-

Bitcoin price must rally above $100k in the coming weeks to invalidate the macro bearish outlook.

-

The correlation between Bitcoin price and the Yen has increased amid the Yen’s unwinding trade.

-

The expected impact of the yen carry trade on Bitcoin will be overshadowed by bullish fundamentals.

After an impressive rebound during the first few days of 2026, Bitcoin (BTC) price has been rejected around $94k. The flagship coin dropped below $91k on Wednesday, January 7, amid rising midterm fear of further bearish impact from the unwinding Yen carry trade.

Bitcoin Suffers Liquidity Crunch Amid Unwinding of Yen Carry Trade

Bitcoin and the wider altcoin market are facing heightened short-term selling pressure as the Yen carry trade continues to unwind. The recent interest rate hikes by the Bank of Japan have caused investors to shift risk-off on crypto assets due to the unwinding of the Yen carry trade.

The liquidity outflow from Bitcoin and altcoins to repay loans denominated in Yen weighed down on midterm bullish sentiment. During the December schedule, the BoJ increased its rate to 0.75%, thus making Yen loans less profitable at the global scale.

According to trading data from TradingView, BTC price closed in the fourth quarter of 2025 in a bearish outlook, amid strong global fundamentals, thus correlated with the Yen.

Bitcoin’s liquidity outflow is clearly visible through the $243 million in cash outflows from the U.S. spot BTC ETFs.

Bigger Picture

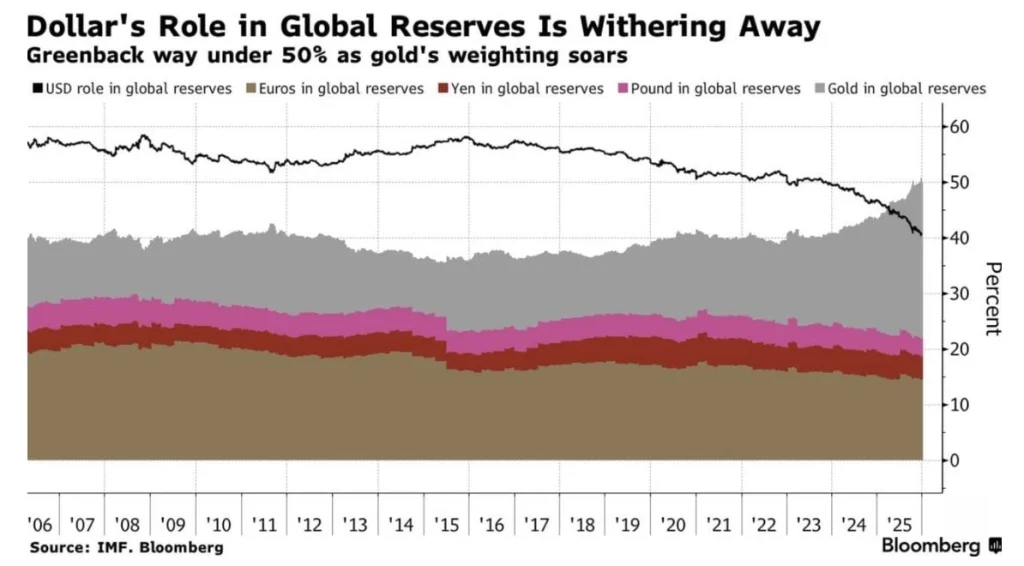

According to Tom Lee, a popular Wall Street analyst heavily invested in crypto, the parabolic rise of Gold in 2025 is an indicator of crypto bullish sentiment in 2026. According to Bloomberg data, the U.S. dollar was recently overtaken by Gold as the dominant global reserve.

With Bitcoin adopted globally as a digital Gold, the flagship coin is well-positioned to rally exponentially in the coming months. Moreover, the ongoing Quantitative Easing (QE) by the Federal Reserve will trigger a risk-on investment mode in the near future.