News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.

1. On-chain funds: $61.9M flowed into Hyperliquid today; $54.4M flowed out of Arbitrum. 2. Largest price changes: $SAPIEN, $MMT. 3. Top news: ZEC surpassed $500, marking a 575% increase since Naval’s call.

Robinhood's crypto revenue grew by 300% in the third quarter, with total revenue reaching $1.27 billions.

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Some crypto funds have outperformed bitcoin during bull markets through leverage or early positioning, offering risk hedging and diversification opportunities; however, their long-term performance has been inconsistent.

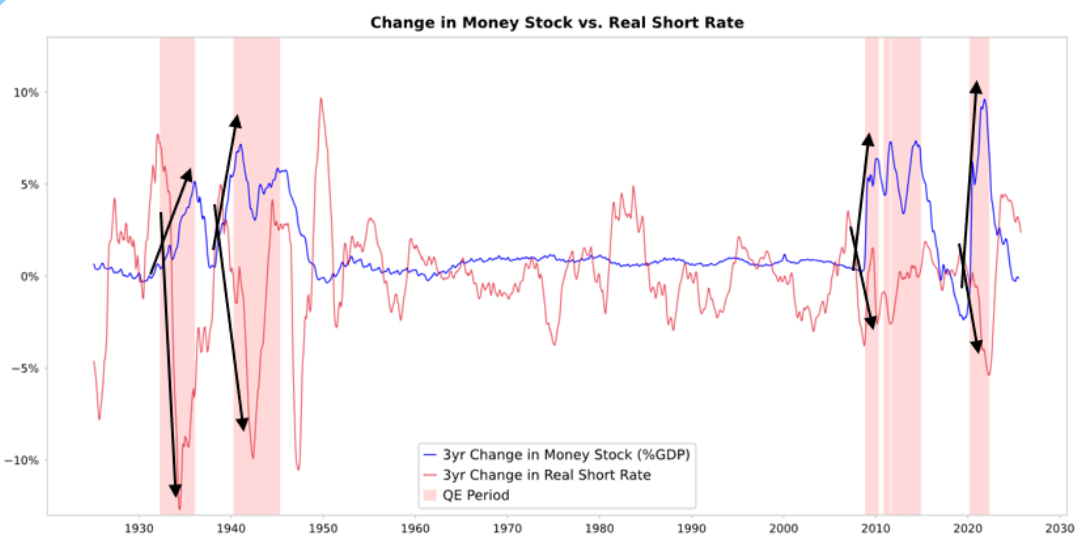

Due to the highly stimulative nature of current government fiscal policies, quantitative easing will effectively monetize government debt rather than simply reinjecting liquidity into the private system.

- 21:03Federal Reserve's Goolsbee: Lack of reliable inflation data, caution needed regarding rate cutsBlockBeats News, November 6, Federal Reserve's Goolsbee said on Thursday that the lack of official inflation data during a government shutdown "further highlights" his cautious stance on further rate cuts. In an interview, Goolsbee said, "My inclination is that when the road ahead is still foggy, we should be even more careful and slow down." Goolsbee pointed out that the Federal Reserve can still access a variety of private data on the job market, including the newly launched biweekly unemployment rate estimate from the Chicago Fed. The latest data shows that the unemployment rate in October may have risen to 4.4%, the highest level in four years. He stated that this estimate and most other labor market indicators show that "the job market remains quite stable." "If the labor market starts to deteriorate, we can almost immediately see signs." However, he also mentioned that alternative data sources on inflation are very limited. Before the government suspended the release of economic data, statistics showed signs of a rebound in inflation. He said, "If there is a problem with inflation, there will actually be no corresponding observational data to reflect it, which makes me even more cautious about cutting rates prematurely." (Golden Ten Data)

- 21:03In the past hour, liquidations across the entire network reached $50.65 million, mainly long positions.BlockBeats News, November 6, according to Coinglass data, in the past hour, liquidations across the entire network reached $50.65 million, with long positions liquidated for $43.09 million and short positions liquidated for $7.37 million.

- 21:02Nasdaq's decline widens to 2%, Nvidia drops 3.43%BlockBeats News, November 7, the Nasdaq's decline widened to 2%. Tesla (TSLA.O) fell 5.78%, Intel (INTC.O) dropped 3.95%, and Nvidia (NVDA.O) decreased by 3.43%. (Golden Ten Data)