News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Upbit uncovered and patched an internal wallet flaw during an emergency audit following its $30 million hack this week, saying the vulnerability could have let attackers derive private keys from onchain data. MegaETH, an upcoming Ethereum Layer 2 scaling solution, said it will refund all capital raised through its pre-deposit bridge campaign after outages, shifting deposit caps, and a misconfigured multisig triggered an unintended early reopening.

Quick Take Amundi has issued its first tokenized share class of a money-market fund on Ethereum as part of a new hybrid distribution model. The initiative was launched in collaboration with CACEIS, which provides blockchain-based transfer agent infrastructure and a 24/7 digital order platform.

Barcelona sparked controversy by partnering with Zero-Knowledge Proof, a Samoa-registered blockchain startup that launched its own cryptocurrency days after the deal.

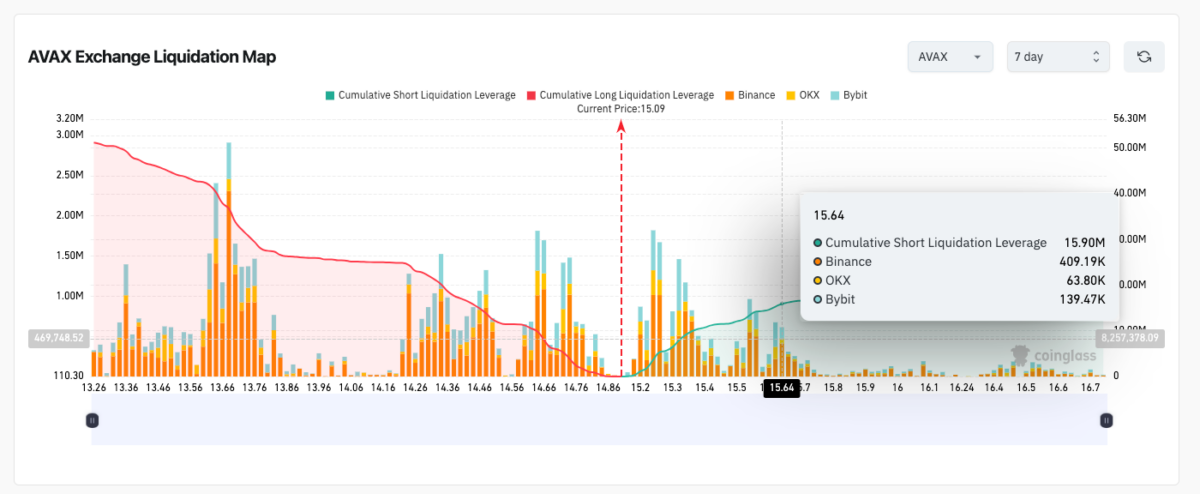

Avalanche surges above $15 following Securitize’s announcement of a pan-European trading platform powered by AVAX, approved under EU’s DLT Pilot Regime for 2026 launch.

- 13:42Trump: Stocks and 401k plans have reached all-time highs, while inflation, prices, and taxes are all decreasingBlockBeats News, November 29, U.S. President Trump stated, "Tariffs have made our country wealthy, strong, prosperous, and secure. The stock market and 401k plans have reached historic highs, while inflation, prices, and taxes are all declining. The United States is respected again, respected as never before. All of this has been brought about by strong leadership and tariffs. Pray to God that our nine Supreme Court justices will show great wisdom and do the right thing for America." (Golden Ten Data)

- 13:42A certain "contract-quitting, spot-buying" whale address has accumulated 7,066 ETH in the past 5 daysBlockBeats News, November 29, according to monitoring by Onchain Lens, a whale address known for "switching to spot trading after suffering large losses in contracts" purchased another 1,000 ETH from HyperLiquid two hours ago. This whale currently holds 7,066 ETH worth $21.22 million, and also has 4.78 million USDC idle, making it very likely that more ETH will be purchased. It is reported that this address previously lost $8 million through contract trading, and has since switched to spot trading.

- 13:42The HyperLiquid team has unstaked 2.6 million HYPE tokens, of which 609,000 were sent to an OTC platform.BlockBeats News, November 29, according to MLM monitoring, among the recent 2.6 million HYPE (USD 91 million) unstaked by the HyperLiquid team, 854,254 HYPE (USD 29.9 million) have been restaked into the same wallet. Subsequently, they transferred 1,745,746 HYPE (USD 61.1 million) to 29 new wallets. So far, 609,100 HYPE (USD 21.3 million) have been sent from 10 of these wallets to Flowdesk (an OTC trading institution). In 4 wallets, they restaked 234,600 HYPE (USD 8.2 million). The remaining 15 wallets currently only hold 902,000 HYPE (USD 31.6 million) — with no action taken for now.