Crypto Speculation Questioned as Gold Demand Rises

- Gold outperforms Bitcoin in 2025 due to speculative concerns.

- Bitcoin falls 25% from peak as gold demand grows.

- Market rotation favors gold, drawing in cautious investors.

In 2025, the gold market outperformed Bitcoin, as institutional investors shifted capital from crypto speculation to gold, reflecting a preference for stability amid global economic volatility.

This trend underscores the persistent perception of crypto as speculative compared to gold’s traditional safety, affecting market dynamics and investor strategies.

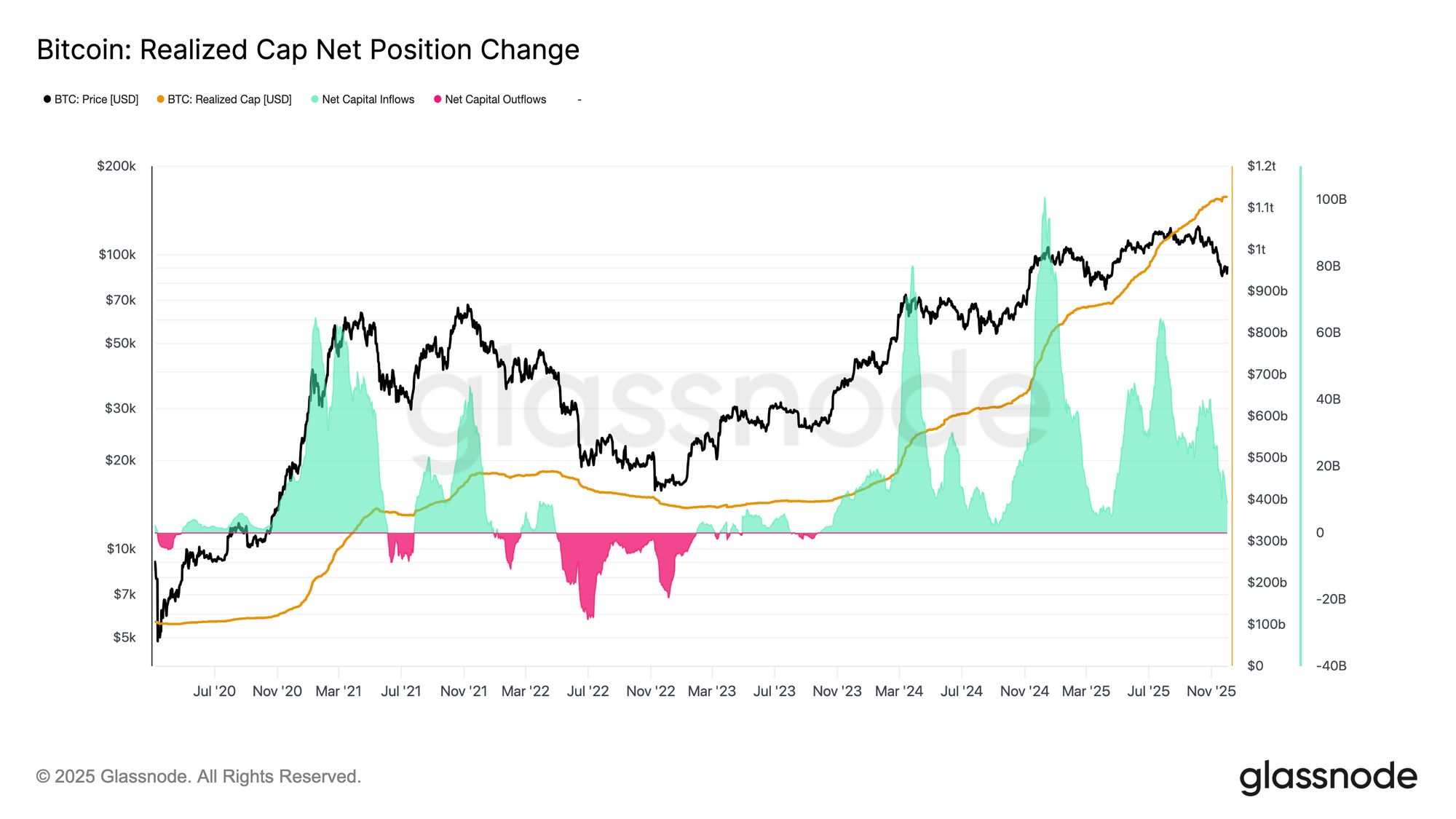

Market analysts point to 2025 data showing gold’s strong performance relative to Bitcoin. Bitcoin-to-Gold ratio charts reveal market preference for gold, highlighting crypto’s perceived speculative nature amid increased market volatility and risk-averse investing.

