Ethereum ‘Window of Weakness’ To Last Three To Four More Weeks, According to Benjamin Cowen – Here’s What He Means

Crypto analyst Benjamin Cowen says Ethereum ( ETH ) is entering a “window of weakness” that may extend into December as the asset struggles to hold key levels against both the US dollar and Bitcoin ( BTC ).

In his latest update, Cowen says ETH continues to oscillate in a familiar range between $4,900 and $2,900.

He notes that the pattern resembles the last cycle when ETH rallied near $4,900 before breaking down to $2,100.

“Now $2,100 is also an important level because $2,100 for ETH would be basically back at the low it had in June.”

He adds that a move to $2,100 was not his base case earlier in the year, but becomes more likely if Ethereum loses its current support at around $2,900.

Cowen expects the broader weakness to last another three to four weeks due to the seasonal behavior of ETH’s valuation relative to Bitcoin. He points to repeated turning points for ETH Bitcoin in December across multiple cycles including 2015, 2016, 2017, 2018, 2019 and 2020.

He says ETH/BTC bottoms this cycle near the same level as last cycle, rallies to a similar area and then drops back toward 0.0029 BTC.

“I’m looking for ETH Bitcoin to continue to bleed into December.”

Bitcoin is trading at $87,462 at time of writing, while ETH is at $2,885.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti

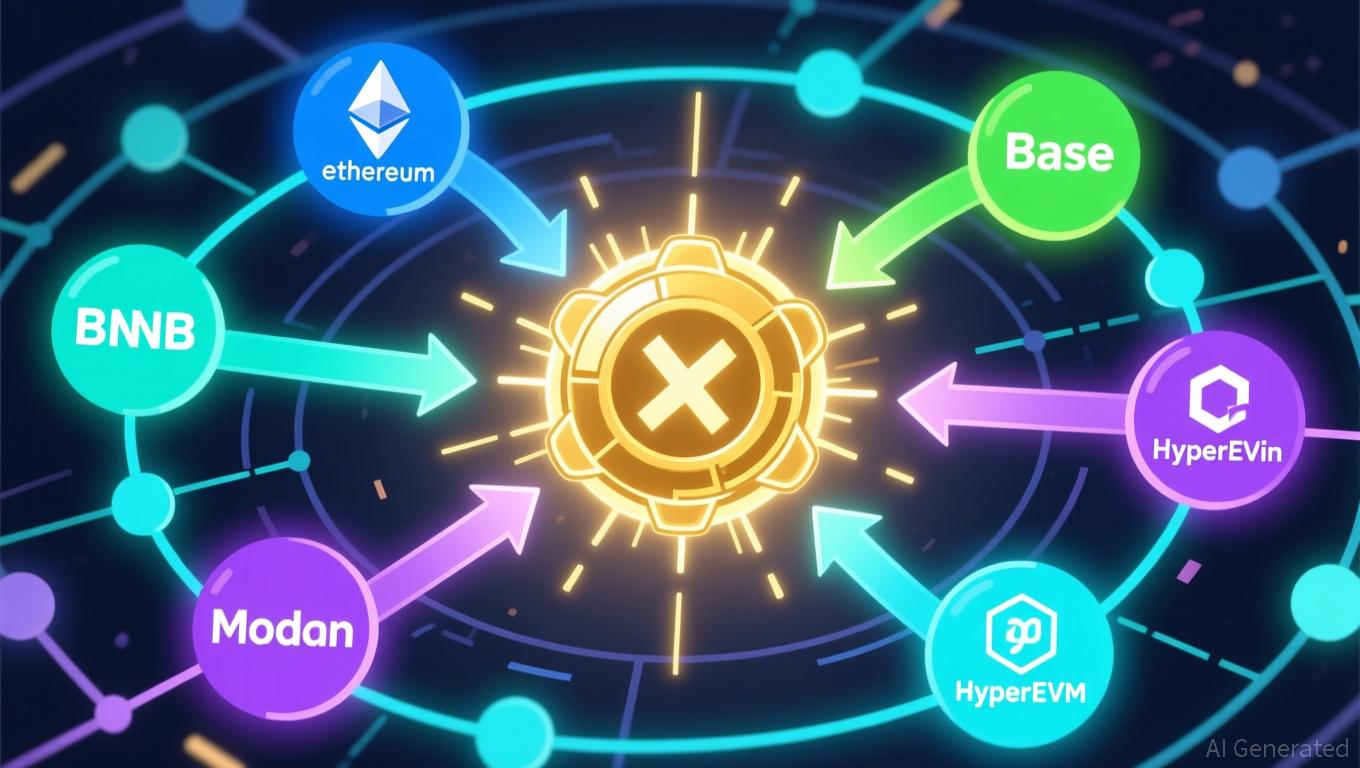

Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to

Bitcoin News Update: Bitcoin's Plunge Signals Trump's Diminishing Influence, as Crypto Connections Weaken Amid MAGA's Downturn

- Nobel laureate Paul Krugman links Bitcoin's $1 trillion crash to Trump's waning political influence and crypto-linked wealth decline. - Trump family's crypto assets lost $1 billion in value, with Eric Trump's ABTC shares down 50% and memecoins losing 90% of peak value. - Despite losses, complex financial structures like Alt5 Sigma holdings buffer the family, while Krugman ties crypto turmoil to fractured MAGA support. - Trump's pro-crypto policies face scrutiny as Bitcoin's $40k drop undermines his econo