Dow Surges Over 250 Points: Market Mood Brightens, Fear & Greed Index Shifts to 'Neutral'

Market Sentiment Shifts to Neutral as Defense Stocks Rally

The CNN Money Fear and Greed Index reflected a more balanced market outlook on Thursday, transitioning into the "Neutral" range.

U.S. equities ended the day with mixed results. The Dow Jones Industrial Average climbed over 250 points, while defense-related shares rebounded sharply, recovering from previous losses. This surge followed President Donald Trump's proposal for a significant boost in military spending, which drew considerable attention from investors.

Defense Sector Leads Gains

Smaller defense contractors were at the forefront of Thursday’s rally. Kratos Defense & Security Solutions, Inc. (NASDAQ: KTOS) soared by 14%. Red Cat Holdings, Inc. (NASDAQ: RCAT) advanced 13%, and Karman Holdings Inc. (NYSE: KRMN) gained 10%.

Economic Updates

On the economic front, initial jobless claims in the U.S. rose by 8,000 to reach 208,000 for the week ending January 3, slightly below the anticipated 210,000. Meanwhile, the U.S. trade deficit narrowed to $29.4 billion in October—the smallest gap since June 2009—down from a revised $48.1 billion in September and well below the expected $58.1 billion.

S&P 500 Sector Performance

Most S&P 500 sectors finished higher, with energy, consumer staples, and consumer discretionary stocks posting the strongest advances. In contrast, health care and information technology sectors lagged behind, ending the day in negative territory.

Major Index Closes

- Dow Jones: Up roughly 270 points, closing at 49,266.11

- S&P 500: Gained 0.01% to finish at 6,921.46

- Nasdaq Composite: Fell 0.44% to 23,480.02

The Fear and Greed Index registered a reading of 46.0 on Thursday, up from the previous value of 43.7, indicating a shift to a more neutral sentiment.

Understanding the CNN Business Fear & Greed Index

The Fear & Greed Index gauges investor sentiment in the stock market. It operates on the principle that heightened fear tends to drive prices lower, while increased greed pushes them higher. The index is derived from seven equally weighted indicators and spans a scale from 0 (extreme fear) to 100 (extreme greed).

Further Reading

Photo via Shutterstock

Featured Defense Stocks

- Karman Holdings Inc (KRMN): $103.80 (+2.49%)

- Kratos Defense & Security Solutions Inc (KTOS): $106.42 (+2.29%)

- Red Cat Holdings Inc (RCAT): $11.93 (+0.85%)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Lower volatility lifts investor confidence in risk assets, Wells Fargo’s Schumacher says

The Senate advances toward a decision on market structure: Crypto Update

Solana ETF Flows and Whale Moves Hint at Bullish Potential

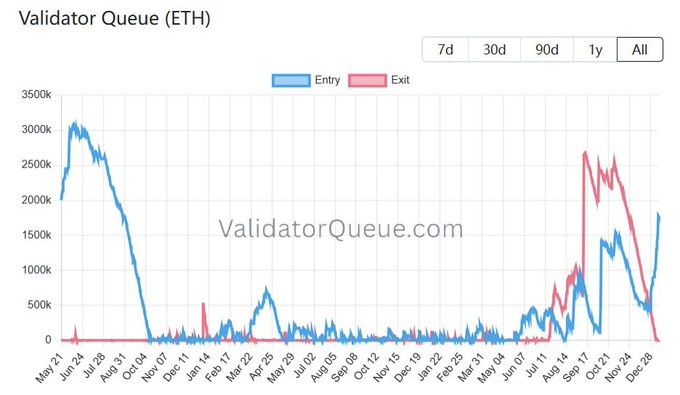

Ethereum’s Validator Entry Queue Hits $5.5B, Marking Highest Level Since August 2023