Fed Left in the Dark as Government Shutdown Postpones Key Inflation Reports

- U.S. government shutdown delays critical September CPI data release to October 24, disrupting Federal Reserve policy planning and market stability. - Cryptocurrency markets react sharply: Ethereum ETFs see $145M outflows while Bitcoin ETFs show faster recovery amid heightened macroeconomic uncertainty. - Delay threatens 2026 Social Security COLA calculations and global confidence, with Canadian dollar and Japanese yen both showing negative impacts from disrupted U.S. economic governance. - Analysts warn

The postponement of crucial inflation statistics due to the U.S. government shutdown has unsettled financial markets and complicated the Federal Reserve’s policy outlook. The September Consumer Price Index (CPI) report, which was initially set for release on October 15, has been rescheduled to October 24, leaving both investors and policymakers in a state of uncertainty, as noted in a

The CPI, a central indicator of inflation, is critical for the Federal Reserve’s policy meeting scheduled for October 28-29. Projections suggest the September CPI will show a 3.1% annual increase—the highest since May 2024—according to a

The shutdown has also interrupted the collection of October CPI figures, raising the possibility of missing data in future reports, as pointed out by MarketMinute. This has added to market anxiety, with Ethereum currently at $3,973—a 0.5% daily increase but a 9.5% decline over the month, based on Coinotag’s earlier reporting.

The ripple effects of the delayed data extend beyond Wall Street. The Social Security Administration relies on the September CPI to set the 2026 cost-of-living adjustment (COLA), which is anticipated to be about 2.7%, according to CBS News. Advocacy organizations caution that if inflation surpasses this adjustment, retirees could feel increased financial strain. Meanwhile, the Federal Reserve’s ability to manage inflation hinges on reliable data, which remains uncertain due to the ongoing shutdown, MarketMinute analysts observed.

Globally, the delay has undermined confidence in U.S. economic leadership. The Canadian dollar slipped after President Donald Trump ended trade negotiations with Canada following a contentious advertisement using Reagan’s voice, further unsettling international markets, as reported in a

What’s next? The CPI data expected on October 24 may provide some short-term answers, but the real challenge will be how the Fed navigates a prolonged lack of economic data in the coming months. If the shutdown continues, the credibility of economic policy—and investor confidence—could deteriorate further. As one analyst remarked, “Without up-to-date data, the Fed is essentially operating in the dark, which could lead to greater mistakes in an already fragile economy,” a sentiment echoed in the MarketMinute commentary.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Major Institutions Invest Billions While Solana Boosts Its Scarcity Approach

- Solana developers propose reducing future SOL emissions by 22M tokens to accelerate disinflation, targeting 1.5% terminal inflation twice as fast. - Institutional adoption grows via staking-enabled ETFs like VanEck's and Bitwise's BSOL , creating dual-income streams through exposure and yield. - Despite $424M in BSOL assets, Solana's price fell below $140 support, with derivatives data signaling short-term selling pressure and crowded long positions. - Coinbase's Vector acquisition enhances Solana's inst

Bitcoin Latest Updates: Macroeconomic Factors and Earnings Challenges Drive 44% DeFi Downturn

- Market analysts predict a 44% correction in DeFi and crypto sectors due to macroeconomic risks, Fed policy uncertainty, and weak corporate earnings. - HIVE Digital faces scrutiny over Bitcoin holdings reduction and shareholder dilution, while Hyster-Yale reports Q3 losses amid industry margin pressures. - Data center infrastructure emerges as a growth outlier with $11.1B backlog and $320B 2030 market projection, though labor shortages and permitting delays persist. - Goldman Sachs adjusts energy sector o

Ethereum Updates Today: Institutional Confidence Faces Challenges Amid Ethereum's Price Fluctuations and Upcoming Upgrades

- Galaxy Digital's 7,098 ETH withdrawal from Binance raises concerns over Ethereum's institutional activity and market stability amid macroeconomic pressures. - ETH faces $993M long liquidation risk below $2,600 and $1.07B short liquidation risk above $2,900, highlighting leveraged position fragility. - Institutional staking inflows remain steady despite declining ETH futures open interest (-7% weekly) and reduced ETF net inflows ($10M vs. $65M in October). - Upcoming Dencun upgrade (EIP-4844) aims to redu

