News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

Estimates show U.S. jobless claims fell to around 215,000 last week

Cointime·2025/10/17 14:48

Ethereum Price Slides Below $4,000 Support As Sellers Tighten Their Grip

Newsbtc·2025/10/17 14:27

Bitcoin falls below $110,000, whose wallet is losing money again?

Market sentiment has fallen into extreme fear.

ForesightNews 速递·2025/10/17 14:23

21Shares Files with SEC for 2x Leveraged HYPE ETF Tracking Hyperliquid Index Performance

Cryptonewsland·2025/10/17 14:06

Ghana Targets December 2025 for Crypto Rules as Enforcement Team Remains Unfilled

Cryptonewsland·2025/10/17 14:06

ACI Worldwide and BitPay Partner to Enable Merchants to Accept Crypto and Stablecoin Payments Globally

Cryptonewsland·2025/10/17 14:06

SEC’s Hester Peirce Calls for Financial Privacy as Tokenization Gains Momentum

Cryptonewsland·2025/10/17 14:06

France Boosts AML Checks on Crypto Exchanges

France’s ACPR tightens AML rules on crypto firms like Binance amid MiCA compliance efforts.Major Exchanges Face Regulatory ReviewMiCA Brings a New Compliance Era

Coinomedia·2025/10/17 14:06

Japanese banks to launch yen and dollar stablecoins

Portalcripto·2025/10/17 14:00

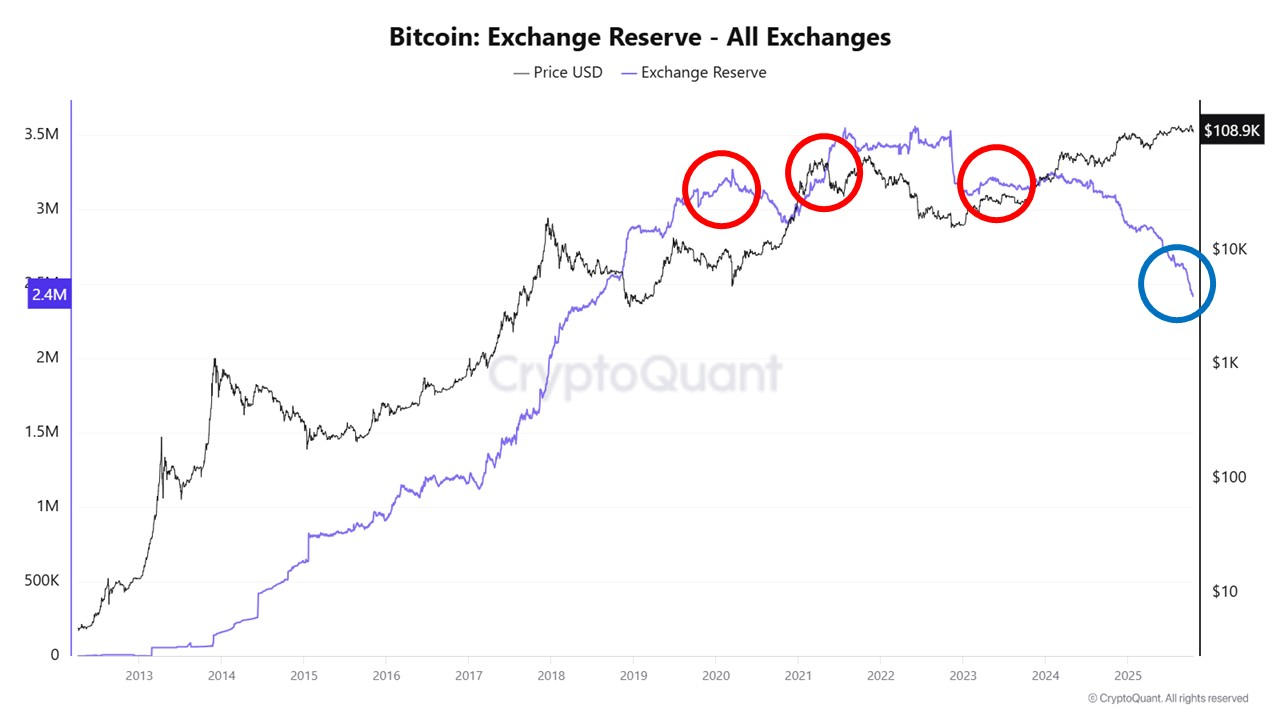

October Crypto Crash Shows Stark Contrast to 2021 Selloffs, Analyst Finds

CryptoNewsNet·2025/10/17 13:57

Flash

- 17:02Goldman Sachs Forms Global Infrastructure Financing Team, Betting on AI and Energy Transition OpportunitiesBlockBeats News, October 17, according to The Wall Street Journal, Goldman Sachs (GS.N) is ramping up its efforts to enter the red-hot market of data center and other infrastructure financing, aiming to secure a larger share amid the artificial intelligence boom. According to sources familiar with the matter, Goldman Sachs is forming a dedicated team within its Global Banking & Markets division, focusing on global infrastructure financing business. This includes not only increasing lending in this sector but also finding investors for these debts. This move is driven by a new wave of multi-billion dollar deals involving AI data centers, their massive energy demands, and financing for processing units that support AI development. The new team will also focus on traditional infrastructure construction or upgrade projects in both developed and emerging markets. In addition, the team will be responsible for raising funds for renewable energy and certain types of liquefied natural gas projects, as well as providing financing for military and other equipment related to rising national defense expenditures.

- 17:02Stablecoin L1 Tempo completes $500 million Series A funding round, led by Greenoaks and Thrive CapitalBlockBeats News, October 18, according to Fortune, Tempo, a payment-focused stablecoin Layer 1 blockchain developed by fintech giant Stripe and Paradigm, has completed a $500 million Series A funding round, led by venture capital giants Greenoaks and Joshua Kushner's Thrive Capital. This round values Tempo at $5 billion, making it one of the highest-valued blockchain venture investments in recent years. According to a source familiar with the matter, Sequoia Capital, Ribbit Capital, and Ron Conway's SV Angel also participated in this round. Paradigm and Stripe did not participate in this round. The Tempo blockchain (with design partners including OpenAI, Shopify, and Visa) is primarily designed for stablecoins, representing a bet that US dollar-backed cryptocurrencies will become the new global payment infrastructure layer.

- 17:01Federal Reserve's Musalem: If employment faces more risks and inflation is under control, I may support a path of further rate cuts.BlockBeats News, October 18, 2025 FOMC voting member and St. Louis Fed President Musalem delivered a speech: If employment faces more risks and inflation is under control, I may support a path of further rate cuts. The Federal Reserve should not stick to a predetermined course, but should adopt a balanced approach. He believes there is limited room before rate cuts make policy more accommodative. It is crucial for the Federal Reserve to remain cautious at present.