News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

How the Trump family is reshaping prediction markets and the boundaries of information.

The MegaMafia 2.0 Accelerator Program focuses on incubating innovative crypto consumer products aimed at mainstream users.

Investing in the new stablecoin sector requires finding a balance among technological innovation, regulatory compliance, and market demand.

Whale Accumulation, Animoca Brands' Entry, and Bullish Technical Indicators Fuel AERO's 7% Surge

Revolutionizing Cross-Border Payments: How Ripple's Partnership Aims to Bypass Traditional Banking in Infrastructure-Limited Regions

The Federal Reserve announced a 25 basis point rate cut and halted quantitative tightening (QT), but the market experienced short-term panic due to Powell's hawkish comments regarding uncertainty over a rate cut in December. Bitcoin and Ethereum prices declined. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

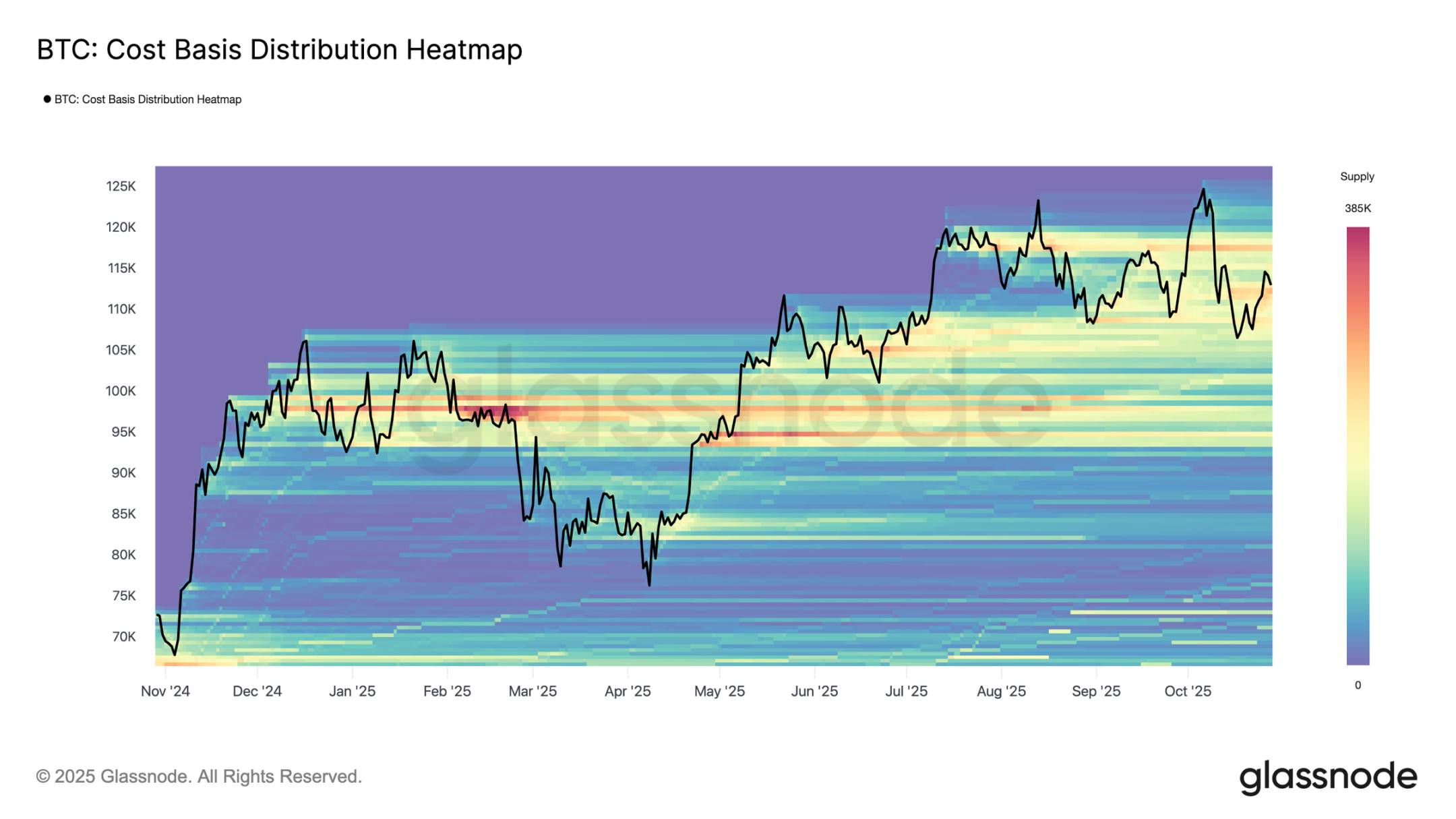

Bitcoin is showing clear signs of weakness, and market confidence is being put to the test.

- 04:11Analyst: Strategy tests 9 new addresses, suspected custody service transitionAccording to a report by Jinse Finance, crypto analyst Emmett Gallic disclosed that Strategy tested 9 new addresses (excluding change addresses). The analyst speculates that this may be related to a custodial service migration. According to his observations, the script hash address type starting with "3" is the same as the Prime deposit address of a certain exchange, but in this case, the test funds were not swept.

- 04:02Bitwise CIO: Institutional Investors Are Turning to Solana, Four Key Factors Driving Its Outperformance Over EthereumJinse Finance reported that Matt Hougan, Chief Investment Officer at Bitwise, stated that Solana is gradually becoming a favored asset among "alpha seekers"—investors looking for excess returns. Institutions view it as a "challenger asset" to Ethereum, and four major factors are driving large investors to favor Solana. 1. A pragmatic "launch first, optimize later" attitude Hougan noted that Solana has established a reputation for "moving fast and prioritizing deployment over perfection." While Ethereum may spend years debating upgrade proposals, Solana launches products first and then iteratively optimizes them in real time—this efficient pace is attracting institutions tired of Ethereum’s "delayed roadmap." 