Evernorth’s unrealized XRP losses expose mounting pressure on DATs: CryptoQuant

The month-long slide in crypto prices hasn’t just hit major assets like Bitcoin (BTC) and Ether (ETH) — it’s also dealing heavy losses to digital asset treasury companies that built their business models around accumulating crypto on their balance sheets.

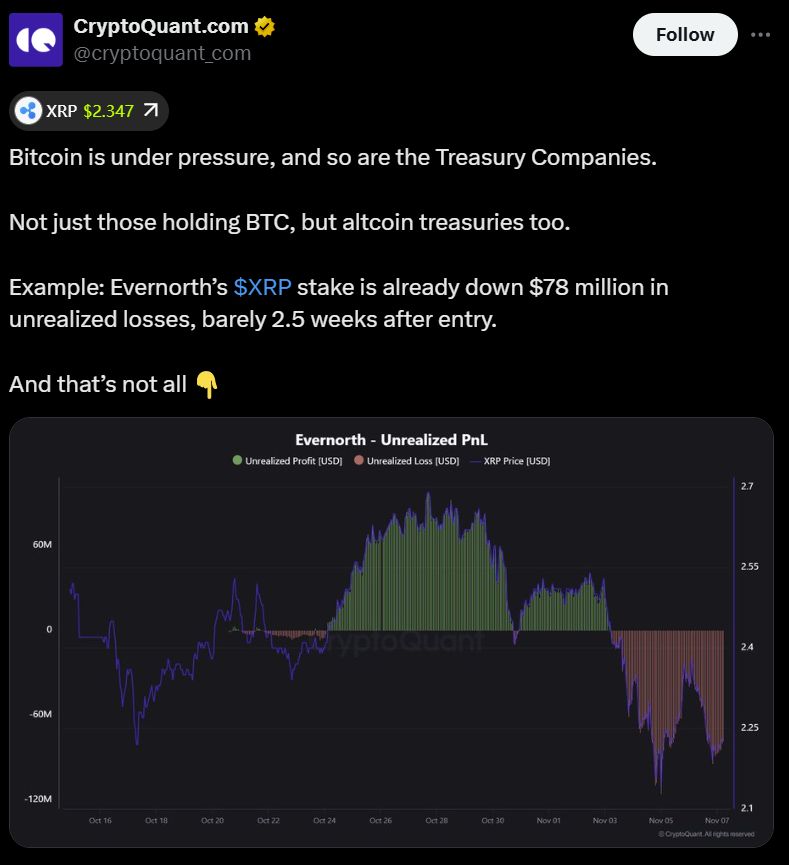

That’s one of the key takeaways from a recent social media analysis by onchain data company CryptoQuant, which cited XRP-focused treasury company Evernorth as a prime example of the risks in this sector.

Evernorth has reportedly seen unrealized losses of about $78 million on its XRP position, mere weeks after acquiring the asset.

The pullback has also battered shares of Strategy (MSTR), the original Bitcoin treasury play. The company’s stock has dropped by more than 26% over the past month, as Bitcoin’s price has slumped, according to Google Finance data. CryptoQuant noted a 53% drop in MSTR shares from their all-time high.

However, Strategy still holds a sizable unrealized gain on its Bitcoin reserves, with an average cost basis of roughly $74,000 per BTC, according to BitcoinTreasuries.NET.

Meanwhile, BitMine, the largest Ether-holding corporation, is now sitting on approximately $2.1 billion in unrealized losses tied to its Ether reserves, according to CryptoQuant.

BitMine currently holds nearly 3.4 million ETH, having acquired more than 565,000 over the past month, according to industry data.

Digital asset treasury companies: Echoes of the dot-com bubble

Digital asset treasury companies, or DATs, have come under mounting valuation pressure in recent months, with analysts cautioning that their market worth is increasingly tied to the performance of their underlying crypto holdings.

Some analysts, including those at venture capital firm Breed, argue that only the strongest players will endure, noting that Bitcoin-focused treasuries may be best positioned to avoid a potential “death spiral.” The risk, they say, stems from a collapse in the companies’ market net asset value (mNAV) — a metric comparing enterprise value to the market value of their cryptocurrency investments.

Others have compared the rise of digital asset treasury companies to the dot-com boom and bust of the early 2000s, a period driven by long-term visionaries and innovators, as well as opportunists chasing quick gains.

Ray Youssef, founder of peer-to-peer lending platform NoOnes, predicted that most digital asset treasuries will ultimately fade out or collapse as market realities set in.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Latest Updates: ZEC Risks $5.65M—Stacked Gains Face Liquidation Threat

- A trader generated $5.65M in ZEC unrealized profits via pyramiding, leveraging Zcash's 400% surge to $586. - The strategy reinvested gains to expand 55,000 ZEC positions, exploiting ZEC's shielded pool and ZK tech adoption. - Whale-driven 5x leverage and $16M long liquidations highlight risks, with $450 support critical to avoid cascading losses. - Diverging institutional/retail flows and overbought RSI signal fragility, urging caution amid bullish Fibonacci targets.

Supreme Court Could Limit Trump Tariffs, Strengthening Congress’s Role in Trade Policy

- U.S. Supreme Court may strike down Trump's emergency tariffs via 7-2 ruling, with conservative justices joining liberals to curb executive overreach. - Ruling would reinforce "major questions doctrine," requiring congressional approval for policies with vast economic impacts like trade measures. - Invalidating tariffs could trigger $90B refunds, strain federal budgets, and reshape congressional-executive power dynamics in economic governance.

Rivian offers RJ Scaringe a revised compensation plan valued at as much as $5 billion

Stellar News Today: Crypto Presales Ignite 100x Buzz While MoonBull Climbs, TON and XLM Falter

- MoonBull (MOONBULL) surges to $550K in presale, seen as potential 100x play by 2025, driven by DeFi and AI analytics. - Toncoin (TON) and Stellar (XLM) decline amid skepticism toward centralized ecosystems and stagnant utility differentiation. - BlockDAG raises $435M via DAG architecture to challenge Layer 1 scalability, while stablecoins reshape monetary policy frameworks. - Presale projects like MoonBull and LivLive attract speculative capital, signaling investor shift toward innovation over establishe