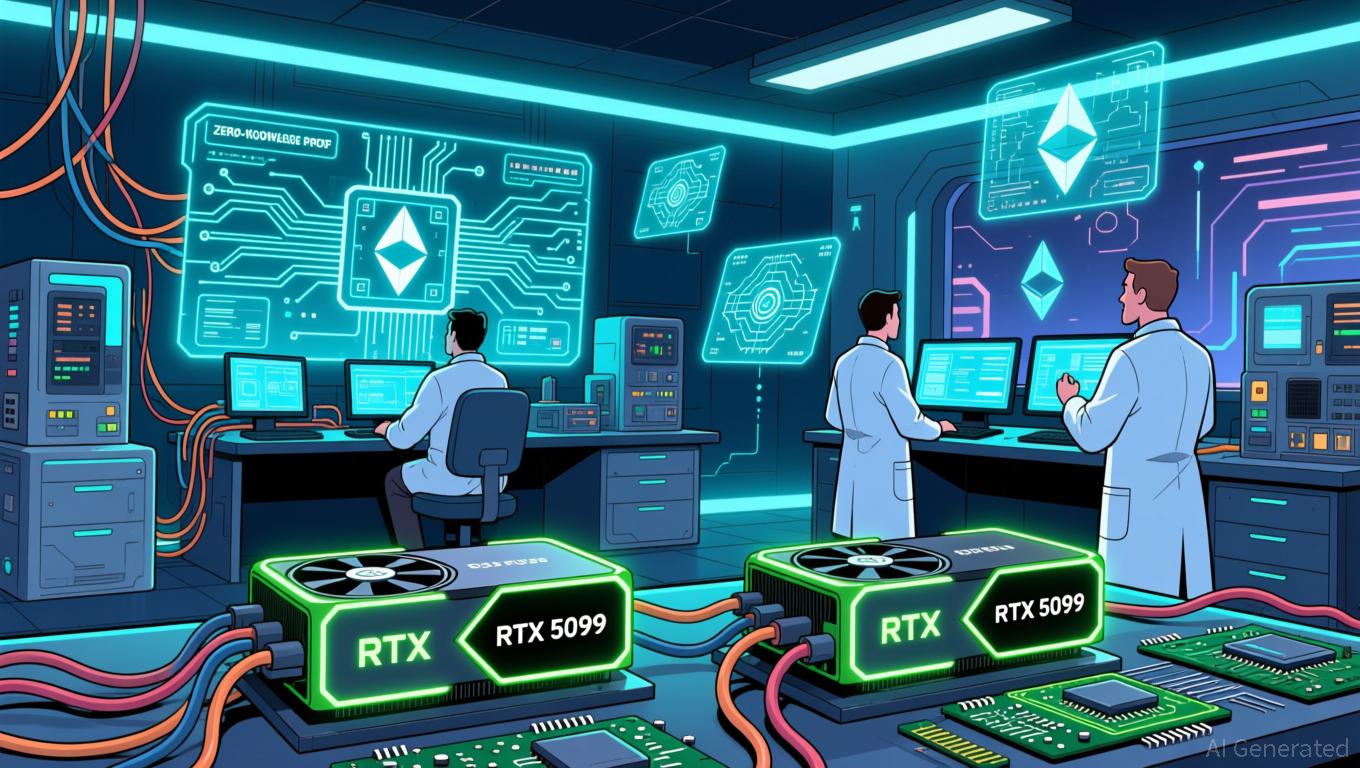

Ethereum Updates: Consumer Graphics Cards Drive Cost-Effective and Decentralized Ethereum Scaling

- zkSync's Airbender prover achieved L1 block proofs using two RTX 5090 GPUs, praised by Vitalik Buterin as a "huge milestone" for Ethereum's scalability. - The breakthrough enables "gigagas L1" expansion, potentially reducing fees and enabling near-zero L2 costs through consumer-grade hardware accessibility. - Succinct's SP1 Hypercube demonstrated 99.7% real-time L1 proving under 12 seconds with 16 RTX 5090s, advancing ZK tech alongside zkSync's progress. - Buterin cautioned against over-optimism, noting

Ethereum has made a major stride in its quest for scalability, as zkSync's Airbender prover

Justin Drake, a researcher at the Ethereum Foundation, pointed out that this could pave the way for "gigagas L1," referring to a substantial boost in Ethereum’s gas limit. This would enable more transactions per block, easing congestion and driving down fees throughout the network.

While Vitalik Buterin celebrated the achievement, he also urged caution. He observed that proving times can fluctuate by as much as 60-fold between typical and worst-case blocks, highlighting the importance of robust solutions. He

The surge in

Together, these technological leaps mark a crucial phase in Ethereum’s scaling journey. Although challenges like worst-case proving times remain, the ability to run ZK proofs on consumer-grade hardware brings Ethereum closer to decentralized, low-cost block validation. As Ethproofs Day gathers innovators to showcase these breakthroughs, Ethereum is poised to strengthen its reputation as a scalable and accessible blockchain platform.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why is MUTM's DeFi approach drawing in $18.9 million and 18,000 investors in 2025

- Mutuum Finance (MUTM) has raised $18.9M from 18,200 investors via a 250% presale price surge to $0.035 in Phase 6. - Its dual-lending model combines peer-to-contract and peer-to-peer mechanisms to optimize liquidity and capital efficiency. - Phase 6 nearing 99% completion highlights demand for MUTM's automated, intermediary-free lending via Ethereum-based smart contracts. - The project plans Q4 2025 launch of its public lending protocol on Sepolia testnet, emphasizing transparent decentralized ownership.

Global authorities suspend the growth of Biometric Blockchain due to worries about data privacy

- Worldcoin (WLD) fell 14% amid regulatory crackdowns, token unlocks, and market weakness, outperforming crypto's 9% decline. - Colombia, Philippines, and Thailand ordered operations halted and biometric data deleted over privacy concerns. - 37M WLD tokens ($25M) unlocked recently, worsening sell pressure as price consolidates near $0.63 resistance. - Analysts predict $0.75–$0.85 by 2025 if regulations clarify, but warn of potential drops to $0.26 amid unresolved compliance risks. - Project's viability hin

Bitcoin News Update: Aave's ETHLend 2.0 Disrupts DeFi's Dependence on Wrapped Tokens by Introducing Native Bitcoin

- Aave founder Stani Kulechov announced ETHLend 2.0's 2026 relaunch using native Bitcoin as collateral, diverging from wrapped tokens. - The hybrid P2P-liquidity pool model aims to enhance DeFi efficiency while reducing synthetic asset reliance through cross-chain BTC integration. - This revival aligns with growing institutional demand for non-wrapped BTC and could restore utility for the legacy LEND token. - Despite bearish market conditions, the move signals confidence in Bitcoin's foundational role for

The Rapid Rise of ZK Technology and What It Means for Cryptocurrency Markets

- ZK proof ecosystems saw 2025 breakthroughs in scalability, institutional adoption, and on-chain activity, reshaping blockchain infrastructure and crypto markets. - Projects like zkSync Era (27M+ monthly txns) and StarkNet (tripled TVL) demonstrated ZK-rollups' capacity to handle 15,000+ TPS, accelerating Ethereum's Layer 2 dominance. - Institutional giants including Deutsche Bank , Sony , and Nike integrated ZKP solutions for compliance, with Polygon securing $1B+ in ZKP development funding. - ZKP market