2. Leading position in tokenization Hougan pointed out that Solana has become the blockchain of choice for "equity tokenization": many real-world asset (RWA) projects prioritize Solana over competitors when selecting their underlying infrastructure. "Solana is ahead in the competition for equity tokenization," he emphasized. 3. Attractive high staking yields Institutions prefer assets that can "passively generate returns," and "stakeable blockchains" like Solana and Ethereum meet this need—among them, Solana’s staking business stands out. Data shows that over 81% of SOL tokens on the Solana network (worth about $51 billions) have been staked; in contrast, only 27% of ETH on the Ethereum network is staked. More importantly, Solana’s annualized staking yield is about 7%, allowing institutions to enjoy both potential token price appreciation and stable passive income; while Ethereum’s annualized staking yield is only about 3%. 4. Greater growth potential The last factor relates to Solana’s "scale." Hougan believes that one of the core reasons institutions are interested in Solana is its much smaller scale compared to Ethereum, which means greater growth potential. "Precisely because Solana is much smaller than Ethereum, its upside potential is much broader," he explained.

- 03:55Ether.Fi DAO New Proposal: Plans to Launch Token Buyback Program of up to $50 MillionJinse Finance reported that Ether.Fi DAO has released a new proposal authorizing the foundation to use part of the treasury funds for ETHFI token buybacks. According to the proposal, when the market price of ETHFI falls below $3, the foundation may execute buybacks from the open market or designated on-chain venues, with a total cap of $50 million. The plan aims to continue accumulating ETHFI tokens and increase the proportion of protocol revenue used for buybacks when the price is below this threshold. All buyback transactions will be transparently recorded on-chain and publicly reported through the ether.fi dune dashboard. The proposal will undergo a 4-day voting period on the Snapshot platform and will take effect immediately upon approval.