Key Notes

- Federal cloud infrastructure expansion positions AWS as dominant provider for government AI processing and research applications.

- Cryptocurrency markets respond positively with AI tokens gaining collective value amid growing institutional adoption signals.

- NEAR Protocol leads sector performance while selective profit-taking affects established tokens like Bittensor despite bullish trends.

AI-linked cryptocurrencies surged on Nov. 24 as Amazon confirmed a landmark plan to invest up to $50 billion in new AI and supercomputing infrastructure for US federal agencies. The initiative will deploy nearly 1.3 gigawatts of high-performance computing capacity across AWS Top Secret, AWS Secret, and AWS GovCloud regions, beginning construction in 2026.

According to the press release , the investment will expand US agencies’ access to AWS’s full AI stack, including SageMaker, Bedrock, Nova, Anthropic Claude, open-weights foundation models, and AWS Trainium chips.

Federal agencies will now be able to process decades of national security data in real time. Amazon stated the expansion will also support autonomous systems, satellite imagery, and scientific research under the Trump Administration’s AI Action Plan.

AWS CEO Matt Garman expressed expectations for the investment to transform how federal agencies leverage supercomputing to enable critical workloads without computational limitations.

Already serving more than 11,000 agencies, the announcement reinforces Amazon’s position as the leading cloud service provider to the US government.

AI Crypto Tokens Rally to $20.7B as Traders Price AI Infrastructure Boom

Amazon’s supercomputing announcement arrived barely 24 hours after Elon Musk revealed a breakthrough in Tesla’s internal AI chip manufacturing efforts, setting AI adjacent markets up for a bullish opening on Nov. 24.

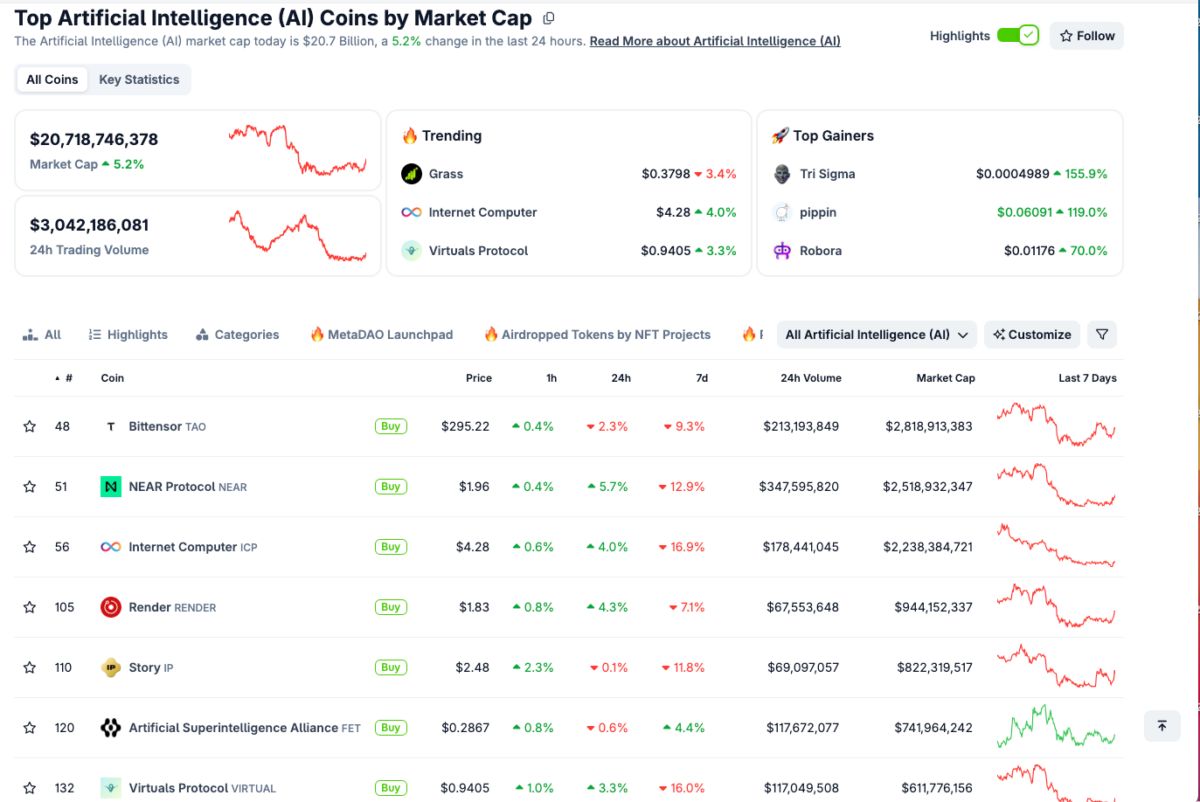

The tailwinds have also lifted crypto AI tokens, with Coingecko data showing sector capitalization rising 5.2% to $20.7 billion on Nov. 24.

Crypto AI tokens rally to $20.7 billion on Nov. 24 | Source: Coingecko

Cumulative intraday volume reached $3.3 billion, reflecting deeper liquidity as traders rotated into AI-adjacent assets. NEAR Protocol NEAR $1.94 24h volatility: 4.6% Market cap: $2.48 B Vol. 24h: $365.32 M led gains with a 5.7% increase, supported by rising developer activity and strong L2 interoperability flows. Internet Computer ICP $4.21 24h volatility: 2.7% Market cap: $2.27 B Vol. 24h: $198.14 M and Render [NC] followed, each posting 4% gains as investors priced in growing demand for decentralized computing.

However, traders remained selective. Bittensor TAO $294.8 24h volatility: 2.2% Market cap: $2.83 B Vol. 24h: $222.35 M , the sector’s largest token by market cap, dropped 2.7% amid profit-taking and recent sell pressure from miners. Story Protocol IP $2.49 24h volatility: 1.8% Market cap: $822.89 M Vol. 24h: $63.78 M and Artificial Superintelligence FET $0.28 24h volatility: 0.5% Market cap: $731.68 M Vol. 24h: $122.41 M also remained flat, while seven of the other top 10 ranked AI tokens traded in profit.

Best Wallet市场表现亮眼,受亚马逊利好情绪推动

As Amazon’s $50 billion investment boosts market sentiment, strategic traders are switching focus to early-stage AI-driven projects like Best Wallet.

Best Wallet

Best wallet offers secure storage, staking rewards, and integrated multi-chain access, combining self-custody and passive income opportunities.