The likelihood of geopolitical turmoil in 2026 is increasing, and financial markets might not be fully accounting for this risk.

Geopolitical Shifts and Market Response in Early 2026

Although 2026 has just begun, the rapid succession and magnitude of global political events are already signaling significant changes in worldwide risk dynamics. The recent surge in geopolitical activity is creating a sense of volatility that could transform international alliances, disrupt global trade, and impact security frameworks across nations.

Interestingly, major financial markets have so far shown little reaction, maintaining a bullish outlook as the new year unfolds. This has led many observers to question whether current market valuations are adequately reflecting the true extent of geopolitical risks in 2026.

Much of the market’s focus has centered on two major recent incidents, each carrying substantial implications for the global landscape...

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana ETF Flows and Whale Moves Hint at Bullish Potential

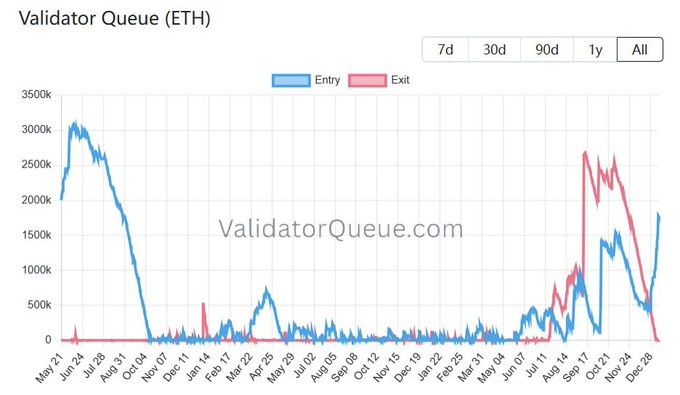

Ethereum’s Validator Entry Queue Hits $5.5B, Marking Highest Level Since August 2023

Solana Low-Cap Tokens See Rising Smart Money Interest

What the Market Misunderstands about Renewable Energy