News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Week Ahead: The US Dollar's Upward Adjustment Since Christmas Could Be Nearing Its End

101 finance·2026/01/18 00:03

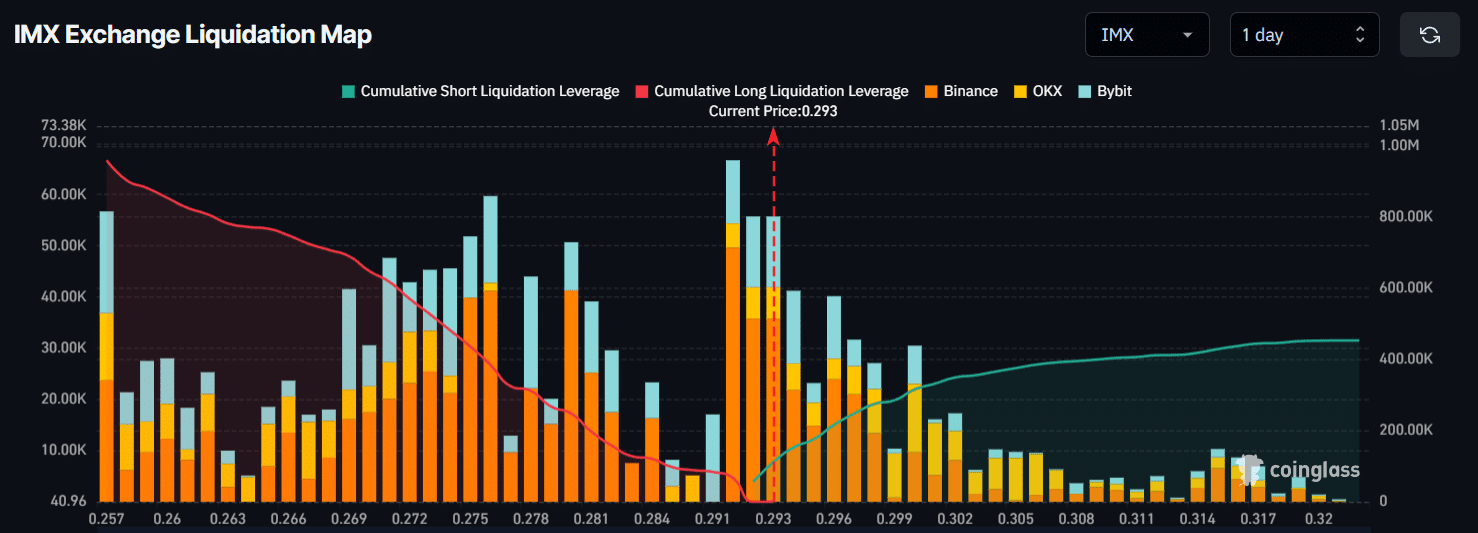

Why Immutable traders are betting long as IMX tests $0.30

AMBCrypto·2026/01/18 00:03

The world's largest auto supplier warns profit margin may fall below 2%

格隆汇·2026/01/17 23:14

$31M ZEC whale inflows: Is Zcash ready to break $439?

AMBCrypto·2026/01/17 23:03

Can Chainlink (LINK) Reverse? Expert Predicts Potential New Higher High

BlockchainReporter·2026/01/17 23:00

Anthropic’s Claude Code is the AI tool everyone’s talking about right now

Cointelegraph·2026/01/17 22:15

Carney’s Closer Ties With China Deepen Rift With US Amid Trump’s Tariff Policies

101 finance·2026/01/17 21:48

Fed transcripts show chair Powell pressed for forceful guidance on rates in 2020

Cointelegraph·2026/01/17 21:36

Metaplanet’s Gerovich, Bitmine’s Lee drum up corporate crypto holdings

Cointelegraph·2026/01/17 20:24

Flash

00:12

Tokenized assets may reach a scale of $40 billion by 2026, with banks and asset management institutions accelerating their entry.According to Odaily, as stablecoins validate product-market fit (PMF) in 2025, the crypto industry is driving the further role of “on-chain dollars,” seeking to tokenize assets such as stocks, ETFs, money market funds, and gold as tradable on-chain financial building blocks. Multiple industry executives expect the tokenized asset market size to reach approximately 40 billion USD by 2026. Samir Kerbage, Chief Investment Officer at Hashdex, stated that the current scale of tokenized assets is about 3.6 billion USD, and the next phase of growth will be more driven by structural reshaping of value transfer methods, rather than pure speculative demand. He pointed out that once stablecoins mature as “on-chain cash,” capital will naturally flow into investable assets, becoming a bridge between digital currencies and digital capital markets. The report notes that by 2025, the scale of tokenized assets will have approached 2 billion USD, with traditional financial institutions such as BlackRock, JPMorgan, and BNY Mellon deeply involved. Tether CEO Paolo Ardoino believes that 2026 will be a key year for banks to move from pilot projects to actual deployment, especially in emerging markets, where tokenization can help issuers bypass traditional infrastructure limitations. Additionally, Centrifuge COO Jürgen Blumberg predicts that by the end of 2026, the total value locked (TVL) of on-chain real-world assets (RWA) may exceed 10 billion USD, and more than half of the world’s top 20 asset management institutions will launch tokenized products. Securitize CEO Carlos Domingo pointed out that native tokenized stocks and ETFs will gradually replace synthetic asset models and become important high-quality collateral in DeFi. CoinDesk believes that legal clarity, cross-chain interoperability, and unified identity systems remain key prerequisites for the expansion of the tokenization market, but industry consensus has shifted from “whether to go on-chain” to “the scale and speed of going on-chain.” (CoinDesk)

2026/01/17 23:06

USDT0 Co-founder: Tokenized gold will become the collateral layer for on-chain finance, just as stablecoins have become the settlement layer.USDT0 co-founder Lorenzo R. stated: "As gold prices continue to reach new highs, the tokenized gold market is also heating up rapidly, and 2026 is expected to be a breakthrough year." He believes that tokenized gold will become the collateral layer for on-chain finance, just as stablecoins have become the settlement layer. He said: "The structural pressures driving the development of stablecoins—interest rate volatility, geopolitical fragmentation, and declining trust in sovereign debt—are now converging on gold-backed assets." He added: "It is becoming increasingly clear that programmable gold will evolve from a niche risk-weighted asset class to the default hard asset standard for on-chain finance."

2026/01/17 22:40

Cathie Wood: Bitcoin is a “good source of diversification” for investors seeking higher returnsAccording to Jinse Finance, Ark Invest CEO Cathie Wood believes that due to bitcoin’s low correlation with other major asset classes, it can serve as a valuable diversification tool in institutional investment portfolios. In a comprehensive report, Wood pointed out that bitcoin’s low correlation with other major asset classes—including gold, stocks, and bonds—is a reason asset allocators should take bitcoin seriously. She wrote: “For asset allocators seeking higher risk-adjusted returns, bitcoin should be an excellent source of diversification.”

News