Is XRP at Risk of a Breakdown Before 2026 Begins? Three Metrics Hint at Trouble

By:BeInCrypto

XRP is down about 1.6% over the past 24 hours. On the weekly chart, it remains one of the weaker large-cap movers, sitting roughly 16% lower than last months levels. Most of the price action is happening near the bottom of a descending triangle pattern, a structure that often leads to continuation moves. This does not confirm a breakdown yet, but three market signals are lining up in a way that should make traders cautious heading into the final days of 2025. Retail And Long-Term Holders Are Moving The Same Way XRP is still stuck inside a descending triangle, trading flat near the lower trendline. Price trended higher between December 18 and December 27, but the Money Flow Index (MFI) moved the opposite way during that same period. MFI tracks money entering or exiting the asset. A lower low in MFI while price rises suggests retail is selling into every bounce instead of accumulating. That pressure keeps the XRP price pinned at the lower boundary of the pattern instead of testing the upper line. Weak Retail Participation: TradingView The concern grows when we zoom out to long-term holders. According to HODL Waves, which visualizes how much supply is held by each age group, wallets holding XRP for 23 years dropped from 14.26% of supply on November 26 to about 5.66% on December 26. These are long-term conviction holders, and their selling removes a layer of market support. Retail weakness is normal. Long-term weakness at the same time is not. Holders Dumping XRP: Glassnode This creates a setup where both short-term and long-term behavior are leaning in the same direction: out of XRP. Capital Flow Shows Fading Demand If retail and long-term conviction are weakening, the next check is capital flow, the third key sign. The Chaikin Money Flow (CMF) is not providing relief either. CMF tracks buying and selling pressure based on volume and price movement. The large money flow indicator remains negative for XRP and is sliding along a descending support trendline. Weak CMF: TradingView In simpler terms, even if the price is flat, big capital entering the asset is thinning out, and the market is leaning toward supply overpowering demand. With no pickup yet in CMF, the market loses another potential safety net. This is why the XRP price has remained flat rather than rebounding. XRP Price Levels Decide If The Breakdown Actually Happens For now, XRP is trapped between $1.90 and $1.81. It lost the $1.90 level on December 22 and hasnt reclaimed it since. Reclaiming $1.90 and then pushing for $1.99 would be the first sign of strength. That would also mark a move above the triangles upper boundary and give bulls something to work with. However, the bearish case is clearer than the bullish one at present. If $1.81 breaks, XRP may fall out of the descending triangle pattern, which would constitute a confirmed breakdown. That loss could open room toward $1.68, where the structure fully fails, and even $1.52 if selling accelerates. XRP Price Analysis: TradingView This isnt a given yet, but the market has not shown a counter-signal yet. As long as retail selling, long-term distribution, and weakening capital inflow remain aligned, the XRP price must fight to hold the range.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Altcoin Market at Make-or-Break Levels: 5 High-Risk Buys as Dominance Nears Potential +40% Move

Cryptonewsland•2025/12/27 23:24

Asia is quietly building a counterweight to the dollar stablecoin empire, and the West isn’t ready

CryptoSlate•2025/12/27 23:18

Bitcoin 4-Year Cycle Is Dead: Famous Crypto Trader Explains What Happens Next

Newsbtc•2025/12/27 23:09

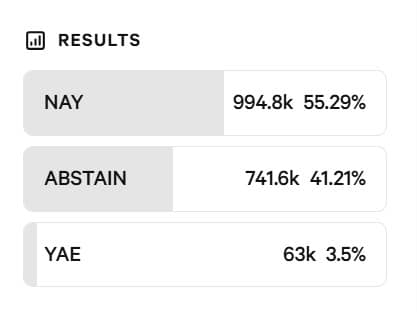

Aave DAO votes down brand control plan as altcoin falls by 14% – Explained

AMBCrypto•2025/12/27 23:03

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,600.61

+0.22%

Ethereum

ETH

$2,939.75

+0.45%

Tether USDt

USDT

$0.9993

+0.01%

BNB

BNB

$842.57

+1.02%

XRP

XRP

$1.86

+1.06%

USDC

USDC

$0.9996

-0.02%

Solana

SOL

$124.29

+1.71%

TRON

TRX

$0.2843

+1.76%

Dogecoin

DOGE

$0.1240

+1.70%

Cardano

ADA

$0.3660

+4.57%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now