The global copper shortage is expected to worsen due to increased demand from AI technology and military expenditures, according to S&P.

Global Copper Shortage Worsens Amid AI Boom and Rising Defense Budgets

According to a recent S&P Global analysis, the rapid growth of artificial intelligence and increased military expenditures are set to deepen the looming copper shortage, as mining companies face significant hurdles in expanding production.

The report, released Thursday and supported by the mining sector, highlights that copper demand is accelerating at a time when mining output is hitting structural barriers. This dynamic could turn copper into a critical constraint for both economic progress and technological innovation.

Top Stories from Bloomberg

- NYC Fights Sale of Bankrupt Rentals After Mamdani Blasts Living Conditions

- We Still Don’t Know if Robotaxis Are Safer Than Human Drivers

- New LA Home Designs, Reimagined By Fire

London copper prices have surged past $13,000 per metric ton, fueled by a wave of mine disruptions and traders stockpiling the metal in the US in anticipation of potential tariffs under a new Trump administration. While these stockpiles have driven prices above what underlying demand would suggest, emerging sectors are poised to tighten the market even further in the years ahead.

“Three years ago, AI and data centers weren’t even part of the conversation,” said Aurian De La Noue, who leads energy transition and critical metals consulting at S&P Global. “Our research indicates that the world is heading toward a supply shortfall, even before factoring in these new demand drivers.”

Future Demand and Supply Challenges

S&P Global projects that worldwide copper consumption will climb by 50%, reaching 42 million metric tons by 2040. While traditional uses—such as construction, appliances, transportation, and power generation—still dominate, the fastest growth is now coming from sectors like electric vehicles, renewable energy, battery storage, and grid upgrades.

Emerging demand from data centers and AI infrastructure is also gaining momentum. As global data center capacity is expected to nearly quadruple by 2040, copper usage in these areas is set to soar.

The study estimates that by 2040, combined copper demand from AI, data centers, and defense spending could triple, adding an extra 4 million tons of annual consumption.

Another potential growth area is humanoid robotics. If 1 billion humanoid robots are in operation by 2040, they would require about 1.6 million metric tons of copper each year—roughly 6% of today’s total usage.

However, global copper output is forecast to peak at around 33 million tons in 2030, as ore grades decline and new mining projects face regulatory, financial, and construction obstacles.

Supply Gap and Industry Response

Even with a sharp rise in copper recycling—expected to more than double to 10 million tons—S&P Global predicts a 10-million-ton shortfall by 2040.

It’s important to note that such a deficit is theoretical, since actual consumption cannot exceed available supply. Higher prices could prompt manufacturers to substitute copper with other materials, and make new mining projects more attractive.

Long lead times, escalating costs, and a highly concentrated supply chain further complicate the situation, making the copper market increasingly susceptible to disruptions as demand accelerates, the report notes.

While record-high prices benefit producers, there’s no certainty they will persist, cautioned Daniel Yergin, S&P Global Vice Chairman and co-chair of the study. “We’re hesitant to conclude that prices are now permanently elevated,” Yergin remarked.

Major Backers and Industry Influence

The research received funding from leading mining companies such as BHP Group and Rio Tinto Group, as well as major commodity traders Trafigura and Gunvor, and tech giant Google.

Most Popular from Bloomberg Businessweek

- The Curious Cult of Aldi

- Zillow’s CEO Is Ready for Another Slow Year in the US Housing Market

- Dutch Bros Is Out-Starbucksing Rivals With the Sugariest Drinks

- Hiring in the Age of AI Means Proving You Need a Human

- Ozempic Users Actually Spend More Dining Out. Smart Restaurants Are Adapting

©2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana ETF Flows and Whale Moves Hint at Bullish Potential

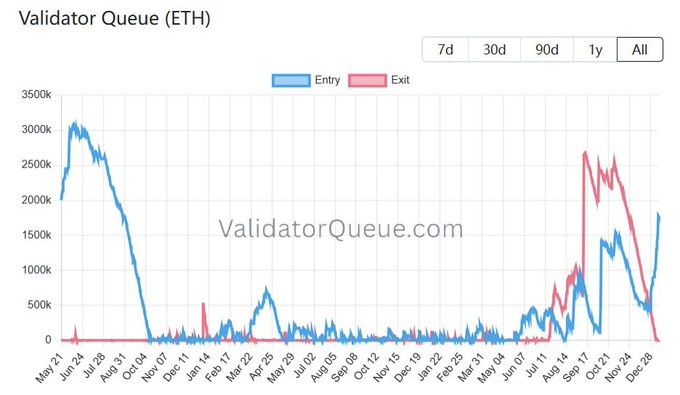

Ethereum’s Validator Entry Queue Hits $5.5B, Marking Highest Level Since August 2023

Solana Low-Cap Tokens See Rising Smart Money Interest

What the Market Misunderstands about Renewable Energy