Bitcoin Leverage Liquidation: Is This a Warning Sign for Individual Investors?

- Q3 2025 saw record $73.59B in crypto leverage, with $19B wiped in single-day Bitcoin liquidations on Oct 10. - Over-leveraging driven by FOMO and social media hype triggered panic selling via ADL mechanisms on major exchanges. - Automated risk controls prevented insolvency but exposed systemic fragility amid rapid price swings and emotional trading. - Experts urge retail investors to adopt strict leverage limits, stop-loss orders, and AI-driven analytics for disciplined risk management. - Regulatory scru

Crypto Market Volatility: Lessons from the Q3 2025 Leverage Shakeout

The unpredictable nature of the cryptocurrency market has always presented both remarkable opportunities and significant dangers. This reality was starkly highlighted in the third quarter of 2025, when Bitcoin leverage liquidations soared to unprecedented heights. On October 10, over $19 billion in leveraged positions were erased in a single day—a record-breaking event in the history of crypto futures. This dramatic episode prompts a crucial reflection: Should individual investors reconsider their strategies around leverage and risk in an increasingly unstable environment?

Historic Liquidations: A Sign of the Times?

According to research from Galaxy, crypto-backed lending reached an all-time high of $73.59 billion in Q3 2025, with decentralized finance (DeFi) platforms making up nearly 67% of that figure. While this surge points to growing participation from both institutions and individuals, it also magnifies systemic vulnerabilities. The sharp price drop on October 10 set off a chain reaction, activating automatic deleveraging protocols on major exchanges such as Hyperliquid and Binance. This, in turn, fueled a cycle of panic-driven sell-offs.

Importantly, this wave of liquidations did not indicate a collapse in credit quality. Instead, it demonstrated the effectiveness of automated risk controls in averting insolvency. Still, the sheer magnitude of these liquidations—far surpassing those seen during the 2021–22 period—shows that, despite greater transparency, the market’s leverage structure remains dangerously sensitive to rapid price movements. For everyday investors, the message is clear: leverage can magnify both profits and losses, and the margin for error in such volatile markets is razor-thin.

The Emotional Side of Over-Leverage

The liquidation crisis of October 2025 was as much a psychological event as a technical one. Many traders, driven by overconfidence and the fear of missing out (FOMO), took on excessive leverage during bullish trends. Social media amplified this effect, with hype and peer pressure encouraging a herd mentality that often prioritized quick action over careful analysis.

For instance, those who had enjoyed consistent gains during Bitcoin’s 2024–2025 rally may have overestimated their ability to manage risk, believing the upward momentum would continue indefinitely. When the market turned, many were caught in highly leveraged positions with inadequate collateral, resulting in margin calls and forced liquidations. The emotional aftermath—panic selling, desperate attempts to recover losses, or doubling down on risky bets—often worsened the initial financial damage.

Resilience Under Pressure: Insights from Founders

There are notable similarities between how investors and startup founders respond to high-pressure situations. Both must navigate uncertainty, balancing hope with realism. During the October 2025 liquidation wave, companies that focused on maintaining liquidity and used stablecoins to hedge against volatility managed to weather the storm better than those heavily reliant on speculative leverage.

One key takeaway from founder resilience is the value of a long-term strategy. Just as startups survive downturns by refining their approach and cutting unnecessary expenses, investors should resist impulsive decisions driven by FOMO or fear, uncertainty, and doubt (FUD). Advanced tools—such as AI-powered platforms like Token Metrics, which combine blockchain data with sentiment analysis—are increasingly vital for maintaining discipline. These technologies provide real-time insights, helping traders stay focused and avoid emotionally charged mistakes.

Building Stronger Risk Management Practices

The events of October 2025 highlight the necessity of robust risk management when using leverage. For retail investors, this involves:

- Imposing strict leverage caps: Limit exposure by keeping leverage at 5x or below, even in bullish markets.

- Implementing stop-loss orders: Set automated exit points to minimize potential losses.

- Diversifying collateral: Allocate part of your portfolio to stablecoins or less volatile assets to cushion against sudden drops.

- Utilizing predictive analytics: Employ AI-driven tools to track market sentiment and liquidity trends.

In addition, regulatory oversight is likely to increase following such incidents, potentially resulting in tighter margin requirements or the introduction of circuit breakers to prevent cascading failures. While these measures may reduce some market efficiencies, they could also help create a more stable and sustainable trading environment by discouraging reckless speculation.

Final Thoughts

The Bitcoin leverage liquidation crisis of Q3 2025 is not an isolated incident but a reflection of deeper structural and psychological challenges within the crypto market. For individual investors, the lesson is unmistakable: leverage should be approached with extreme caution, and risk management strategies must evolve alongside the market’s growing complexity. By adopting a disciplined, long-term perspective and leveraging advanced analytical tools, investors can better navigate volatility and avoid its most dangerous pitfalls.

As the digital asset space continues to mature, the distinction between opportunity and disaster will become increasingly subtle. Those who succeed will be the ones who treat leverage as a sophisticated tool—one that demands careful calculation, patience, and an unwavering commitment to managing risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Rate Cuts and QT End Set Crypto Up for 2026 Tailwind

Russia Calls Bitcoin Mining an Underrated Export as Production Rises

MicroStrategy Builds $1.44B Cash Wall as Bitcoin Signals Turn Bearish

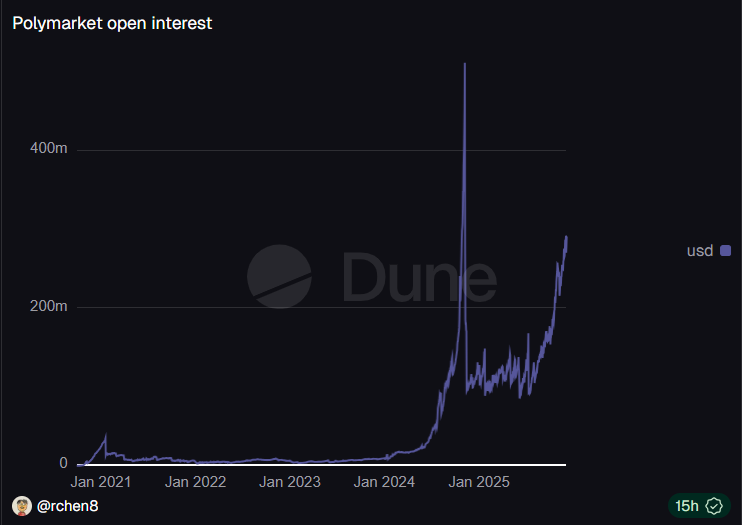

Polymarket may be tapping market making help in shift to boost liquidity