Notable figures like Vitalik Buterin and Raoul Pal highlight Bitcoin and gold’s respective roles. While Bitcoin shows growing maturity, leaders emphasize gold’s enduring status as a safe-haven asset during volatile market conditions.

Gold surged over 50% in 2025, overshadowing Bitcoin’s earlier gains and subsequent slump. Bitcoin lost $600 billion in market cap , indicating a rotation toward safer investments, challenging critiques of crypto’s speculative nature.

Financial landscapes shifted as asset managers allocated resources toward gold. Institutional reports, tweets, and public discourse reflect a re-evaluation of gold’s traditional safety versus Bitcoin’s risk. This signals confidence in gold’s stability.

Historical precedents align with current trends, underscoring gold’s consistent role during crises. Crypto’s high-beta status, influenced by market sentiments, repeatedly encounters challenges despite advancements in blockchain technology and adoption. Raoul Pal, Co-founder & CEO, Real Vision, stated, “Bitcoin’s volatility relative to gold has fallen below 2.0, signaling maturity and attracting cautious institutional investors,” stressing crypto is evolving but that gold remains the “ultimate store of value.”

Regulatory scrutiny and liquidity data illustrate cautious crypto positions while gold’s time-tested appeal endures. Potential regulatory impacts on crypto ETFs and stablecoins further bolster gold’s safe investment reputation, reshaping market confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

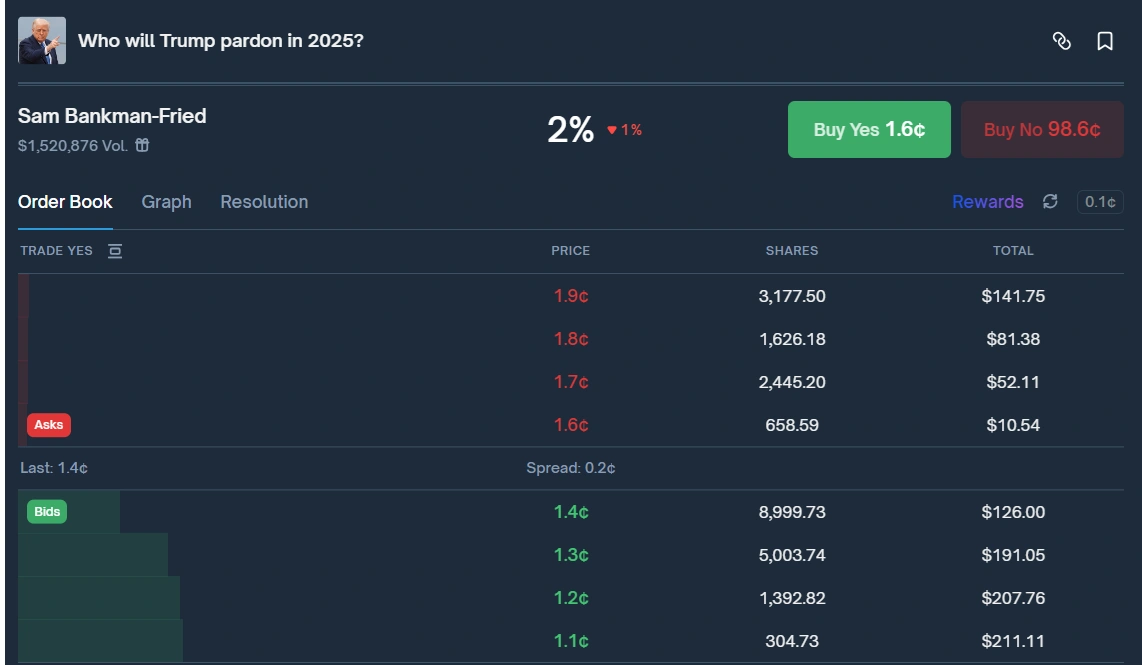

Trump continues to overlook SBF as president issues fresh pardons

Ledger Finds Popular Smartphone Chip Vulnerable to Unpatchable Attacks

With a sub‑30% underwater supply, Bitcoin price actions now looks eerily like early 2022