CryptoSlate·2026/01/12 23:30

South Korea Crypto Budget Allocation Targets 25% by 2030 – Kriptoworld.com

Kriptoworld·2026/01/12 23:24

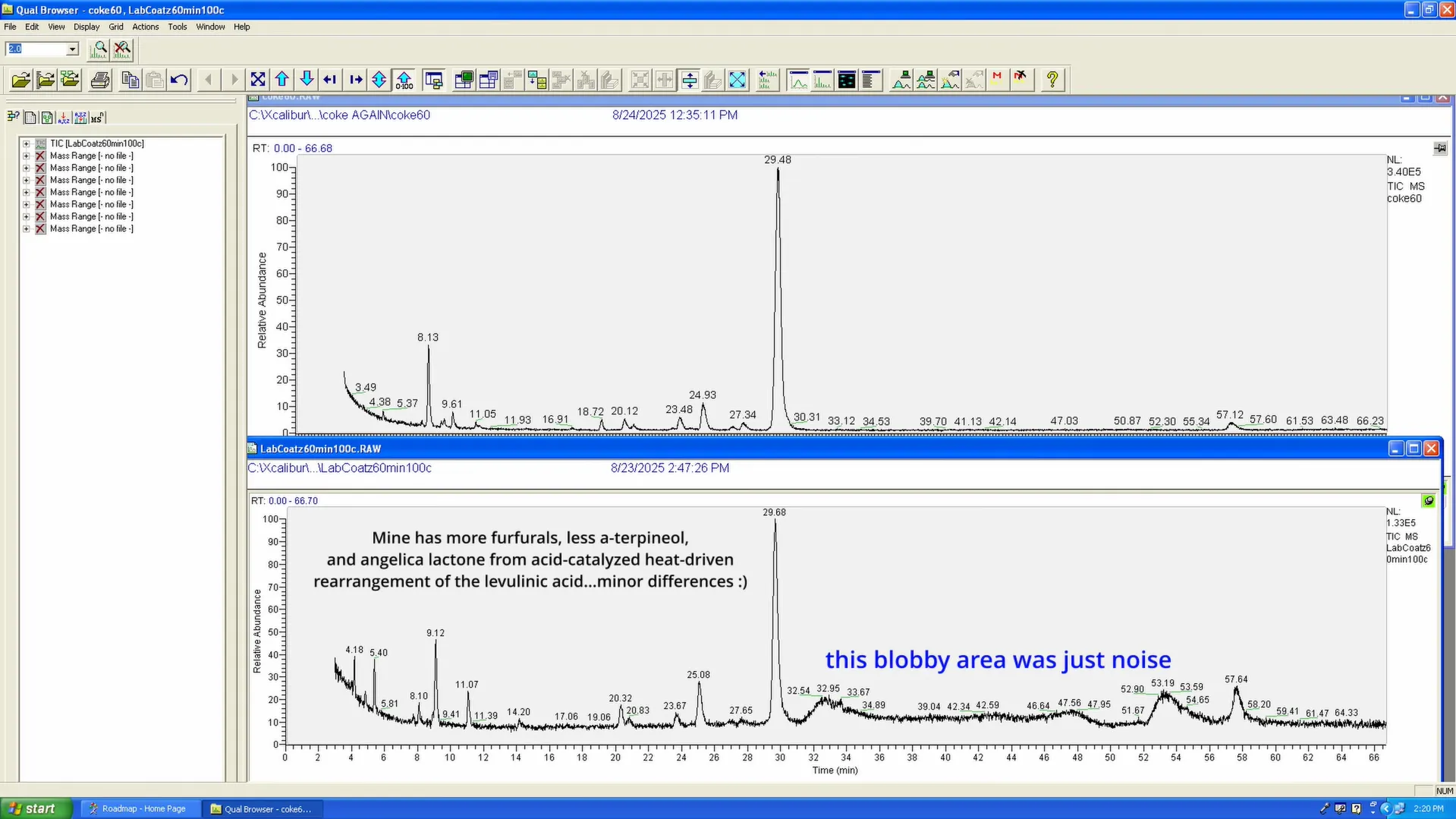

YouTuber Cracks Coca-Cola's 139-Year-Old Secret Formula—Here 's the Recipe

Decrypt·2026/01/12 23:20

Ukraine picks US-linked investors to develop Dobra lithium deposit

101 finance·2026/01/12 23:15

Zero Knowledge Proof Draws Investor Focus 1000x ROI Forecasts While Solana & Hedera Lose Momentum

Coinomedia·2026/01/12 23:09

MicroStrategy’s Near-Term Outlook Depends on This Bitcoin Price Level

BeInCrypto·2026/01/12 23:06

Williams: Some Thoughts for the Start of the Year

101 finance·2026/01/12 23:03

Flash

01:54

NYC Token Deployer Profits Around $1 Million by Adding One-Sided LiquidityBlockBeats News, January 13th, according to Bubblemaps analysis, former New York City Mayor Eric Adams launched the NYC token. Wallet 9Ty4M, associated with the token deployer, created a one-sided liquidity pool on the Meteora platform, withdrew approximately $2.5 million USDC at the price peak, and reinvested only about $1.5 million after a 60% token value drop, netting about $1 million in profit.

01:53

The Mt. Gox hacker's associated address deposited another 926 BTC into an unknown trading platform. according to Emmett Gallic's monitoring, the Mt.Gox hacker Aleksey Bilyuchenko's associated address has deposited 926 BTC to an unknown trading platform. The aforementioned address still holds 3,000 BTC (valued at $275 million).

It is currently unclear whether Bilyuchenko owns these assets. Bilyuchenko was last seen serving a 3.5-year sentence in Moscow.

01:53

The NYC project team withdrew over $1 million through circulating USDC, reducing its market value from $600 million to below $100 million. according to Bubblemaps monitoring, suspicious liquidity provider (LP) activity has appeared in the NYC token launched by former New York City Mayor Eric Adams. The project team extracted over 1 million US dollars by cycling USDC in and out of the liquidity pool. The market value of NYC once reached 600 million US dollars, then dropped to below 100 million US dollars.

The wallet 9Ty4M (9Ty4...) associated with the NYC deployer created a one-sided LP on Meteora, removing about 2.5 million USDC at the price peak, and re-adding about 1.5 million USDC after the price dropped by 60%.