Aave [AAVE] is going through a tough time.

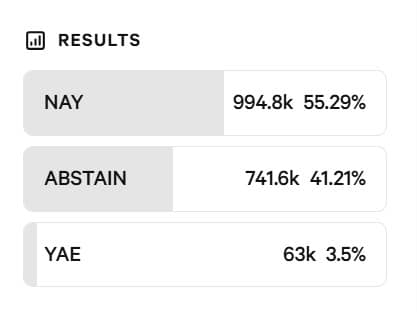

A proposal to bring the protocol’s brand and intellectual property under DAO control has failed to gain support. Meanwhile, AAVE’s price slid by nearly 14% this week.

There seems to be very little confidence inside the ecosystem. And, one wonders what’s next for one of DeFi’s biggest names.

A vote that drew the line

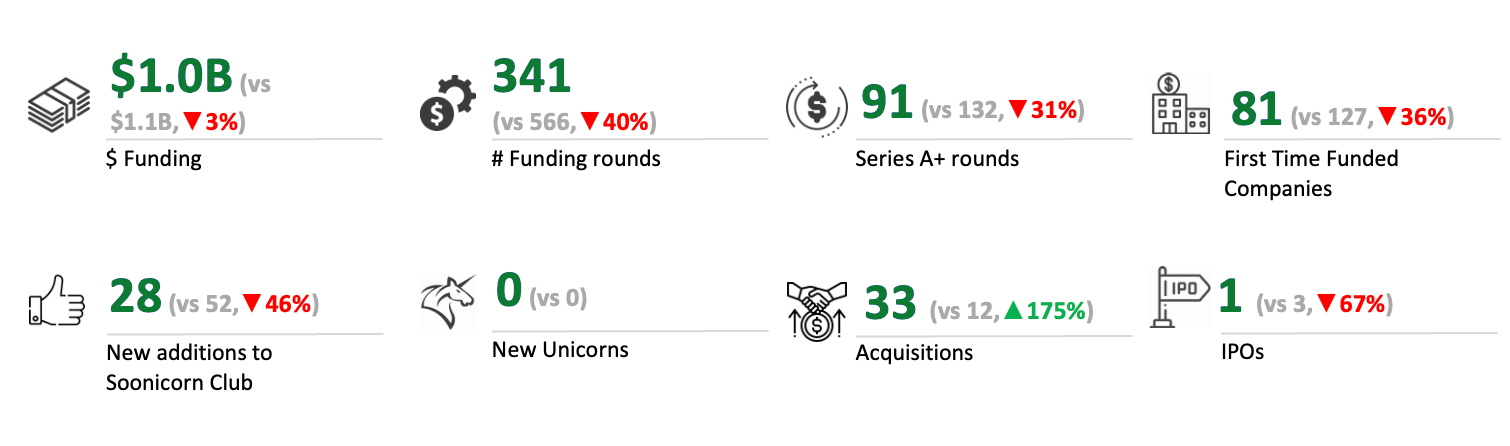

The recent governance vote to bring the protocol’s brand and intellectual property under DAO control was decisively rejected. Over 55% voted against and just 3.5% in favor of the same. A large percentage abstained though. Hence, it wasn’t exactly outright opposition.

Source: snapshot.org

At its core, the proposal sought to shift control of Aave’s domains, social handles, and naming rights away from entities like Aave Labs and BGD Labs and into the hands of token holders. It was understood that this would have been a step towards deeper decentralization and long-term alignment.

Alas, for many, the timing, structure, and implications were concerning.

AMBCrypto previously reported that Aave founder and CEO Stani Kulechov publicly opposed the proposal. He had claimed that a simple yes/no vote was the wrong way to resolve such a complex issue. This had the community accusing Aave Labs of interfering in DAO governance.

Rejection didn’t happen in isolation

In the days leading up to the vote, there was anger over how the process unfolded. Some community members pushed back against the decision to move the proposal to a snapshot vote while discussions were still active.

Then, attention turned to Kulechov, who reportedly acquired $10 million worth of AAVE ahead of the vote. While not improper on its own, it does bring tough questions about influence and power concentration within token-based governance systems.

An uncertain market ahead?

After a big drop earlier this month, the altcoin slipped below $150 before bouncing slightly. At the time of writing, it was still trading under key moving averages (MAs) – A sign that usually means sellers might be in control.

Source: TradingView

The RSI was low and money flow was negative – Indicative of buyers being cautious. On the contrary, the selling pressure seemed to be slowing down. If buyers return, AAVE could try to move back towards the $165-$170 range.

For now, the market is waiting for a clear direction to go in.

Final Thoughts

- Aave’s brand takeover vote failed, with over 55% voting no.

- Native token AAVE also fell by 14% this week.