EUR/CAD climbs toward 1.6200 as the Canadian Dollar weakens amid worries over Oil demand

EUR/CAD Continues Upward Momentum Amid Shifting Oil Market Dynamics

The EUR/CAD currency pair maintained its upward trajectory for a fourth consecutive session, hovering near 1.6200 during Thursday’s Asian trading hours. This sustained rally is largely attributed to weakness in the Canadian Dollar, which has been pressured by signals from US President Donald Trump regarding the potential resumption of Venezuelan oil imports. These developments have heightened concerns about increased global oil supply and intensified competition, potentially undermining demand for Canadian crude.

Despite these market jitters, Prime Minister Mark Carney emphasized that Canadian oil remains a reliable and competitive option, even if Venezuelan exports return to the market. In a bid to reduce reliance on the United States amid ongoing trade policy uncertainties, Carney’s office announced his upcoming visit to China from January 13 to 17, aiming to broaden Canada’s export destinations.

Turning to economic indicators, Canada’s seasonally adjusted Ivey Purchasing Managers’ Index (PMI) rebounded to 51.9 in December 2025, up from 48.4 in November and exceeding the forecast of 49.5. This improvement marks a shift back to expansion following a brief period of contraction. Investors are also awaiting Canada’s Trade Balance figures for October, set to be released on Thursday, while attention will soon shift to Friday’s labor market updates.

Key Economic Data from Europe

Later in the day, market participants will monitor several medium-impact releases from Europe, including Germany’s Factory Orders, as well as Business Climate and Unemployment Rate statistics from the Eurozone. On Wednesday, Eurostat reported that the preliminary Harmonized Index of Consumer Prices (HICP) for the Eurozone rose by 2% year-over-year in December, matching expectations but slightly below November’s 2.1% pace.

On a monthly basis, HICP inflation increased by 0.2%, reversing a 0.3% decline from the previous month. The Core HICP, which strips out volatile items such as food, energy, alcohol, and tobacco, advanced by 2.3% year-over-year—slower than both the prior reading and forecasts of 2.4%. Month-over-month, the core measure edged up by 0.3%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana ETF Flows and Whale Moves Hint at Bullish Potential

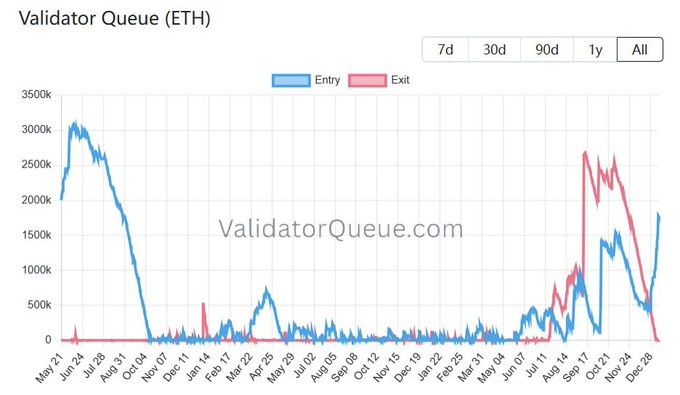

Ethereum’s Validator Entry Queue Hits $5.5B, Marking Highest Level Since August 2023

Solana Low-Cap Tokens See Rising Smart Money Interest

What the Market Misunderstands about Renewable Energy