News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 16)|SEC to Introduce Innovative Exemption Mechanism by End of 2025; Japan Plans Legislation to Ban Crypto Insider Trading; Aptos Partners with Reliance Jio to Launch Blockc2Chainlink holds 63% oracle market share as LINK price tests resistance3Top 3 Altcoins for November Gains: Experts Highlight ETH, ADA, and LINK

BNB faces pullback risk after 10% drop as charts signal overbought levels

Coinjournal·2025/10/14 14:00

BTC price forecast: Bitcoin stays below $112k ahead of Powell speech

Coinjournal·2025/10/14 14:00

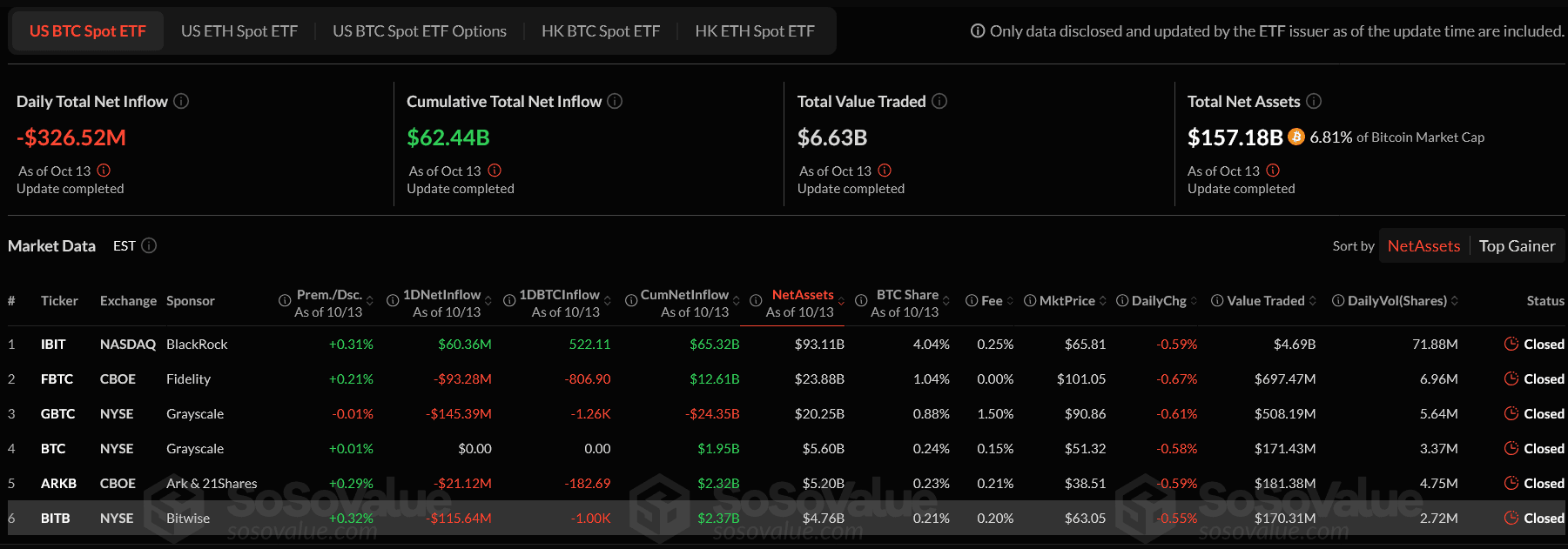

Bitcoin and Ethereum ETFs Crash with $755M Outflow

Cryptoticker·2025/10/14 13:54

Monad has opened the MON token airdrop, ending on November 3

PANews·2025/10/14 13:45

UK politics attempts to copy £5B Trump crypto script, without his levers or power

