Forex Today: US Dollar continues its weekly advance as markets await crucial NFP report

Friday, January 9: Key Market Highlights

As Friday unfolds, the US Dollar (USD) maintains its strong performance against other major currencies, with investors closely watching for significant economic updates. The US Bureau of Labor Statistics is set to release December’s employment figures, including Nonfarm Payrolls, the Unemployment Rate, and wage growth data. Additionally, the University of Michigan will provide an early look at January’s Consumer Sentiment Index.

On Thursday, the USD Index continued its upward trend, marking its third straight day of gains. Recent US data revealed a notable reduction in the trade deficit, dropping to $59.1 billion in October from $78.3 billion previously. Weekly Initial Jobless Claims also came in slightly better than anticipated at 208,000, compared to the forecast of 210,000. Early Friday, the USD Index holds steady near 99.00, up over 0.5% for the week. Projections for December suggest Nonfarm Payrolls will increase by 60,000, while the Unemployment Rate is expected to edge down to 4.5% from 4.6%.

During Friday’s Asian trading session, China’s National Bureau of Statistics reported that annual inflation, measured by the Consumer Price Index (CPI), rose to 0.8% in December, up from 0.7% in November, though still below the expected 0.9%.

Major Currency Movements

- AUD/USD: The Australian Dollar continues to retreat from its recent 15-month peak near 0.6770, posting losses for a second consecutive day. Early Friday, the pair remains under pressure, trading just below 0.6700.

- EUR/USD: The Euro faces ongoing downward momentum, hovering around 1.1650 in Friday’s European morning session. The pair has declined about 0.6% since the start of the week and is on course for a second week of losses.

- GBP/USD: After a strong start on Monday, the British Pound reversed course, closing lower for three straight days and turning negative for the week. The pair remains below 1.3450 as the European session begins.

Commodities and Other Majors

- Gold (XAU/USD): After a pullback on Wednesday, gold prices stabilized on Thursday, posting modest gains. Early Friday, gold remains steady, trading above $4,470.

- USD/JPY: The US Dollar gains further strength against the Japanese Yen, advancing toward 157.50 on Friday after a slight increase the previous day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana ETF Flows and Whale Moves Hint at Bullish Potential

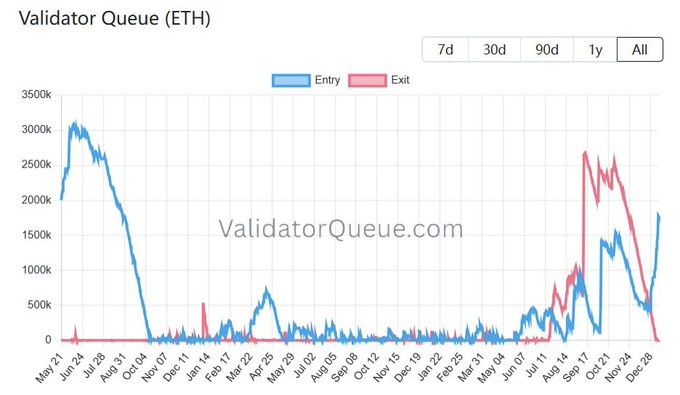

Ethereum’s Validator Entry Queue Hits $5.5B, Marking Highest Level Since August 2023

Solana Low-Cap Tokens See Rising Smart Money Interest

What the Market Misunderstands about Renewable Energy