XRP Update: Digitap's Practical Applications Put XRP's Delayed Ambitions to the Test

- Digitap ($TAP) raised $1.4M in November 2025, outpacing rivals like Bitcoin Hyper and Pepenode with an 80% early investor discount. - The project combines crypto and fiat banking via a live app, Visa cards, and deflationary tokenomics, positioning it as XRP's real-world competitor. - $TAP's fixed 2B token supply and transaction-burning model create scarcity, with analysts projecting 50x-70x price growth by late 2026. - Digitap's 124% APR staking rewards and privacy-focused features like offshore-shielded

Digitap ($TAP) has quickly become a standout in the November 2025 crypto scene, amassing more than $1.4 million and surpassing competitors such as

The rapid rise of this project has shifted investor attitudes, especially among

Digitap’s token structure further sets it apart. With a capped supply of 2 billion tokens and a deflationary mechanism that burns tokens with every transaction, $TAP’s rarity is systematically maintained, as noted by

When compared to others such as BlockDAG ($434 million raised) and Pepenode (which emphasizes meme-based gamification), Digitap’s practical value stands out. While BlockDAG is centered on technical scalability and Pepenode on speculative GameFi, Digitap’s functioning app and privacy-first features—including offshore-protected accounts and AI-powered low-fee remittances—tackle real financial challenges. The project’s $1.3 million achievement and 124% APR staking incentives have heightened investor FOMO.

As Digitap moves closer to widespread adoption, its capacity to transform conventional banking has drawn parallels to XRP’s unrealized goals. With nearly 100 million tokens sold and the price soon increasing to $0.0297, the opportunity to participate is shrinking. Analysts believe that $TAP’s combination of practical use, deflationary economics, and real-world application positions it as a top contender for 100x growth in 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Regulatory Changes and Unprecedented Staking Returns Drive Institutional Growth for Ethereum

- Ethereum's institutional adoption accelerates due to SEC's in-kind ETF approval, boosting market efficiency and participation. - SharpLink and Bit Digital report record staking yields (up to 2.93%), highlighting Ethereum's "productive" treasury asset advantage over Bitcoin . - Justin Sun's $154M ETH staking via Lido signals growing confidence in Ethereum's infrastructure despite liquid staking centralization concerns. - Regulatory tailwinds and $12.5M ETH ETF inflows counterbalance price declines, with t

Vitalik Buterin Introduces New ZK Technology: What It Means for Ethereum's Development

- Vitalik Buterin leads Ethereum’s shift to ZK proofs, targeting modexp removal and GKR protocol integration to boost scalability and privacy. - Modexp precompile’s 50x computational burden on ZK-EVM proofs will be replaced by standard EVM code, prioritizing long-term efficiency over short-term gas costs. - GKR protocol enables 2M Poseidon2 hashes/sec on consumer hardware, accelerating verification and enhancing quantum resistance for Ethereum’s "Lean Ethereum" vision. - ZKsync’s 150% token surge and Citib

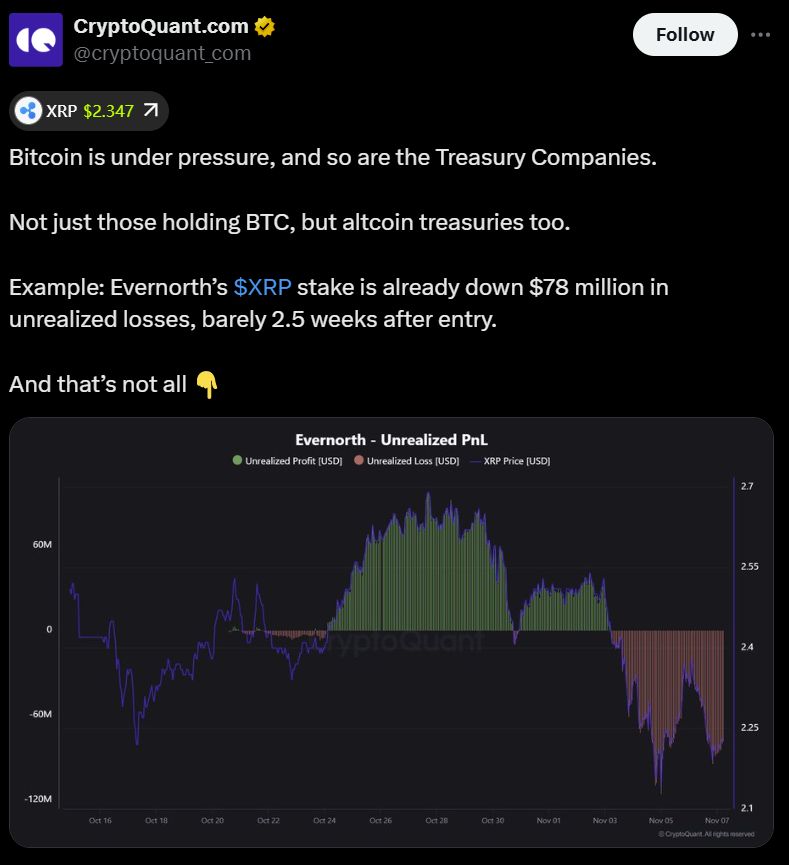

Evernorth’s unrealized XRP losses expose mounting pressure on DATs: CryptoQuant

Marina Protocol and Audiera Ally to Bring AI-Powered Music and Dance to Web3