XRP Institutional ETF Inflows Signal Market Interest

- Institutional ETF inflows into XRP signal market interest.

- XRP faces resistance near $2.46.

- Market momentum linked to BTC and ETH performance.

Ripple’s XRP sees pivotal interest as institutional ETF inflows surpass $640 million, enhancing momentum. The crypto community closely monitors XRP, which trades near $2.00, anticipating potential breakthroughs.

Experts highlight ETF-driven demand as a crucial shift for XRP amidst strong price resistance and market correlation with Bitcoin and Ethereum, affecting its price trajectory and investment sentiment.

XRP is seeing a surge in institutional ETF inflows surpassing $640 million recently, pushing its trading price around $2.00. The cooling phase is apparently fading, inviting optimism among XRP holders.

Key players include Ripple Labs leading the XRP development, with recent interest from institutional investors through ETFs . Prominent crypto analyst Ray Youssef noted the inflows as the awaited signal for Ripple holders.

The influx has drawn attention from the market , potentially shifting XRP’s liquidity and price dynamics. Analysts observe the resistance levels between $2.46-$2.60, cautious of long-term holder clusters influencing future breakouts.

ETF movements suggest a shift in institutional interest, contributing to broader crypto market trends. The correlation between XRP and major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) is influencing its valuation.

Historical data shows December often records mixed results for XRP, but the current ETF-driven interest might alter usual patterns. The persistent resistance levels pose challenges to potential bullish runs, contingent on sustained institutional backing.

Insight shows ETF inflows as a relatively new catalyst, contrasting previous retail-driven rallies. The 700 million XRP in escrow by Ripple could maintain controlled supply, influencing price stability. XRP’s outlook hinges on broader market and institutional dynamics.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

