News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Here are four key points to keep an eye on as major US banks release their earnings reports

101 finance·2026/01/12 18:18

Hyperliquid (HYPE) Sees Major Whale Unloading — Can Key Support Hold?

Coinsprobe·2026/01/12 18:15

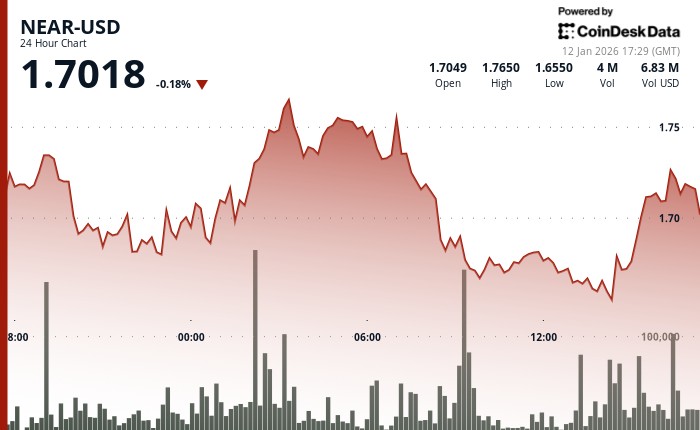

NEAR rises 5.7% to $1.73 before giving back gains

CryptoNewsNet·2026/01/12 18:12

BlockDAG’s Presale Nears Its Jan 26 End With Only 3.29B Coins Left as ZCash & XRP Seek Recovery

Coinomedia·2026/01/12 18:12

2 prominent Republican senators challenge Fed nominations after DOJ issues warnings to Powell

101 finance·2026/01/12 18:06

US Treasury Auction Results

101 finance·2026/01/12 18:06

BitGo targets nearly $2b valuation in IPO bid as crypto listings stir back to life

Crypto.News·2026/01/12 18:00

Developers have earned $550 billion through Apple’s App Store since 2008

101 finance·2026/01/12 17:57

EURC Borrowing on Aave Climbs to €42.4 Million New ATH, Indicating Growing Usage in DeFi

BlockchainReporter·2026/01/12 17:51

Crypto Market Structure Bill Vote Creates Pivotal Watershed Moment for Digital Asset Regulation

Bitcoinworld·2026/01/12 17:51

Flash

16:59

Goldman Sachs CEO Praises Prediction Markets, Plans to Enter Real-World Event TradingBlockBeats News, January 16, Goldman Sachs is exploring opportunities in prediction markets, a move aimed at enabling the investment bank to benefit from this rapidly developing sector focused on betting on real-world events. The company's CEO, Solomon, described prediction markets as "very interesting" and stated that in the past two weeks, he personally met with the heads of two of the largest companies in this field. "We have a team here that is engaging with them and conducting research," Solomon said during the analyst call following the bank's fourth-quarter earnings release on Thursday. The entry of this mainstream Wall Street institution into prediction markets could enhance the legitimacy and trading volume of this loosely regulated but thriving financial niche. Some market-making firms have already joined the race. (Golden Ten Data)

16:56

Goldman Sachs CEO Praises Prediction Markets, Plans to Enter Real-World Asset TradingBlockBeats News, January 16th, Goldman Sachs is exploring prediction market opportunities, aiming to enable the investment bank to benefit from this rapidly growing area of betting on real-world events. The company's CEO Solomon called prediction markets "very interesting" and said that he had personally met with the leaders of the two largest prediction market companies in this field in the past two weeks.

"We have a team here who is in contact with them and doing research," Solomon said during the Thursday analyst conference call following the bank's release of fourth-quarter earnings. The entry of this mainstream Wall Street institution into the prediction market may enhance the legitimacy and transaction volume of this loosely regulated but thriving financial niche. Some market maker companies have already joined the fray. (Jinse)

16:54

Michael Saylor says bitcoin volatility is vitalityMichael Saylor stated that if bitcoin increased by 2% every month without volatility, Warren Buffett would own all the bitcoin.