Death Cross Confirmed: Is Bitcoin Bottoming or About to Crash?

Bitcoin's death cross signals volatility, with data pointing to mixed short-term and strong medium-term trends.

The Bitcoin (BTC) price action triggered a Death Cross on Sunday, November 16, after its 50-day moving average dipped below the 200-day moving average.

Historically considered a bearish technical signal, the event has sparked fresh debate among traders and analysts. The key question: does this mark a local bottom, or is a further drop looming?

What Is a Death Cross and Why It Matters Now for Bitcoin Price

In technical analysis, a Death Cross occurs when short-term price momentum falls below long-term trends, signaling potential downward pressure. As of this writing, Bitcoin trades around $93,646, after slipping below the $94,000 threshold for the first time since May 5.

Bitcoin (BTC) Price Performance. Source:

TradingView

Bitcoin (BTC) Price Performance. Source:

TradingView

Market sentiment is extremely bearish, with the Fear & Greed Index plunging to 10, indicating extreme fear. Meanwhile, whale selling and spot ETF outflows have accelerated recent downward moves.

Amidst these negative sentiments and fear of further downside, analysts say that a Death Cross does not automatically predict crashes.

Historical data from 2014 to 2025 shows mixed short-term outcomes but strong medium- to long-term rebounds in many cycles.

Historical Performance: Short-Term Losses, Medium-Term Gains

Data shared by Mario Nawfal and on-chain analysts indicates:

- 1–3 weeks post-cross: Returns are nearly 50/50 between gains and losses; median returns slightly positive (~0.25–2.35%).

- 2–3 months post-cross: Average gains jump to 15–26%, suggesting a potential recovery if historical patterns hold.

- 12 months later: Outcomes vary widely; some cycles delivered 85%+ gains, others experienced severe drawdowns, depending on the macro context.

Bitcoin Price After Death Cross. Source:

Mario Nawfal on X (Twitter)

Bitcoin Price After Death Cross. Source:

Mario Nawfal on X (Twitter)

Benjamin Cowen and Rekt Fencer argue that previous Death Crosses have often marked local lows, rather than market tops. The timing of the next bounce could be critical. If BTC does not rally within 7 days, analysts warn another leg down could precede a larger recovery.

Bitcoin had a death cross today.Note that prior death crosses marked local lows in the market.Of course, when the cycle is over, the death cross rally fails.The time for Bitcoin to bounce if the cycle is not over would be starting within the next week.If no bounce occurs…

— Benjamin Cowen (@intocryptoverse) November 16, 2025

What’s Next for Bitcoin Investors? Key Levels and Market Signals

Technical and macro indicators highlight crucial thresholds:

- Support range: $60,000–$70,000, a potential floor if selling pressure intensifies.

- Bullish confirmation: Reclaiming the 200-day moving average as support could signal renewed upward momentum.

Analyst Brett notes that the 50-week MA remains a more decisive long-term indicator than the Death Cross alone.

Bitcoin's Death Cross vs. 50w MAThe death cross is confirmed, and unless Bitcoin pumps to $103,000 within 12 hours, the close below the 50w MA will also be confirmed.The good (bull case): The death cross is typically a local bottom indicator.The bad (bear case): We're…

— ₿rett (@brett_eth) November 16, 2025

Historical cycles indicate that Death Crosses during bull markets often precede rallies toward new all-time highs. Conversely, those during bear markets are typically short-lived.

Nonetheless, investors should monitor short-term price action closely because historical data implies:

- A bounce within a week could signal the bull cycle remains intact.

- Failure to bounce may trigger another decline, creating a macro lower high before a larger rally.

Meanwhile, medium-term projections indicate a 15–27% recovery gain over the next 2–3 months if BTC follows median historical behavior.

The long-term upside remains plausible, but variability is high, highlighting the importance of combining technical, on-chain, and macro analysis for informed strategic decisions.

