Global authorities suspend the growth of Biometric Blockchain due to worries about data privacy

- Worldcoin (WLD) fell 14% amid regulatory crackdowns, token unlocks, and market weakness, outperforming crypto's 9% decline. - Colombia, Philippines, and Thailand ordered operations halted and biometric data deleted over privacy concerns. - 37M WLD tokens ($25M) unlocked recently, worsening sell pressure as price consolidates near $0.63 resistance. - Analysts predict $0.75–$0.85 by 2025 if regulations clarify, but warn of potential drops to $0.26 amid unresolved compliance risks. - Project's viability hin

Worldcoin (WLD) experienced a steep 14% drop in a single day as global regulatory pressures mounted, token unlocks increased, and the broader market weakened, dealing a notable blow to the biometric-identity blockchain initiative. This rapid decline, which surpassed the overall crypto market’s 9% fall, came after a series of regulatory measures targeting the project’s data handling and business model. Authorities in Colombia, the Philippines, and Thailand all issued cease-and-desist orders,

These regulatory interventions have added to existing structural challenges. In recent weeks, more than 37 million

Forecasts for WLD’s price are varied, reflecting the clash between short-term negative factors and the potential for future growth.

The project’s future will depend on how well it can address regulatory concerns and prove real-world value for its token. For now, investors should keep an eye on token unlock timelines, regulatory updates, and on-chain adoption as key indicators. As one expert put it, “Worldcoin’s future depends less on speculation and more on its ability to scale compliant onboarding and turn verified users into real economic activity.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Bitcoin Declines While Altcoins Show Strength: Different Trends Suggest Market Recovery

- Bitcoin's prolonged slump below $90,000 contrasts with altcoin resilience as ETF outflows and fading Fed rate-cut hopes drive market correction. - On-chain data shows retail capitulation and subdued whale activity, historically signaling potential rebounds amid oversold technical indicators. - Institutional adoption and tokenized assets sustain long-term crypto optimism despite short-term volatility and unrealized losses in digital treasuries. - Diverging investor behavior highlights altcoin utility-driv

KITE's Price Movement After Listing and Institutional Perspectives: Managing Immediate Fluctuations and Sustained Worth in AI-Powered Real Estate

- KITE's post-IPO volatility reflects retail sector fragility and AI-driven industrial real estate opportunities amid macroeconomic headwinds. - Q3 2025 earnings missed forecasts (-$0.07 EPS, $205M revenue) as rate cuts and OBBBA fiscal impacts amplified REIT sensitivity to market shocks. - Strategic divestments of noncore retail assets and 7.4% dividend growth signal portfolio optimization, though opaque institutional ownership complicates sentiment analysis. - Industrial real estate's AI-powered logistic

The MMT Token TGE: A Fresh Driving Force in the Web3 Investment Arena

- MMT Token's 2025 TGE launched a hybrid tokenomics model combining liquidity provision and RWA integration, sparking Web3 debate. - Binance listing and airdrop drove 3,880% initial surge but 86.6% 48-hour crash, exposing volatility risks and $114M liquidations. - Tokenomics allocates 42.72% to community, 24.78% to investors, with 80% supply locked until 2026, yet early unlocks triggered $24. 3M sell-offs. - Institutional adoption grew 84.7% post-CLARITY/MiCA 2.0, but 34.6% weekly price drop highlights fra

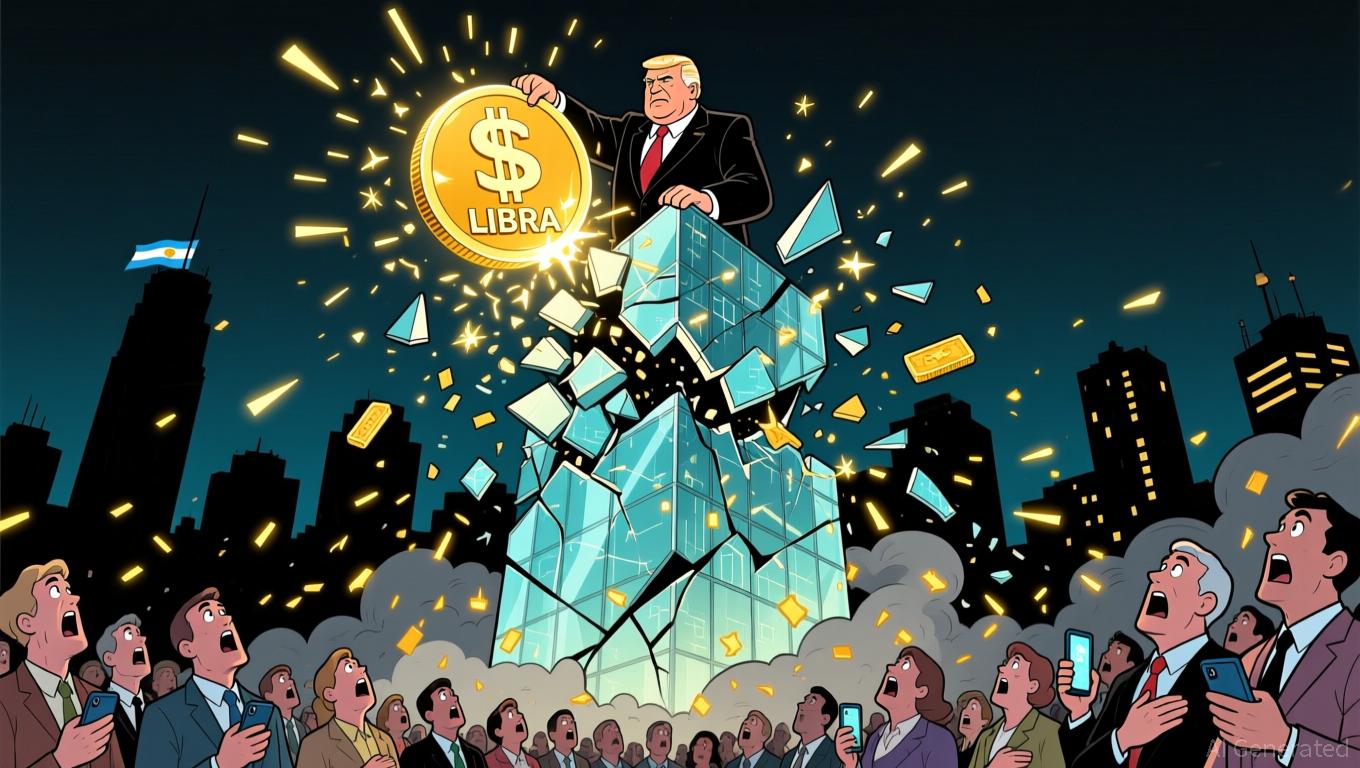

Milei's $LIBRA Endorsement Reportedly Led to $100M Cryptocurrency Crash, Investigation Suggested

- Argentine President Javier Milei faces investigation for promoting $LIBRA, a collapsed crypto linked to $100M+ investor losses. - Congressional report claims his endorsement boosted the token's visibility, enabling a "rug pull" and draining liquidity pools. - The probe also ties Milei to prior crypto projects and corruption allegations involving his sister at the National Disability Agency. - Legal actions freeze assets of $LIBRA organizers, while political challenges persist amid a new Congress dominate