DTCC Lists Canary’s Staked SEI ETF as Market Eyes SEC Decision

Canary’s Staked SEI ETF has entered the DTCC pipeline, marking real progress toward institutional access to SEI even as the network faces contrasting trends in net flows and on-chain activity.

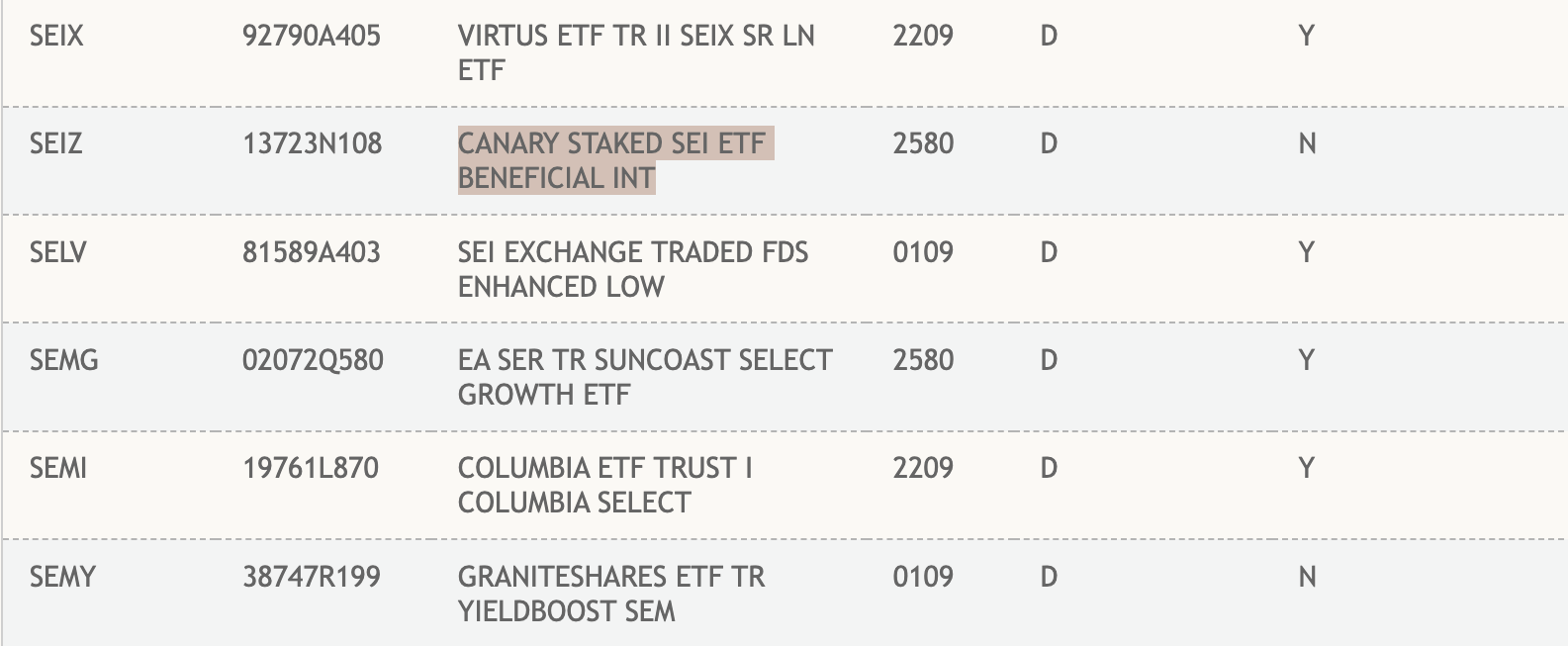

The Canary Staked SEI exchange-traded fund ETF has been officially registered on the Depository Trust & Clearing Corporation (DTCC) platform.

The listing does not constitute approval by the US Securities and Exchange Commission (SEC). Nonetheless, it is a significant operational milestone and is often viewed as a positive sign.

Canary’s Staked SEI ETF Joins DTCC List

According to DTCC records, the product currently appears under the “active and pre-launch” category. This classification indicates thatETF is technically set up for future electronic trading and clearing, pending approval by the SEC.

Canary’s Staked SEI ETF on the DTCC List. Source:

DTCC List of ETFs Active and Pre-Launch

Canary’s Staked SEI ETF on the DTCC List. Source:

DTCC List of ETFs Active and Pre-Launch

Importantly, the ETF cannot yet be created or redeemed, meaning it remains non-operational despite its inclusion in DTCC’s system. However, the listing is a standard step in the ETF deployment process, often interpreted by market participants as a sign of issuer confidence.

“DTCC handles the behind-the-scenes clearing and settling for most US stocks and ETFs. Meaning this puts the SEI ETF into the usual pipeline before it shows up on brokerage platforms. Once the market sentiment turns around, SEI is going to be a big runner,” an analyst noted.

Canary Capital filed an S-1 earlier this year to introduce a staked SEI ETF. At the time, the SEC maintained a cautious stance toward staking mechanisms within exchange-traded products. The regulatory outlook has shifted now.

BeInCrypto reported that the US Treasury and Internal Revenue Service issued Revenue Procedure 2025-31, establishing a clear safe-harbor framework for crypto ETFs and trusts wishing to engage in staking and distribute rewards to investors.

