News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The Philippines introduced a bill to acquire 10,000 BTC over five years, locking holdings for two decades. Supporters highlight diversification benefits, while critics warn of risks as global governments accelerate sovereign Bitcoin accumulation.

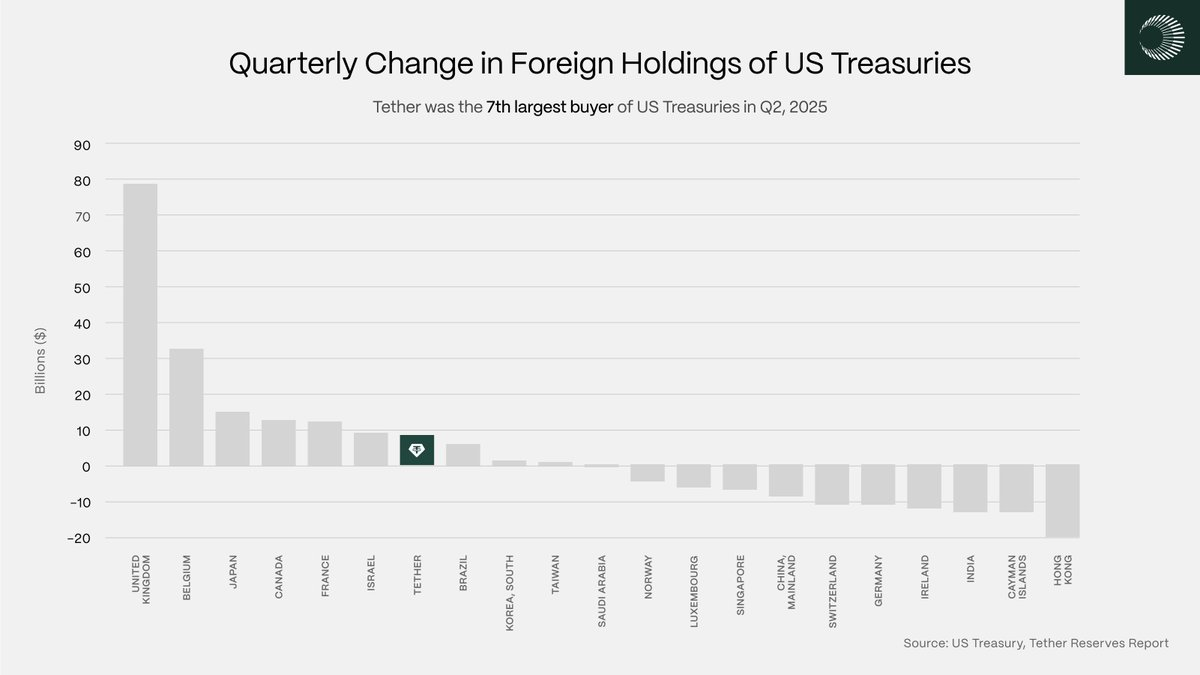

Tether’s ascent as a top-10 foreign buyer of Treasurys signals stablecoin issuers are no longer just liquidity users

BTC and ETH rally on dovish Fed signals

Japan’s Financial Services Agency (FSA) is preparing sweeping changes to its digital asset framework. The changes, which combine tax reforms and regulatory upgrades, could introduce exchange-traded funds (ETFs) tied to cryptocurrencies. The initiative signals Japan’s intent to integrate crypto into mainstream finance and attract broader investment. Tax Burden Under Review The reform package, reported domestically, … <a href="https://beincrypto.com/japan-fsa-crypto-tax-overhaul-etf-reforms-2026/">Con

- 23:08Progress on Balancer security incident: DAO begins discussion on $8 million recovery planAccording to ChainCatcher, citing CoinDesk, weeks after the Balancer v2 vault suffered a major exploit resulting in the loss of over $110 million in funds, Balancer DAO has begun discussing a plan to allocate approximately $8 million in recovered assets to affected LPs. The proposal includes structured rewards for white hat hackers and compensates users based on snapshot data of user pool assets at the time of the exploit, in line with the "Safe Harbor Agreement." This agreement stipulates a maximum bounty of $1 million per incident, and white hat hackers must complete comprehensive KYC and sanctions screening. Several anonymous rescuers on Arbitrum have waived their bounty claims. The recovered tokens span networks such as Ethereum, Polygon, Base, and Arbitrum, and liquidity providers will be compensated proportionally according to the original tokens provided and by pool. A claims mechanism is currently under development, and if the proposal passes, users will need to accept updated terms of use. Additionally, $19.7 million worth of osETH and osGNO recovered by StakeWise will be handled separately; $4.1 million recovered internally in collaboration with Certora is not eligible for bounties due to a prior agreement. This exploit was caused by a smart contract flaw, marking Balancer's third major security incident and resulting in the total value locked (TVL) plummeting from approximately $775 million to $258 million, while the value of the BAL token also dropped by about 30%.

- 23:07UK FCA opens stablecoin regulatory sandbox, Debt Management Office explores expanding Treasury bond market sizeJinse Finance reported that the UK Financial Conduct Authority (FCA) has announced the establishment of a stablecoin task force within its regulatory sandbox, with applications open until January 18, 2026. Meanwhile, according to Bloomberg, the UK Debt Management Office is studying the expansion of the UK Treasury bill market, a move that may be linked to the reserve structure of stablecoins.

- 22:44BIS warns of liquidity risks in tokenized money market fundsJinse Finance reported that the Bank for International Settlements (BIS) has released a briefing stating that tokenized money market funds (MMFs) face liquidity mismatch risks between daily redemptions and T+1 settlements, which become particularly prominent under market stress. However, industry solutions have already emerged. For example, Broadridge's DLR system enables intraday transfer and monetization of government bonds, providing a technological pathway to alleviate liquidity mismatches.