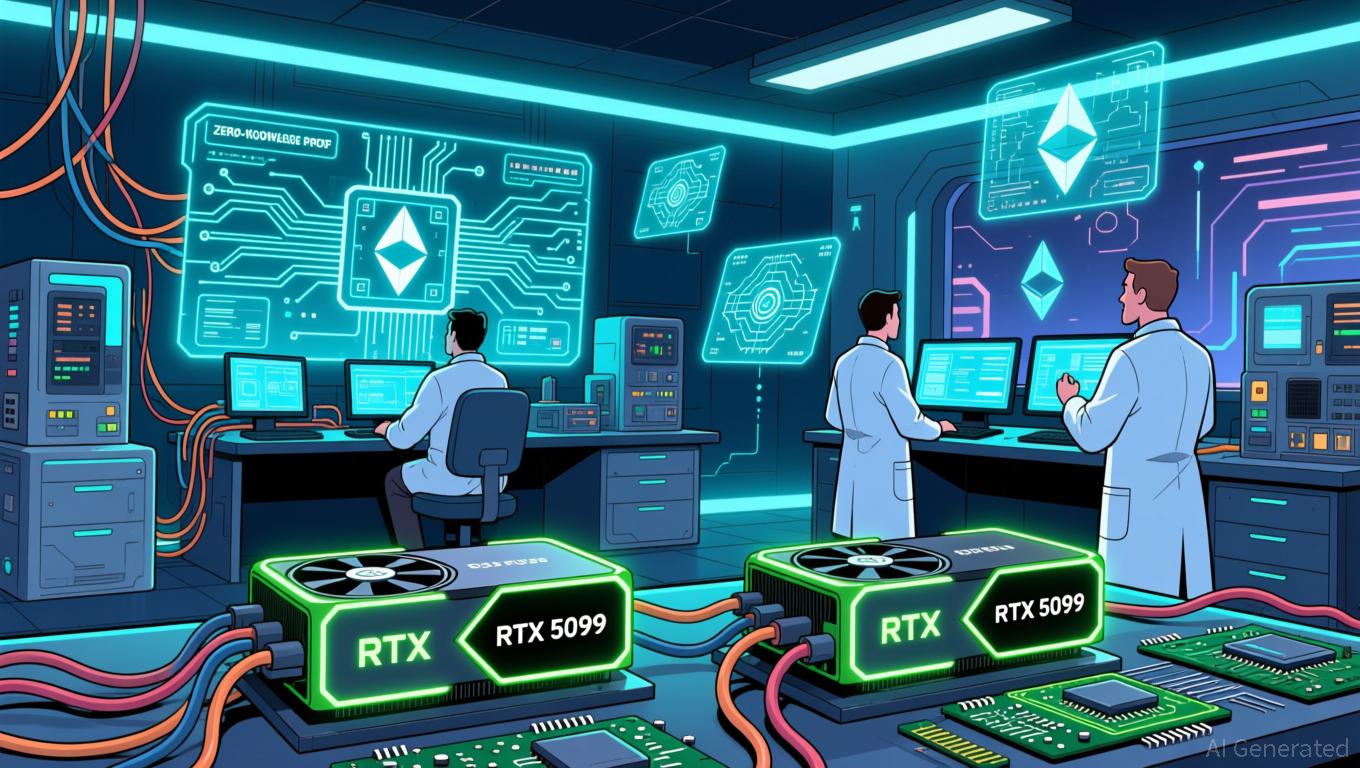

Ethereum Updates: Consumer Graphics Cards Drive Cost-Effective and Decentralized Ethereum Scaling

- zkSync's Airbender prover achieved L1 block proofs using two RTX 5090 GPUs, praised by Vitalik Buterin as a "huge milestone" for Ethereum's scalability. - The breakthrough enables "gigagas L1" expansion, potentially reducing fees and enabling near-zero L2 costs through consumer-grade hardware accessibility. - Succinct's SP1 Hypercube demonstrated 99.7% real-time L1 proving under 12 seconds with 16 RTX 5090s, advancing ZK tech alongside zkSync's progress. - Buterin cautioned against over-optimism, noting