Kakaobank unveils won-pegged stablecoin development hiring blockchain experts

Kakaobank is developing a won-pegged stablecoin, and preparing for security token offerings amid South Korea’s new legislation.

- Kakaobank is building blockchain infrastructure for a “Kakao Coin” stablecoin.

- The bank plans to launch security token offerings (STO), partnering with Korea Investment & Securities and Lucent Block.

- New South Korea laws pave the way for STO market growth, while rivals Naver and Dunamu advance their own stablecoin and digital wallet strategies.

South Korean digital bank KakaoBank has entered the development phase for a won-pegged stablecoin called “Kakao Coin,” according to local media reports.

The bank is establishing blockchain infrastructure for the digital currency, the company announced .

Kakaobank and the won-backed stablecoin integration

KakaoBank Chief Financial Officer Kwon Tae-hoon announced during the bank’s first-half 2025 earnings call in August that the firm is entering the stablecoin market. Kakao Group, the parent technology company, has formed a stablecoin task force and is conducting weekly strategy discussions, according to local media reports. The bank is reviewing various approaches, including the issuance of a won-backed stablecoin and digital asset custody services.

KakaoBank is also planning a security token offering (STO) utilizing blockchain technology, the report stated. The bank has signed partnerships with Korea Investment & Securities and Lucent Block to develop blockchain-based STO financial products and systems.

The development follows South Korea ‘s recent legislative amendments to the Electronic Securities Act and the Capital Markets Act, which establish the framework for an STO circulation market scheduled to open in the first half of 2026.

South Korea’s financial industry estimates the security token offerings market could reach $287 billion by 2030. The stablecoin development activity in South Korea intensified after President Lee pledged to launch a won-pegged digital currency for business and international trade applications.

South Korean technology company Naver recently launched a wallet service for a local stablecoin in Busan, partnering with venture capital firm Hashed and the Busan Digital Asset Exchange. Naver Financial is pursuing a merger with Dunamu, the operator of Upbit , South Korea’s largest cryptocurrency exchange.

Both Kakao and Naver operate payment platforms with substantial user bases. Naver’s payment platform serves 30 million users monthly, while KakaoPay maintains a similarly large customer base, positioning both companies to leverage their existing networks for stablecoin adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti

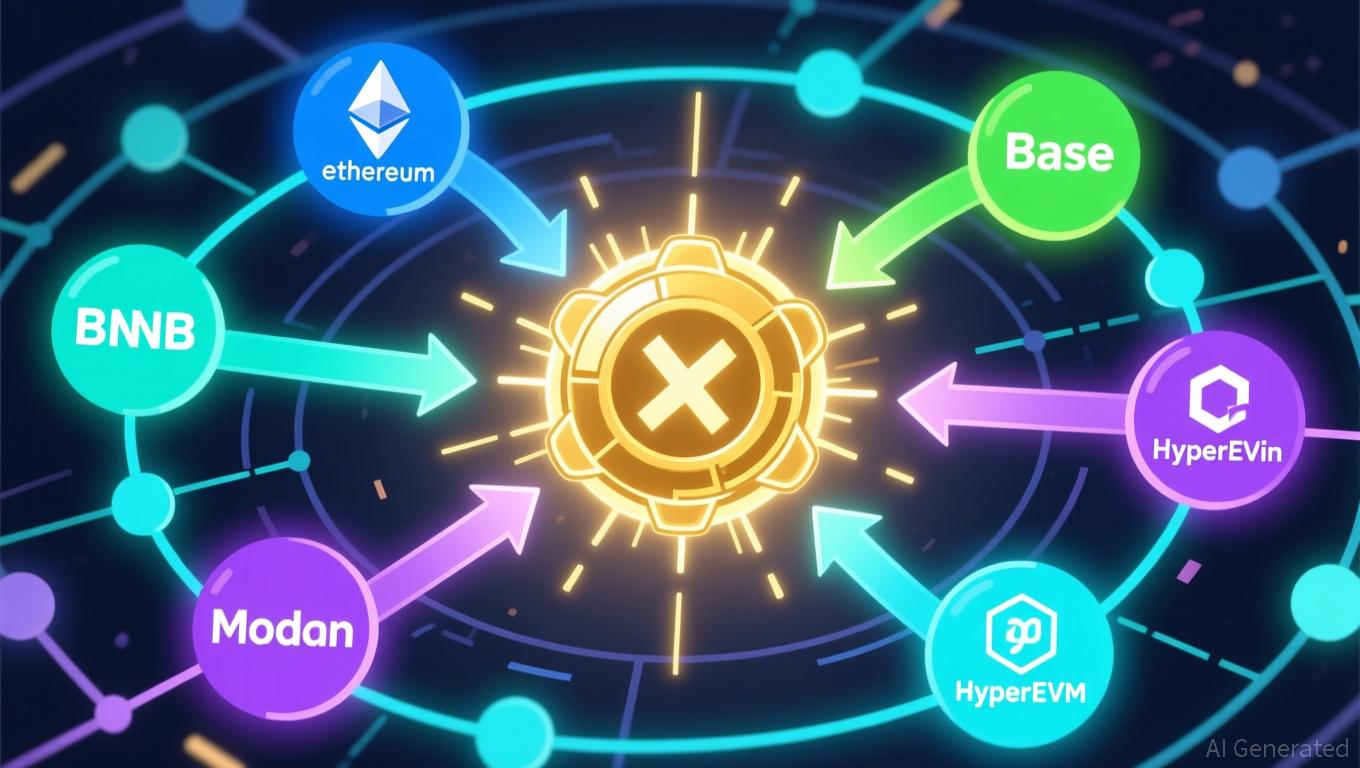

Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to

Bitcoin News Update: Bitcoin's Plunge Signals Trump's Diminishing Influence, as Crypto Connections Weaken Amid MAGA's Downturn

- Nobel laureate Paul Krugman links Bitcoin's $1 trillion crash to Trump's waning political influence and crypto-linked wealth decline. - Trump family's crypto assets lost $1 billion in value, with Eric Trump's ABTC shares down 50% and memecoins losing 90% of peak value. - Despite losses, complex financial structures like Alt5 Sigma holdings buffer the family, while Krugman ties crypto turmoil to fractured MAGA support. - Trump's pro-crypto policies face scrutiny as Bitcoin's $40k drop undermines his econo