Bitcoin Whale Wallets Surge to Four-Month High as Retail Investors Exit

Large Bitcoin holders have increased their positions to a four-month high of 1,384 wallets holding at least 1,000 BTC. At the same time, retail investors with 1 BTC or less dropped to an annual low of 977,420. This divergence highlights a recurring pattern: experienced whales accumulate during downturns, while smaller holders exit in fear. Whale

Large Bitcoin holders have increased their positions to a four-month high of 1,384 wallets holding at least 1,000 BTC. At the same time, retail investors with 1 BTC or less dropped to an annual low of 977,420.

This divergence highlights a recurring pattern: experienced whales accumulate during downturns, while smaller holders exit in fear.

Whale Accumulation Accelerates During Market Correction

According to Glassnode data, wallets holding at least 1,000 BTC rose to 1,384 this week from 1,354 three weeks ago—a 2.2% increase. This count is the highest for large holder wallets in four months, suggesting renewed confidence among institutional and high-net-worth investors despite turbulence in the broader market.

Meanwhile, wallets containing 1 BTC or less declined to 977,420—down from 980,577 in late October. This marks the lowest level of smallholder participation in a year. It follows the typical pattern of less experienced investors capitulating during price corrections.

Bitcoin has endured its third-largest drawdown of the current cycle, dropping over 25% from its all-time high six weeks ago. Bitcoin opened on Wednesday near $92,600, and was traded in a choppy range between $92,200 and $92,800 throughout the morning session in Asia, displaying typical volatility as traders navigated between support and resistance.

Historical trends suggest that whale accumulation amid retail selling often precedes stabilization. Currently, just 7.6% of the short-term holder supply is in profit—a level commonly seen at cycle lows. In addition, the STH Realized Profit-Loss Ratio has dropped below 0.20, another metric that often aligns with market bottoms.

Capital Rotating within Crypto Markets

The Crypto Fear & Greed Index stays at 11 out of 100 for two days, reflecting deep fear across the market. Social media sentiment has become strongly negative. Traders share memes about returning to traditional jobs and express doubts about a quick recovery.

According to Coinglass’s Bitcoin Long/Short Ratio Chart, the overall trend shows persistent bearish pressure, with traders repeatedly positioning for price declines. However, sentiment occasionally swung back toward optimism before returning to predominantly negative expectations.

Some market observers see this extreme pessimism as a contrarian signal. Sentiment is compressed, leverage is lower in derivatives markets, and whale accumulation persists. According to Bitfinex’s on-chain analysis, selling exhaustion is apparent, and capital is rotating within crypto markets rather than leaving altogether.

Open Interest for BTC/USDT sits around 100K, showing stronger trader participation even as prices fall. This scenario—rising Open Interest and falling prices—usually signals bearish sentiment, possibly driven by aggressive shorting. However, the pace of sales and realized losses has begun to stabilize, suggesting a possible transition to consolidation.

Bob Diamond, the former Barclays CEO and now head of Atlas Merchant Capital, views the recent turmoil in global asset markets as a healthy correction—not the start of a full-blown bear market. Diamond points out that investors are still working out how to price risk assets amid rapid technological shifts.

As Bitcoin searches for a bottom in late 2025, the split between whale accumulation and retail selling forms a classic market structure. The coming weeks should reveal whether institutional confidence is enough to stabilize the market or if fear continues to rule trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti

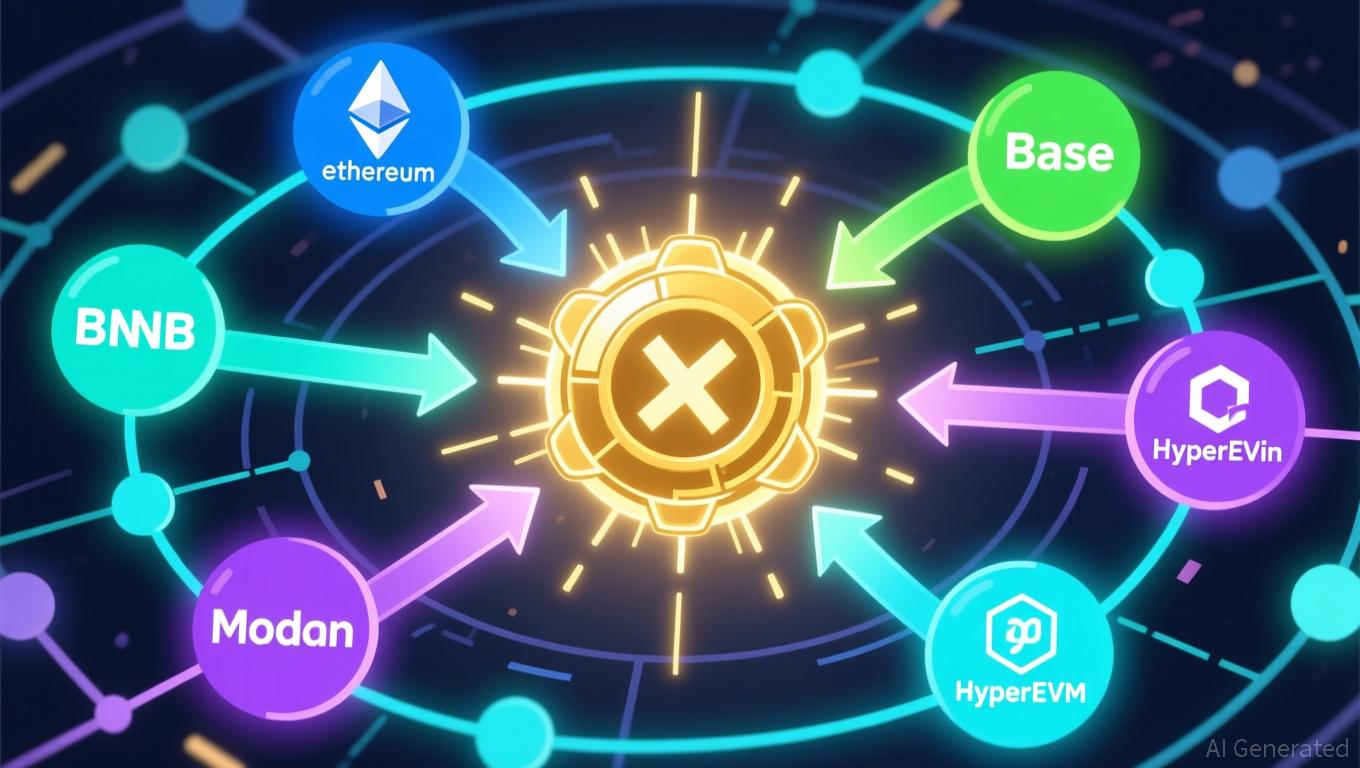

Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to

Bitcoin News Update: Bitcoin's Plunge Signals Trump's Diminishing Influence, as Crypto Connections Weaken Amid MAGA's Downturn

- Nobel laureate Paul Krugman links Bitcoin's $1 trillion crash to Trump's waning political influence and crypto-linked wealth decline. - Trump family's crypto assets lost $1 billion in value, with Eric Trump's ABTC shares down 50% and memecoins losing 90% of peak value. - Despite losses, complex financial structures like Alt5 Sigma holdings buffer the family, while Krugman ties crypto turmoil to fractured MAGA support. - Trump's pro-crypto policies face scrutiny as Bitcoin's $40k drop undermines his econo