While the Death Cross signals caution, history shows that Bitcoin often rebounds after similar events. Traders should remain alert, watch key support levels, and be prepared for short-term volatility, even as potential medium- and long-term gains remain within reach.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti

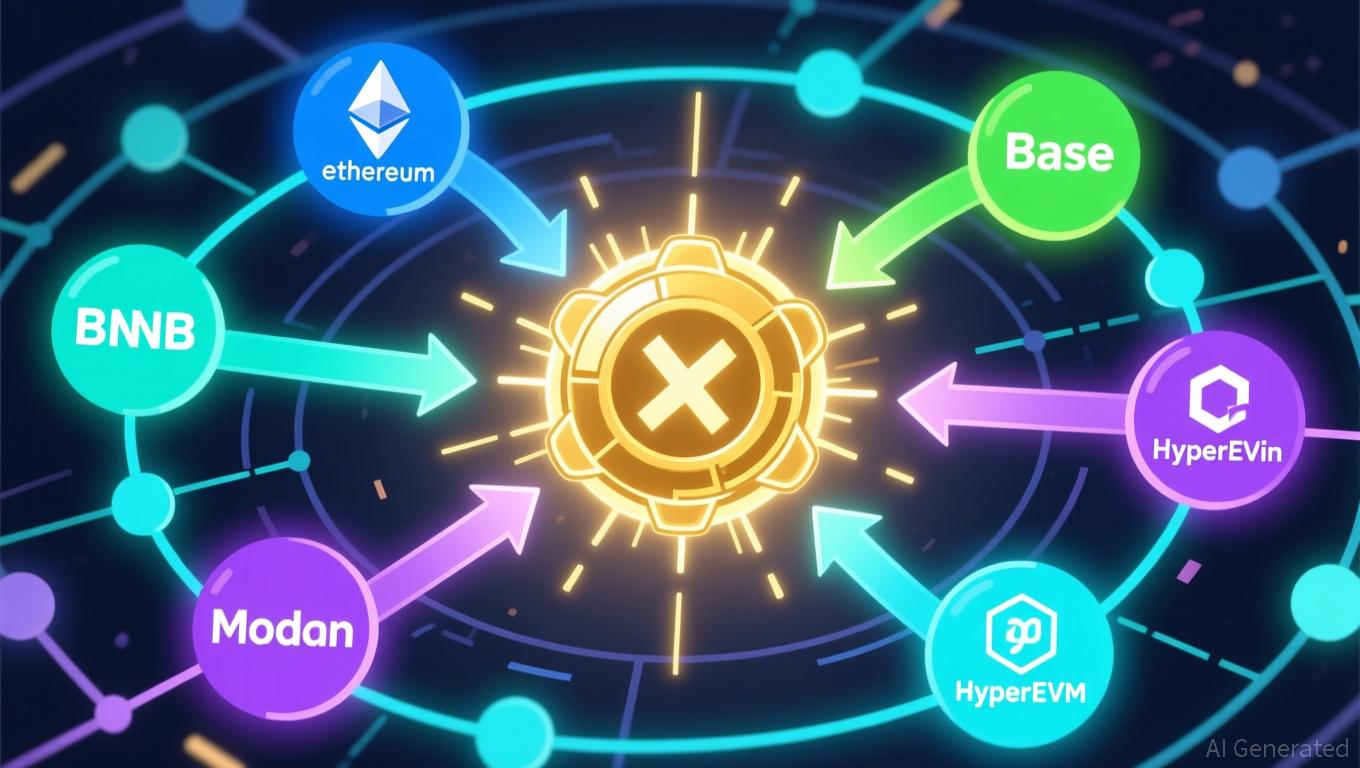

Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to

Bitcoin News Update: Bitcoin's Plunge Signals Trump's Diminishing Influence, as Crypto Connections Weaken Amid MAGA's Downturn

- Nobel laureate Paul Krugman links Bitcoin's $1 trillion crash to Trump's waning political influence and crypto-linked wealth decline. - Trump family's crypto assets lost $1 billion in value, with Eric Trump's ABTC shares down 50% and memecoins losing 90% of peak value. - Despite losses, complex financial structures like Alt5 Sigma holdings buffer the family, while Krugman ties crypto turmoil to fractured MAGA support. - Trump's pro-crypto policies face scrutiny as Bitcoin's $40k drop undermines his econo