Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to

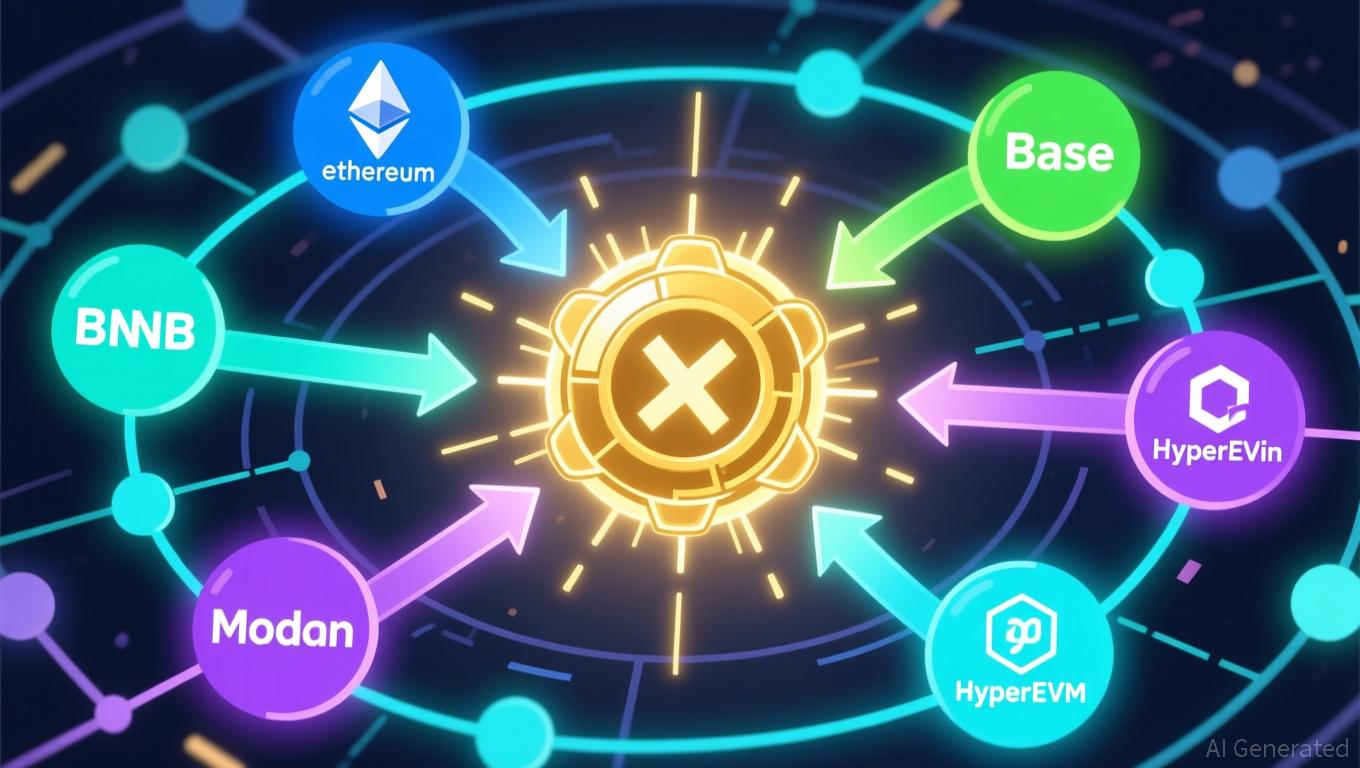

Avail has unveiled Nexus Mainnet, a cross-chain execution platform built to connect liquidity and user activity across leading blockchain networks, such as

Led by co-founders Anurag Arjun and Prabal Banerjee, this project positions Nexus as a core advancement for the on-chain economy. Arjun highlighted that Nexus transitions the blockchain space from isolated, chain-centric operations to a model of shared execution and liquidity, making processes more efficient for both developers and users. The platform’s intent-solver system enhances how transactions are routed, and Avail DA (Data Availability) will later deliver unified verification,

The AVAIL token, which is currently valued at about $0.0080, functions as the coordination token within the Nexus ecosystem. Banerjee explained that Nexus eliminates the usual challenges of cross-chain execution,

The debut of Nexus Mainnet represents a major advancement in overcoming the shortcomings of current blockchain systems. By merging liquidity and execution across various chains, Avail seeks to minimize dependence on risky bridges and fragmented setups, paving the way for a more cohesive and accessible Web3 ecosystem

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Conor McGregor accuses Khabib Nurmagomedov of scamming fans with $4.4 million NFT sale

XRP News Today: XRP ETFs Draw $600M in Investments, Yet Price Remains Stuck Under $2.20 Barrier

- XRP ETFs approved by NYSE, including Franklin Templeton's XRPZ and Grayscale's GXRP , attracted $600M in combined inflows as institutional demand grows for Ripple's token. - Regulatory milestone enables structured institutional access to XRP, with Franklin Templeton's $62.59M and Grayscale's $67.36M inflows highlighting traditional asset managers' crypto appetite. - XRP price remains trapped below $2.20 resistance at $2.13 despite ETF inflows, with technical analysts noting a rising wedge pattern and cri

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti