- TRON: High-volume network activity and stablecoin flows signal responsiveness to liquidity shifts.

- Binance Coin: Exchange utility and consolidation set up quick price reactions to FOMC volatility.

- Ripple: Cross-border payment role and technical support position XRP for immediate macro-driven moves.

As the FOMC meeting draws near, traders are closely watching altcoins that react quickly to shifts in market liquidity and risk sentiment. Some tokens tend to move more in response to macro events than to speculative hype, making them ideal for tracking potential short-term swings. Knowing which coins are positioned for volatility can help investors plan trades and manage risk. Among the top contenders, TRON, Binance Coin, and Ripple stand out. Each has a combination of network strength, liquidity, and trading patterns that could drive sharp moves when policy decisions hit the market.

TRON (TRX)

Source; Trading View

Source; Trading View

TRON Network has built a reputation for high-volume on-chain transfers and fast transaction processing. Its network activity ranks among the most efficient in the crypto ecosystem. Historically, TRON experiences spikes in activity during periods of macro uncertainty, particularly when stablecoins move across the blockchain. These patterns make it a valuable tool for capital rotation and settlement rather than purely speculative trading. Although TRX currently trades within a tight range, on-chain data indicates that liquidity shifts could trigger a quick response. Analysts monitor TRON closely to understand rotational flows between stable and utility assets, which often signal broader market trends during policy-driven events.

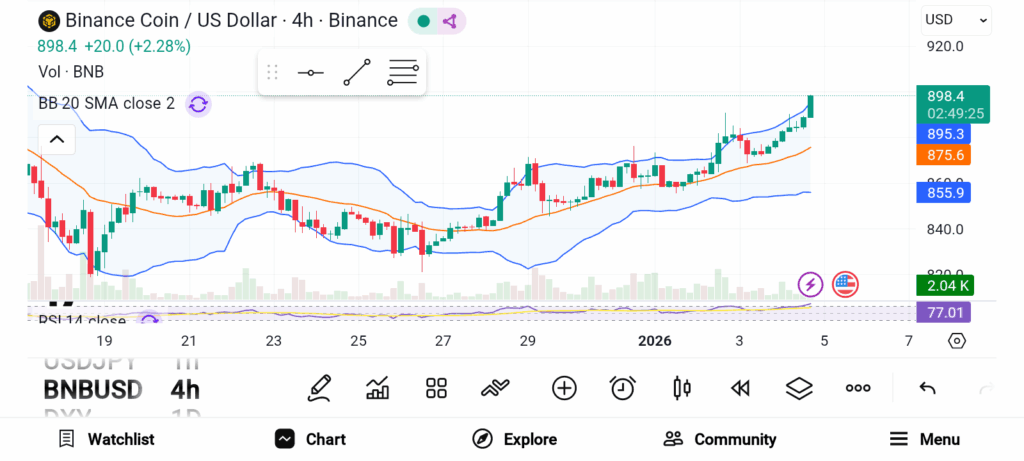

Binance Coin (BNB)

Source: Trading View

Source: Trading View

BNB serves as a core utility token within the Binance ecosystem. Its price often moves in tandem with exchange activity rather than general speculative demand. This behavior makes BNB particularly responsive during macro events and liquidity changes. Currently, BNB is consolidating within a narrow range, suggesting a pause before potential directional moves. Analysts highlight that this structure allows BNB to react rapidly when volatility spikes, making it a coin worth watching as FOMC news arrives. The combination of exchange utility and price sensitivity to market shifts gives BNB an edge over many other altcoins in times of uncertainty.

Ripple (XRP)

Source: Trading View

Source: Trading View

Ripple’s XRP plays a central role in cross-border payment settlements and is often praised for its innovative transaction network. Price behavior shows that XRP responds quickly during policy events, reflecting changes in risk sentiment. Its liquidity allows rapid adjustments without creating large volume imbalances, which is rare among major tokens. Currently, XRP trades near technical support, positioning it to move swiftly if macro conditions shift. Investors and traders often monitor XRP during FOMC or other central bank announcements because its behavior can provide early signals of market rotation, helping to anticipate broader trends.

TRON, Binance Coin, and Ripple are among the altcoins best positioned for volatility during upcoming FOMC events. Each demonstrates strong technical and structural traits that support quick reactions to liquidity changes and macro shifts. Traders can use these tokens as indicators for potential short-term market moves. Monitoring these coins closely may uncover opportunities for strategic positioning during policy-driven rotations in the crypto market.