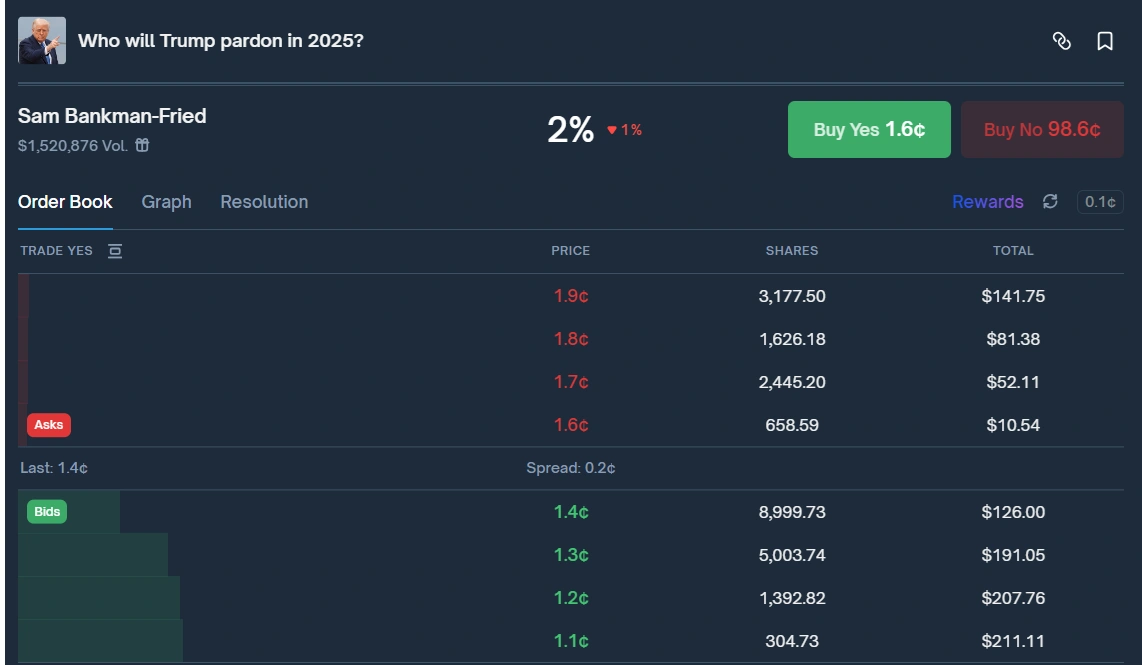

Trump continues to overlook SBF as president issues fresh pardons

Ledger Finds Popular Smartphone Chip Vulnerable to Unpatchable Attacks

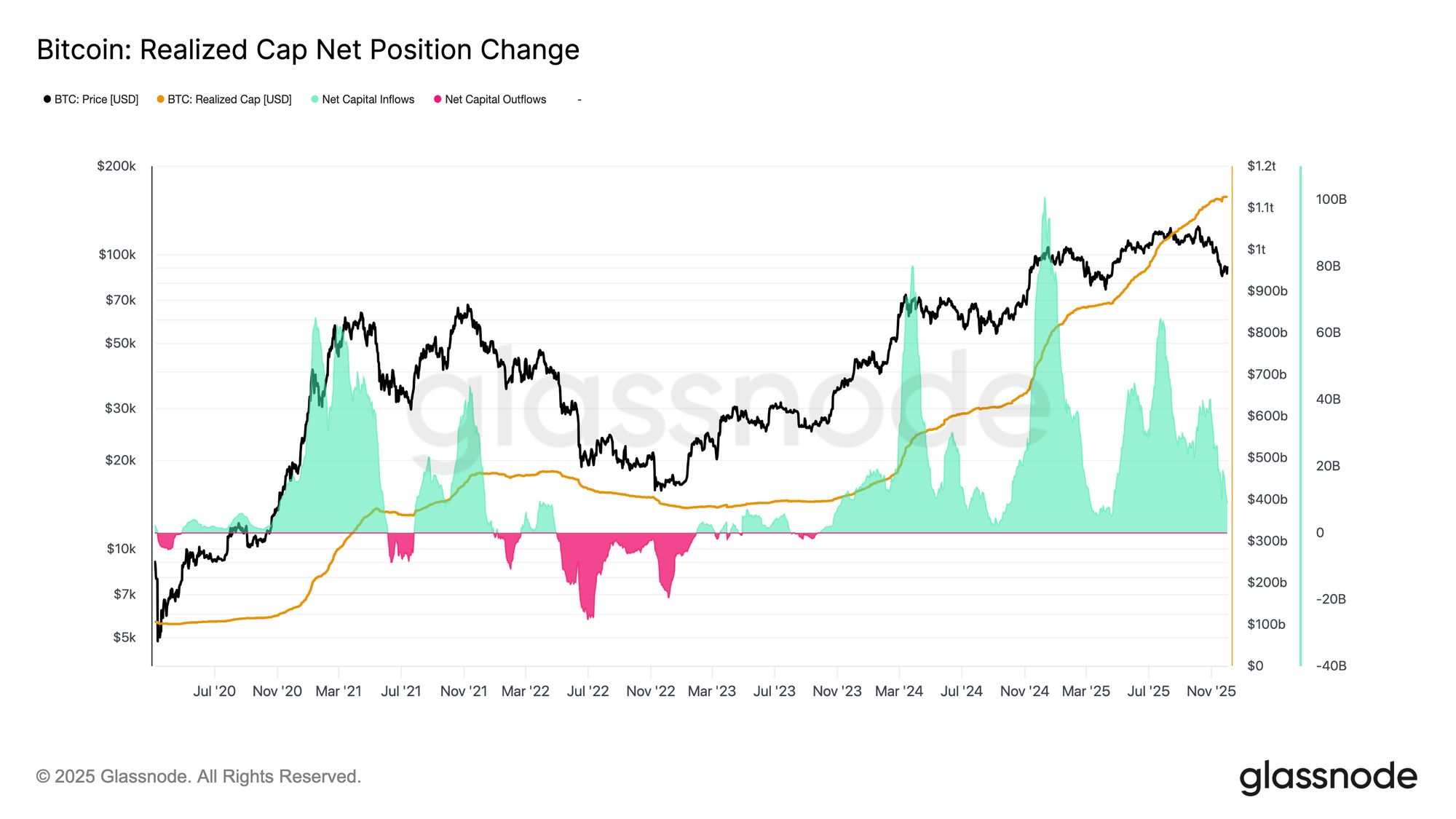

With a sub‑30% underwater supply, Bitcoin price actions now looks eerily like early 2022