CryptoSlate·2025/10/14 13:35

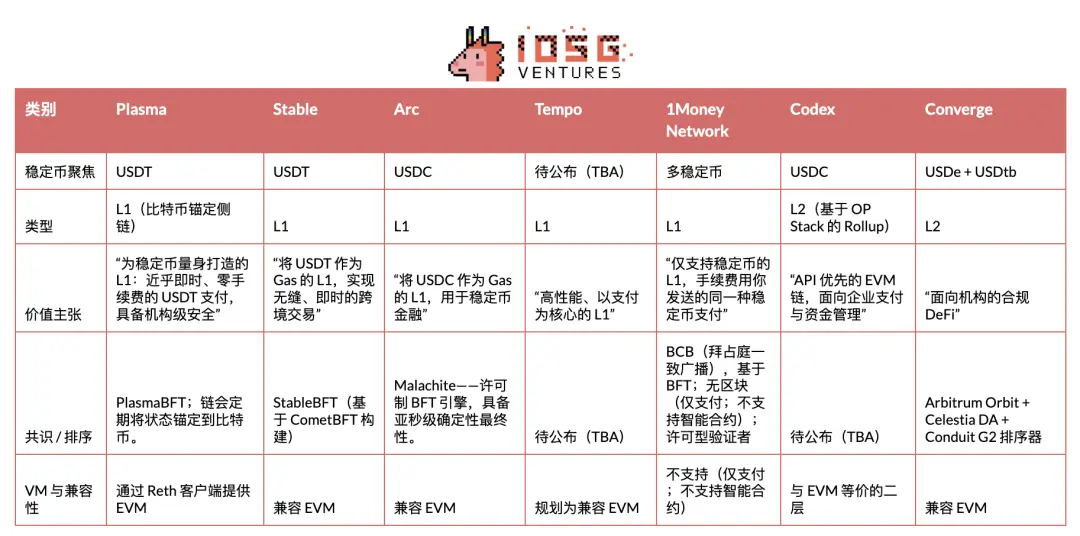

IOSG | In-depth Analysis of Stablecoin Public Chains: Plasma, Stable, and Arc

A deep dive into the issuers behind it, market dynamics, and other participants.

深潮·2025/10/14 13:31

Japan Could Make a Major Change To Crypto Trading Rules

Japan’s financial regulators are preparing a pivotal legal change to treat crypto as a financial product, giving the FSA broader authority to tackle insider trading and tighten oversight of Web3 markets.

BeInCrypto·2025/10/14 13:23

Whale Activity Boosts WLFI Price Amidst Stablecoin Growth

Coinlineup·2025/10/14 13:09

DekaBank Partners with Börse Stuttgart for Retail Crypto Expansion

Coinlineup·2025/10/14 13:09

Vaulta continues to expand its institutional-grade service offering and launches the all-new financial management platform, Omnitrove.

Omnitrove is committed to bridging native crypto assets with the real-world financial infrastructure, providing a unified interface, AI smart tools, and real-time prediction capability to empower diverse digital asset management scenarios and applications.

BlockBeats·2025/10/14 13:06

Flash

- 13:05Public companies now hold approximately 1.04 million bitcoins (about $117 billion), reaching a record high.Jinse Finance reported that corporate Bitcoin holdings have reached a record high: the amount of Bitcoin held on public companies’ balance sheets has reached approximately 1.04 million BTC (about $117 billion), setting a new historical record. The number of public companies holding Bitcoin increased by nearly 40% from the previous quarter, reaching 172. MicroStrategy leads with about 640,031 BTC, and the entry and rising ranks of many new companies indicate a continued increase in corporate interest in long-term investment in cryptocurrencies.

- 13:05Figment acquires Rated Labs to enhance staking data servicesChainCatcher reported that blockchain staking service provider Figment has announced the acquisition of UK-based blockchain analytics company Rated Labs, with the transaction amount undisclosed. The Toronto-based company, which manages over $18 billions in staked assets, stated that this acquisition will help its clients—mainly exchanges, custodians, and asset management firms—make more informed staking decisions through enhanced data transparency. Rated Labs, founded in 2022, provides tools such as Rated Explorer and data APIs for tracking staking performance on networks like Ethereum, Solana, and Cosmos. This acquisition is part of Figment's strategy to invest up to $200 millions in acquiring regional players and networks. Figment Chief Product Officer Andrew Cronk stated that as staking becomes an important part of institutional portfolios, "transparent and reliable data remains the foundation of trust."

- 12:55IOBC Capital Managing Partner: Crypto investment is entering the era of US dollar fund investmentChainCatcher reported that Alva Xu, managing partner of IOBC Capital, stated on X that IOBC Capital has been established for four years and has invested in more than ten crypto VCs, with even deeper investments in Chinese funds. She believes thatit is no longer news that crypto VCs are facing development difficulties, but it is news that crypto VCs are upgrading. Recently, she has learned about some updates from various funds, which make her believe that the crypto VC ecosystem is entering a new stage: A well-known investor has launched a new crypto fund, raising 100 millions, with the first closing already completed at 30 millions; A leading fund is raising a 600 millions USD fund, with the first closing already reaching 300 millions USD; Another leading fund is raising a new fund, with the first closing already at 60 millions; “The second generation of Asian crypto VCs is being cleared out, and crypto investment is ushering in the era of USD-denominated funds.” These funds have very long lifespans, with investment periods as long as 10 years, which are typical of USD-denominated funds and are more inclined toward ‘equity investment’.