This procedure mandates strict conditions, including holding only one type of digital asset plus cash, using qualified custodians for key management, maintaining SEC-approved liquidity policies, and limiting activities to holding, staking, and redeeming assets without discretionary trading.

Moreover, these guidelines resolve prior tax ambiguities. This could potentially pave the way for SEC approval of staking-inclusive products, such as the Canary’s SEI ETF.

Besides Canary, Rex-Osprey has also filed for a staked SEI ETF. Lastly, 21Shares is seeking SEC approval for an ETF focused on the SEI. This reflects broader institutional interest in gaining exposure to the Sei Network.

SEI Climbs in Net Flows Even as TVL Suffers

Meanwhile, this comes as Sei experiences strong capital movement. According to Artemis Analytics, the network currently ranks second in net flows over the past 24 hours, with inflows making up the majority. This trend suggests that investors are rotating into SEI despite broader market volatility.

Analysts are also increasingly optimistic about SEI’s price potential. ZAYK Charts noted that the altcoin is completing another falling-wedge cycle, arguing that a breakout could trigger a 100–150% rally.

$SEI is holding on to this major support level.Expecting a strong bounce here! pic.twitter.com/6Uqg0woJAN

— Mister Crypto (@misterrcrypto) November 13, 2025

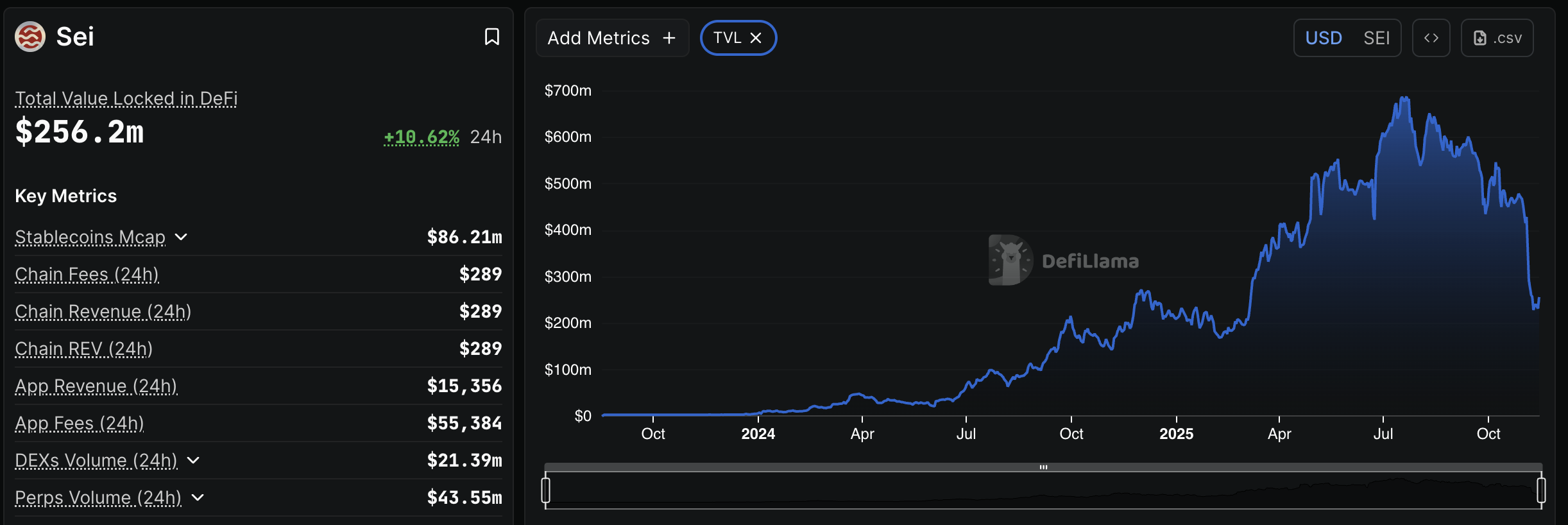

However, on-chain data paints a more complex picture.Figures from DefiLlama reveal a steep contraction in the network’s total value locked (TVL) during November, representing the largest decline in nearly two years.

Approximately 1 billion SEI tokens have been unstaked, reflecting an accelerated rate of user exits from the ecosystem.

Sei TVL Dip in November. Source:

DefiLlama

Sei TVL Dip in November. Source:

DefiLlama

Thus, for now, the listing serves as a procedural but meaningful signal that the pathway toward institutional SEI exposure is beginning to take shape—against a backdrop of both recovering inflows and lingering challenges within the network.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti

Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to

Bitcoin News Update: Bitcoin's Plunge Signals Trump's Diminishing Influence, as Crypto Connections Weaken Amid MAGA's Downturn

- Nobel laureate Paul Krugman links Bitcoin's $1 trillion crash to Trump's waning political influence and crypto-linked wealth decline. - Trump family's crypto assets lost $1 billion in value, with Eric Trump's ABTC shares down 50% and memecoins losing 90% of peak value. - Despite losses, complex financial structures like Alt5 Sigma holdings buffer the family, while Krugman ties crypto turmoil to fractured MAGA support. - Trump's pro-crypto policies face scrutiny as Bitcoin's $40k drop undermines his econo