- Ethereum: ETF optimism and staking growth may push prices toward $5,200 in November.

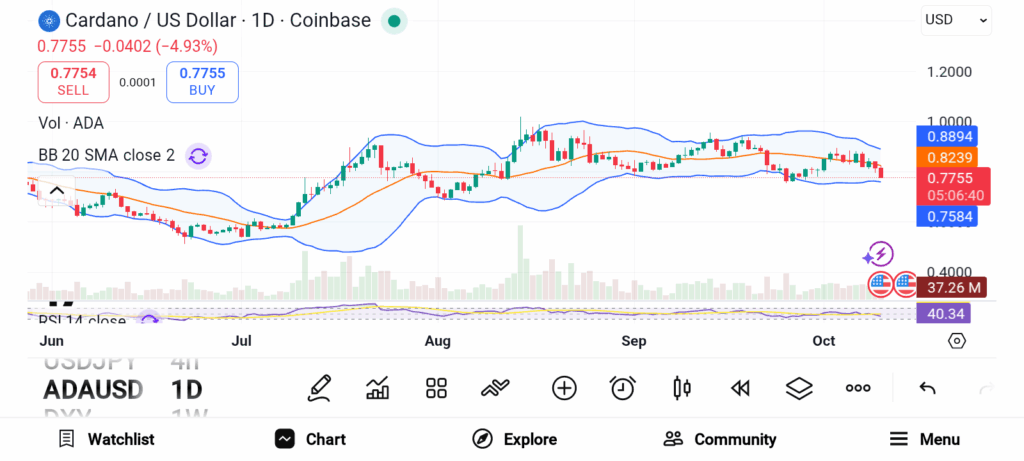

- Cardano: Strong support above $0.80 and rising institutional interest could fuel a short-term rally.

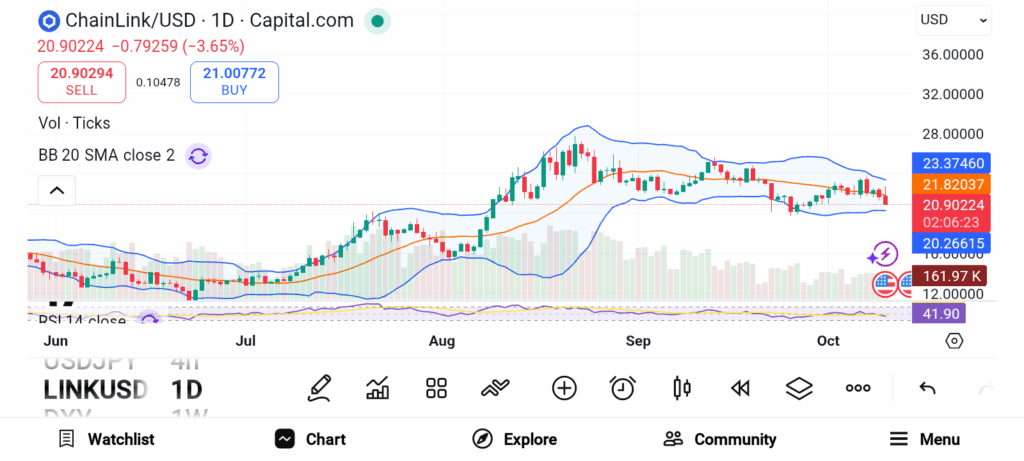

- Chainlink: Leading DeFi development and network expansion may drive LINK toward $28 this month.

Crypto investors are looking at November with optimism, as leading altcoins are giving strong setups that look good for potential gains. Ethereum, Cardano and Chainlink are projects that have caught analysts’ imaginations, leading them to believe that strong trends with solid backing from technicals and institutional investors will lead to strong performance. The steadiness of these projects and the continued confidence by investors make them good buys for potential short term rallies.

Ethereum Price Prediction

Source: Trading View

Source: Trading View

Ethereum’s ETH trades at around $4,490, also firmly above $4,450. Analysts say this stability is attributed to the optimism currently surrounding the prospect of ETFs and increasing institutional accumulation. Staking activity is also increasing, meaning more individuals with tokenized holdings are locking tokens for yield. DeFi activity on the network also continues to be strong.

This shows users are continuously involved with the cryptocurrency. On-chain data shows that substantial capital is flying into Ethereum by way of alternative altcoins. This indicates an increase in demand. If Ethereum can cross the $4,600 mark, analysts expect a rapid move toward the $5,200 mark in a short time frame.

Cardano Price Prediction

Source: Trading View

Source: Trading View

Cardano’s ADA is trading near $0.823, consolidating between $0.805 and $0.842. Market activity appears to show a shift as open interest rises to $1.57 billion, indicating a development of new speculative positions. If there is a clear break above $0.842, then a rally to $0.878 and $0.906 may unfold.

Strong support above $0.80 shows accumulation by investors in anticipation of a rally in the near term. Analysts view this as a healthy sign of confidence. The entry of Cardano into the S&P Broad Crypto Index Fund and Nasdaq Crypto Index ETF of Hashdex adds new strength to the growing institutional footprint.

Chainlink Tops DeFi Development List

Source: Trading View

Source: Trading View

Chainlink dominates the DeFi infrastructure space, thanks to its strong developer activity and extensive integrations. The project’s Cross-Chain Interoperability Protocol (CCIP) has gained momentum among large DeFi projects. Chainlink is currently consolidating near support after a nice rally as developers continue working ahead with new use cases. Chainlink ranks number one in DeFi developer activity according to Santiment’s October report. This steady progress helps boost confidence in the markets and indicates a potential for future growth.

Ethereum, Cardano, and Chainlink show strong potential for November gains. Ethereum benefits from ETF optimism and growing staking participation. Cardano gains strength from institutional involvement and active network development. Chainlink remains dominant in DeFi innovation, with consistent developer activity supporting further growth.