News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The Bitcoin Market Recovery Is Sending Positive Signs, With Anchor Mining Reaching $4,535 Daily

BlockchainReporter·2026/01/15 14:00

Ethereum’s surprising usage drop suggests the network solved the wrong problem with Fusaka upgrade

CryptoSlate·2026/01/15 14:00

Korea drops Naver, NCSoft from ‘Sovereign AI’ contest

Cointelegraph·2026/01/15 13:57

Bitcoin and XRP Price Prediction As US Senate Cancels Crypto Market Structure Bill Markup

CryptoNewsNet·2026/01/15 13:51

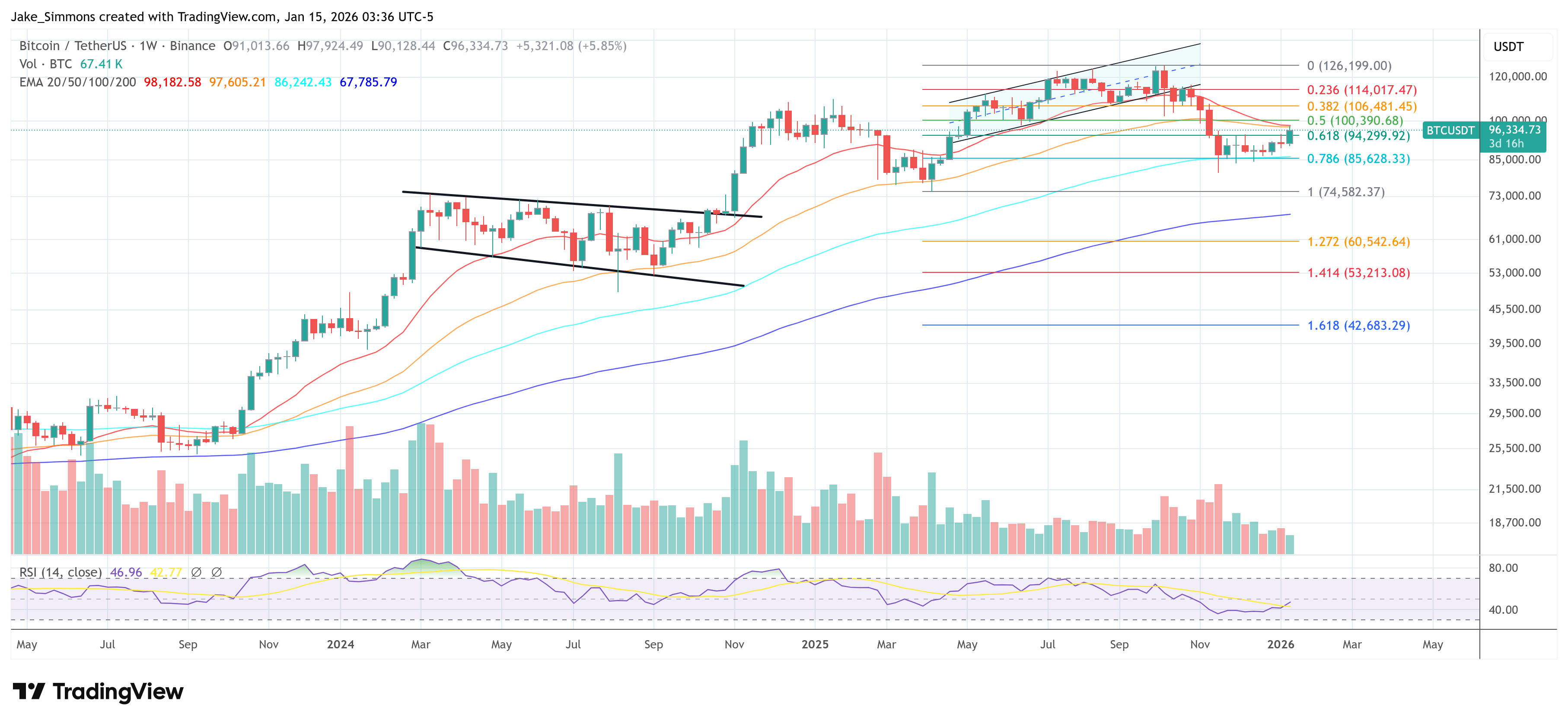

Glassnode: Bitcoin Is Back At $96K, Hitting The Same Sell Ceiling Again

Newsbtc·2026/01/15 13:51

WTI Oil retreats on easing Iran tensions, Venezuela exports

101 finance·2026/01/15 13:48

Canada’s Wholesale Trade, November 2025

101 finance·2026/01/15 13:39

US Import and Export Price Indices - November 2025

101 finance·2026/01/15 13:36

January 2026 Survey on the Outlook for US Manufacturing Businesses

101 finance·2026/01/15 13:36

Empire State Manufacturing Survey

101 finance·2026/01/15 13:36

Flash

00:50

A certain whale bought 11,089 AAVE from an exchange, worth $1.9 million.PANews January 16th news, according to Onchain Lens monitoring, a whale "0xE9D" purchased 11,089 AAVE (worth $1.9 million) from a certain exchange. Currently, this whale holds 355,093 AAVE, valued at $59.15 million, and also has a debt of $30 million.

00:50

A whale has increased its holdings by 11,089 AAVE, now owning 355,093 AAVEBlockBeats News, January 16, according to Onchain Lens monitoring, the whale '0xE9D' after a month, withdrew 11,089 AAVE from an exchange (approximately $1.9 million).

Currently, the whale holds a total of 355,093 AAVE, worth $59.15 million, and has a debt of $30 million.

00:45

The White House Disclosure Reveals Trump Holds Bonds of Multiple Companies Influenced by His PoliciesBlockBeats News, January 16th, according to a latest financial disclosure released by the White House on Thursday, as of December, Trump's investment in municipal bonds and corporate bonds included some corporate bonds that were partially influenced by his government policies, totaling at least $51 million. The bonds purchased by Trump include bonds from companies such as Netflix, CoreWeave, General Motors, Boeing, Occidental Petroleum, as well as municipal bonds issued by various U.S. cities and local school districts, utilities, and hospitals. Officials are only required to disclose transactions within ranges, so the specific amounts or transaction prices are unknown.

Trump's report stated that he conducted a total of 189 buy transactions and two sell transactions between November 14th and December 29th last year, with the latter totaling at least $1.3 million. The U.S. government had previously stated that Trump has always disclosed his investment situation as required, but neither he nor his family members are involved in the specific management of the portfolio, which is handled by a third-party financial institution. (Golden Finance)